GBP/USD Talking Points:

- GBP/USD was an item of interest addressed in yesterday’s webinar for scenarios of USD-weakness.

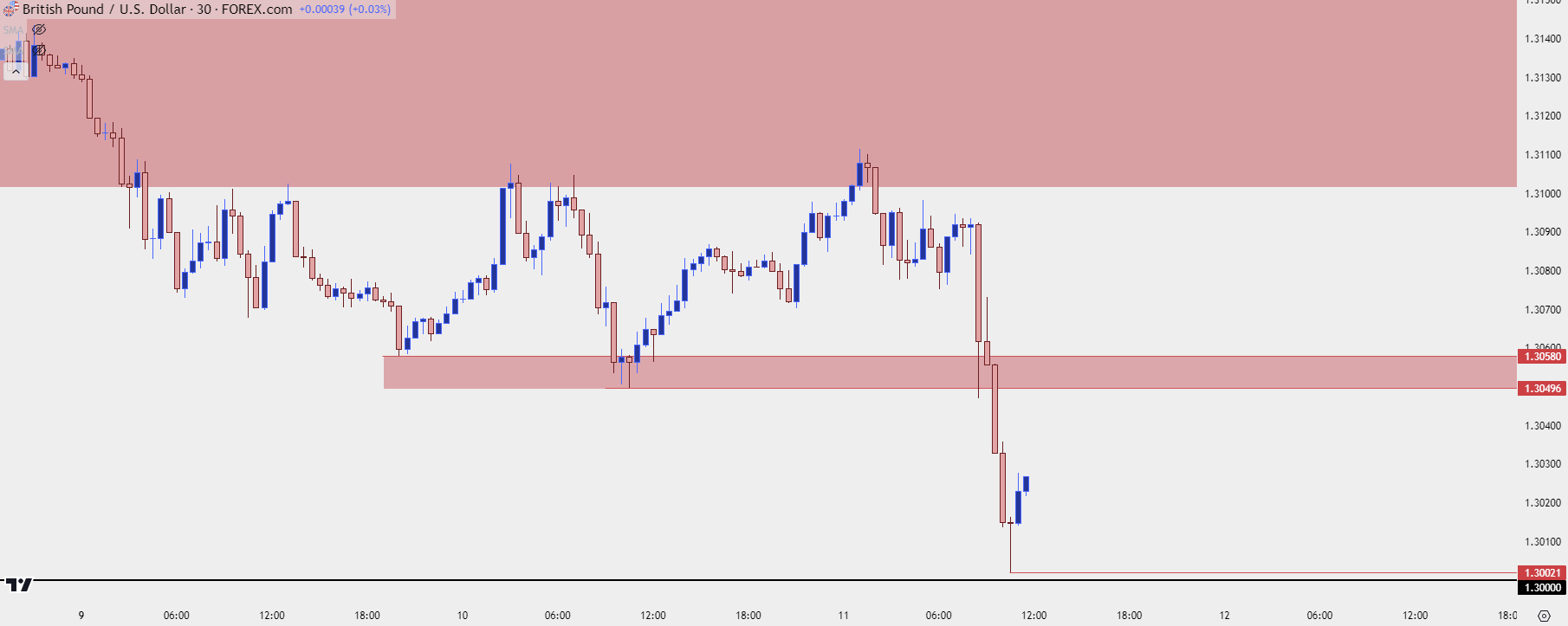

- The pair has pulled back this morning with buyers showing up two pips above a test of the psychologically important 1.3000 level.

- I’ll be looking into these setups in the Tuesday webinar and you’re welcome to join, click here for registration information.

It’s been a busy morning in the US Dollar after the release of US CPI and for GBP/USD, there’s been a visible sell-off taking-hold since the US open.

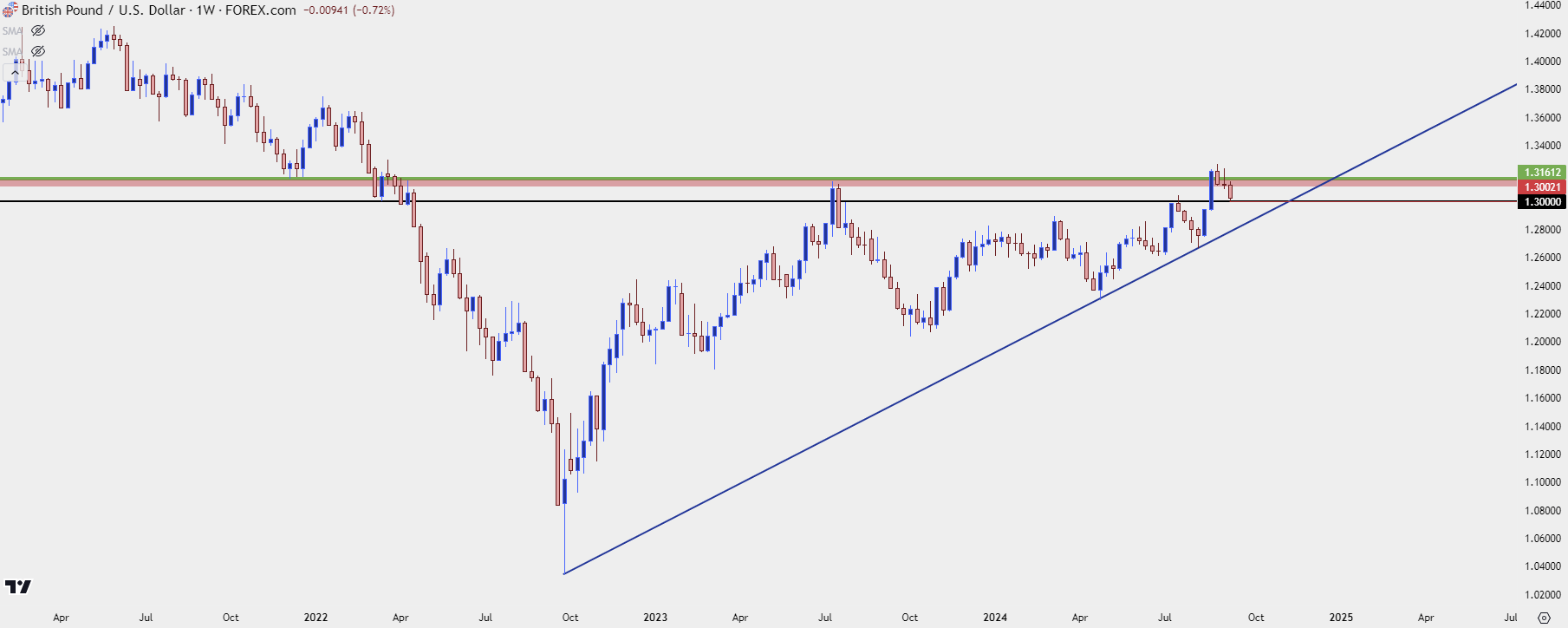

I looked into the pair in yesterday’s webinar specifically for themes of USD-weakness, highlighting the 1.3000 level as an area of interest. That price had helped to set the high in July and was followed by a strong pullback, but since the breakout on August 20th hasn’t re-tested that price as support.

GBP/USD Weekly Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

Bulls aren’t yet out of the woods as all that we’ve seen at this point was a bounce two pips above the 1.3000 spot. There’s an area of lower-high resistance potential spanning from 1.3050-1.3058 that buyers will need to break through to exhibit a greater sense of control. If they can, the next area of resistance potential that I’m tracking plots around the 1.3100 level with another big spot around 1.3161.

GBP/USD 30-Minute Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

--- written by James Stanley, Senior Strategist