The S&P 500, Russell 2000, Dow Jones Industrial Average, German Dax, UK FTSE 100, and the Hang Seng Index are all down 2%-3% on the day after a surge in coronavirus cases related to the Delta variant. As the excitement around the “2020” Olympic Games increase, unfortunately so do the number of coronavirus cases in Tokyo. The host city is under State of Emergency until mid-August as the Games draw nearer. In addition, other areas in Asia are also dealing with an increase in the number of cases, such as Malaysia, Singapore, and Indonesia. However, it isn’t just Asia. European countries such as Spain and Portugal are also experiencing a rise in the number of daily cases. Also, in the UK, it’s Freedom Day! Today all restrictions have been lifted in the UK, despite warnings from scientists and a growing number of cases. The Olympics and Freedom Day will be watched to see if they turn into super-spreaders. Stock markets are becoming increasingly concerned about in the spreading of variants.

How does the stock market work?

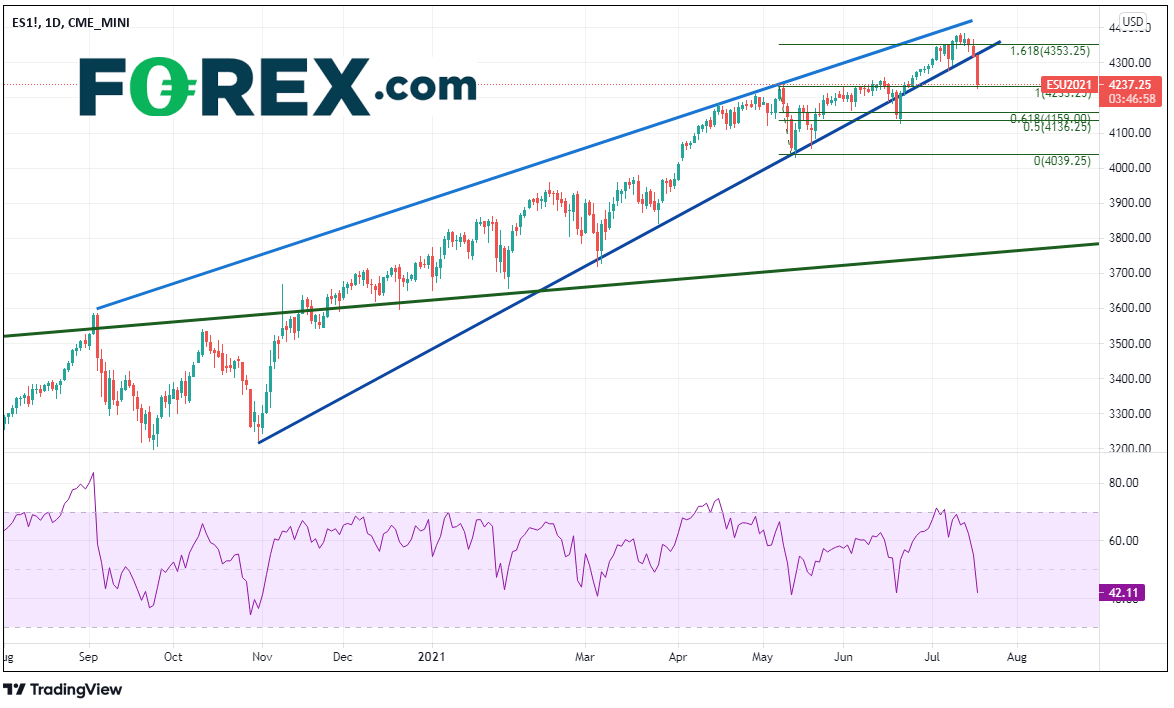

S&P 500 breaking below long-term rising wedge

Source: Tradingview.com, FOREX.com

But it’s not just the coronavirus that is weighing on the markets. Joe Biden has accused China of either carrying out cyber-attackers or aiding Nationals in the carrying out cyber-attacks around the world. In particular, the US government called out a hack on Microsoft Exchange. This further sours a tumultuous relationship between the 2 countries as more “consequences” are expected. This is also causing a drag on stock markets.

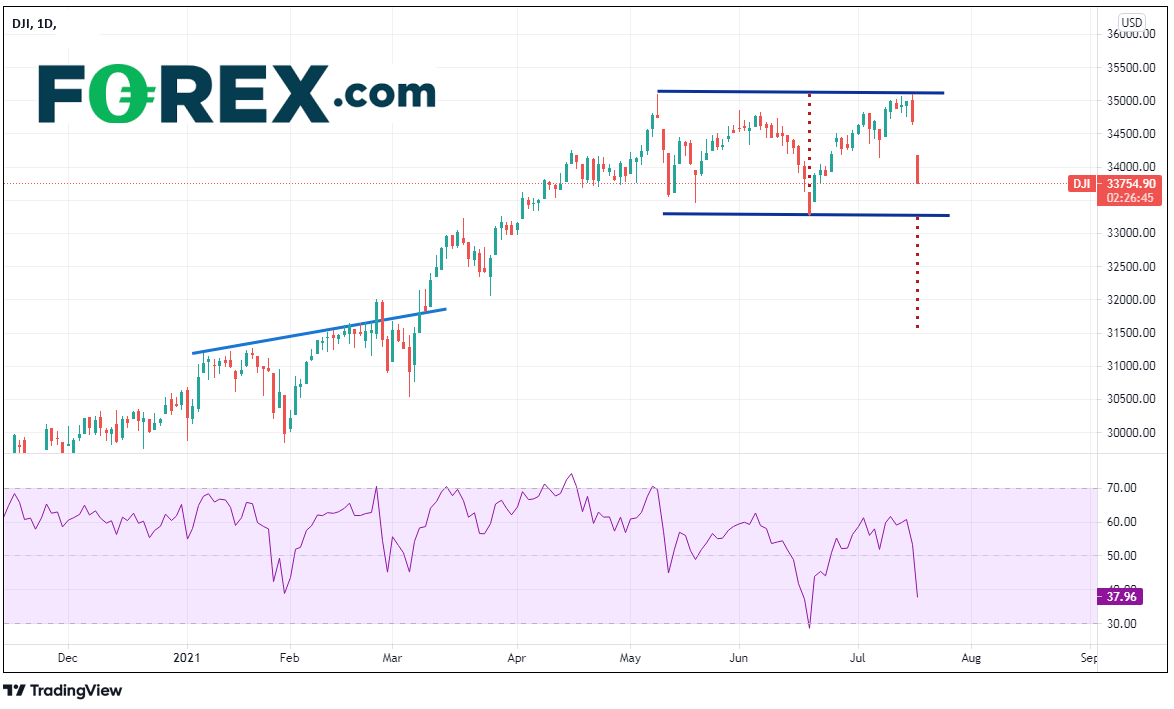

DJIA gaps lower; range of nearly 1000 points on the day; break of 33271 targets 31625

Source: Tradingview.com, FOREX.com

Over the weekend OPEC+ agreed to an increase in the supply of oil by 400,000 barrels per day. As opposed to previous recent agreements that were short-term in nature, this agreement is expected to run through September 2022. OPEC+ still has a long way to go before supply returns to pre-Covid levels but this long-term agreement is a step in the right direction. As a result, at the time of this writing, WTI Crude Oil is down over -7.5%.

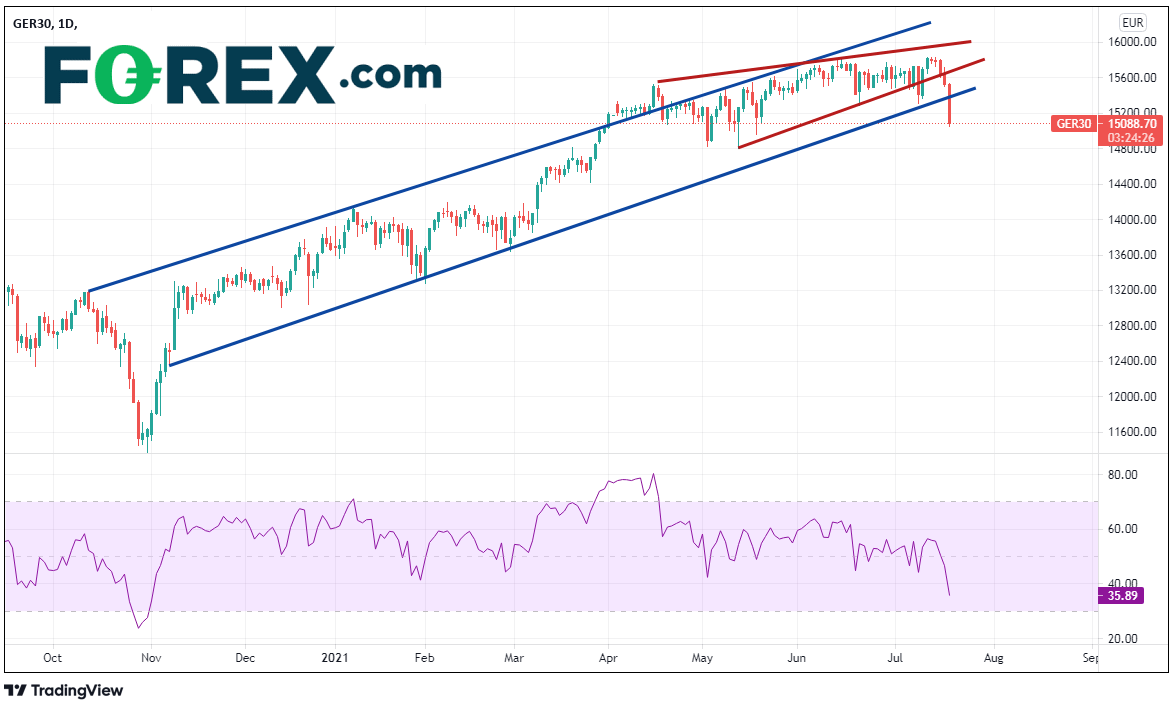

German Dax down nearly -3% below rising wedge and ascending channel

Source: Tradingview.com, FOREX.com

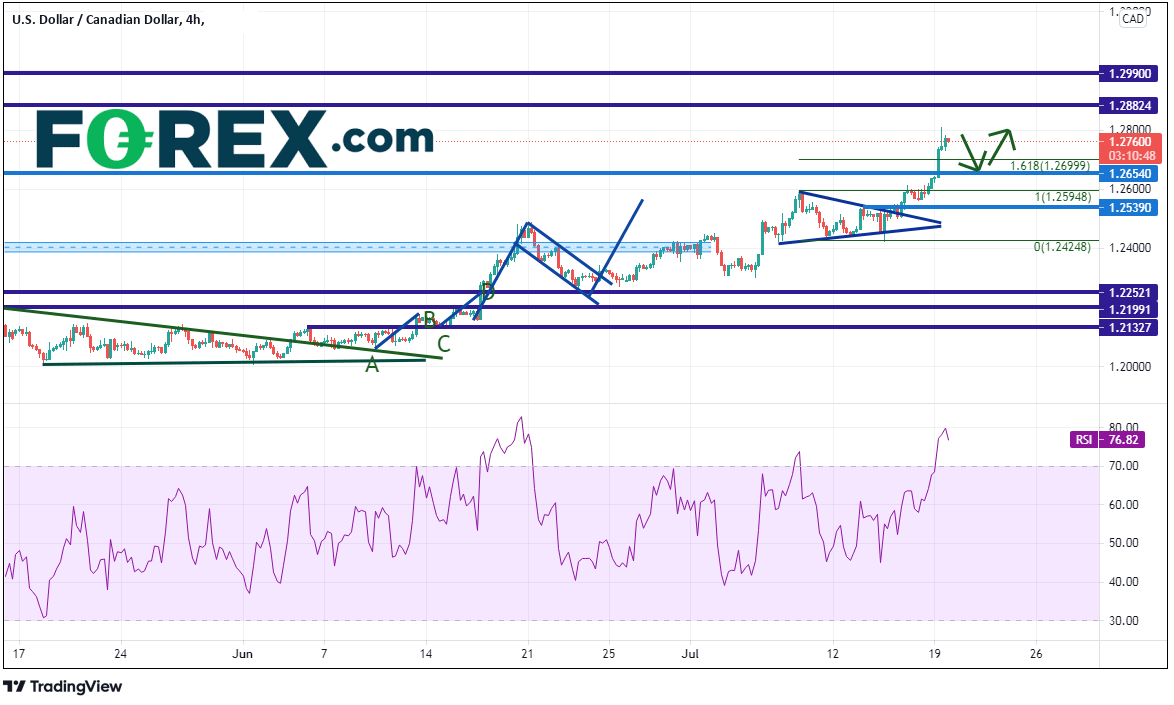

All these factors are weighting on global stock markets. And with the risk-off in stocks and commodities, it also means a selloff in commodity currencies. USD/CAD has already broken about the April 21st highs (the BOC surprise taper meeting) at 1.2654. On a 240-minute timeframe, the RSI is in overbought territory and the range appears extended. Bulls will be looking for dips towards 1.2654 to buy, with targets near horizontal resistance at 1.2880 and 1.2990. Bears will be looking for “Turnaround Tuesday”, hoping to sell the pair and look for a move back to the 1.2600 area.

USD/CAD

Source: Tradingview.com, FOREX.com

With the large selloff in global stock market indices today, traders may turn cautious on risk. However, “Turnaround Tuesday” is always a possibility, as markets seem a bit stretched today. But with stocks lower, commodities lower, and an expectation of more sanctions to come on China (which, by the way, economic data show China’s economy may have peaked), traders will be watching USD/CAD to help determining risk-on/risk-off moves!