US Dollar Outlook: GBP/USD

GBP/USD may consolidate over the coming days as it continues to trade within the opening range for February, but the exchange rate may struggle to retain the advance from the December low (1.2500) amid the failed attempt to close above the 50-Day SMA (1.2671).

GBP/USD Vulnerable amid Failure to Close Above 50-Day SMA

GBP/USD seems to be retracing the decline following the softer-than-expected UK Consumer Price Index (CPI) as it bounces back ahead of the weekly low (1.2536), and the exchange rate may track the flattening slope in the moving average as it holds above the monthly low (1.2518).

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

The range bound price action in GBP/USD may persist amid the ongoing divide within the Bank of England (BoE), and it remains to be seen if the Federal Reserve will face a similar fate as Chairman Jerome Powell tames speculation for a rate cut in March.

US Economic Calendar

Looking ahead, it remains to be seen if the Federal Open Market Committee (FOMC) Minutes will sway GBP/USD as the central bank endorses a data dependent approach in managing monetary policy, but little indications of an imminent change in regime may prop up the Greenback as the Fed appears to be on track to keep US interest rates higher for longer.

At the same time, signs of a dissent within the FOMC may drag on the Dollar as Fed officials project lower interest rates for 2024, and a further adjustment in the forward guidance for US monetary policy may keep GBP/USD within the monthly range as the committee plans to switch gears later this year.

With that said, GBP/USD may consolidate over the coming days should it track the flattening slope in the 50-Day SMA (1.2671), but the exchange rate may struggle to retain the advance from the December low (1.2500) amid the failed attempt to close above the moving average.

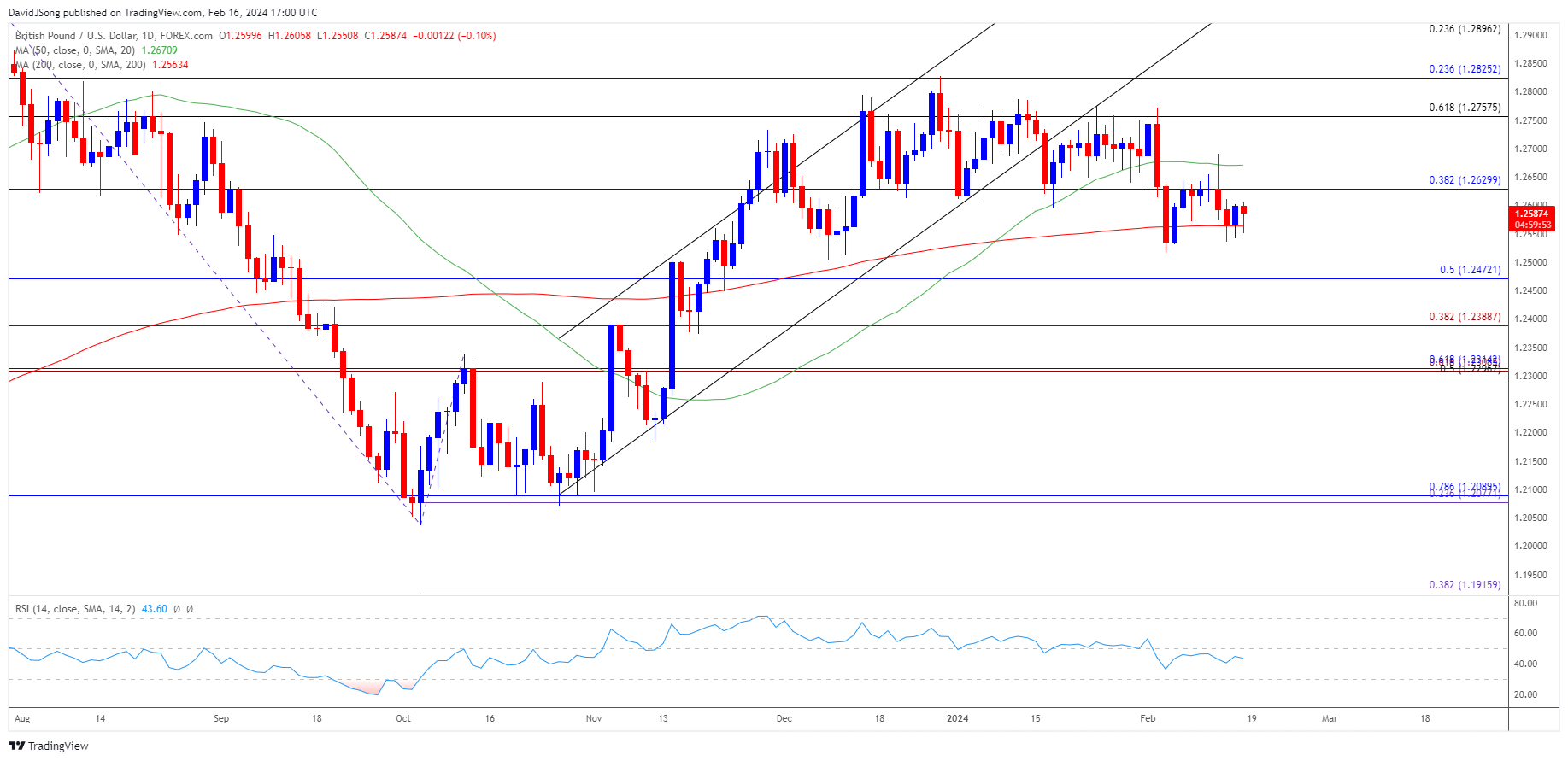

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD may continue to trade within the opening range for February as it bounces back ahead of the monthly low (1.2518), and the exchange rate may consolidate over the coming days amid the flattening slope in the 50-Day SMA (1.2671).

- A move above 1.2630 (38.2% Fibonacci retracement) may push GBP/USD towards the moving average, with the next area of interest coming in around the monthly high (1.2772).

- However, GBP/USD may struggle to retain the advance from the December low (1.2500) amid the failed attempt to close above the moving average, with a break/close below 1.2470 (50% Fibonacci retracement) opening up the 1.2300 (50% Fibonacci retracement) to 1.2390 (38.2% Fibonacci extension) region.

Additional Market Outlooks

USD/CAD Rate Susceptible to Flattening Slope in 50-Day SMA

USD/JPY Post-US CPI Breakout Fails to Push RSI into Overbought Zone

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong