US Dollar Outlook: GBP/USD

GBP/USD climbs to a fresh weekly high (1.3186) as the ADP Employment report warns of slowing job growth, and the exchange rate may continue to retrace the decline from the August high (1.3267) as it carves a series of higher highs and lows.

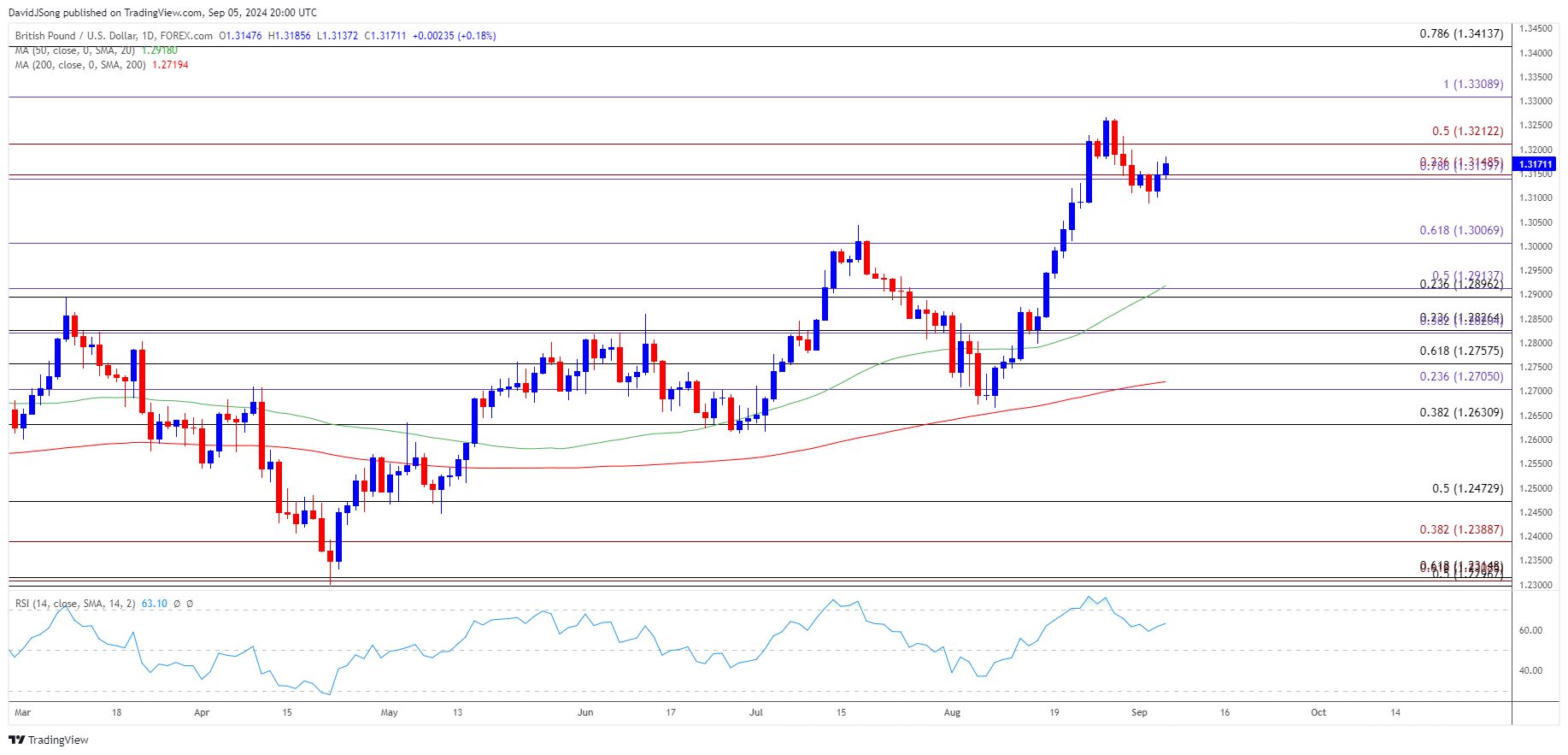

GBP/USD Rebound Pushes RSI Back Towards Overbought Zone

GBP/USD extends the advance from earlier this week as the ADP Employment report shows a 99K rise in August versus forecasts for a 145K print, and the Relative Strength Index (RSI) may show the bullish momentum gathering pace as it moves back towards overbought territory.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

A move above 70 in the RSI is likely to be accompanied by a further advance in GBP/USD like the price action from last month, but the Non-Farm Payrolls (NFP) report may sway the exchange rate as the update is anticipated to reflect a resilient labor market.

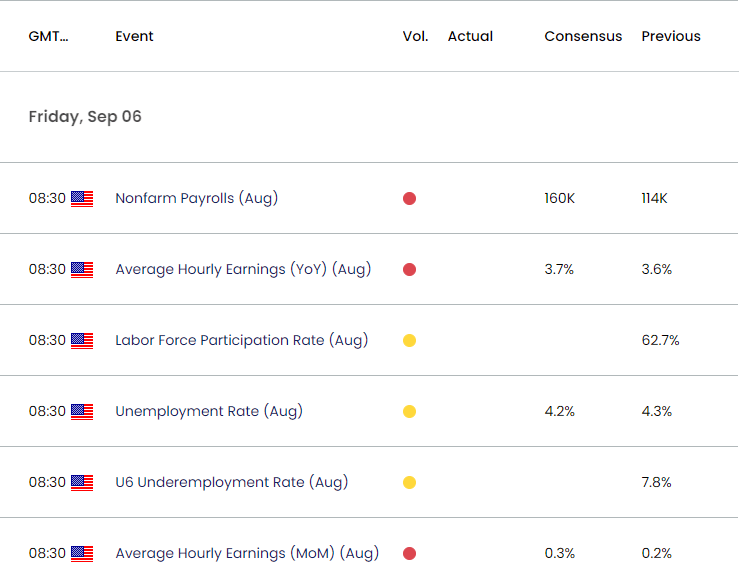

US Economic Calendar

The US is expected to add 160K jobs in August following the 114K expansion in the month prior, and a positive development may spur a bullish reaction in the US Dollar as it encourages the Federal Reserve to further combat inflation.

With that said, GBP/USD may struggle to retain the rebound from the weekly low (1.3088), but another weaker-than-expected NFP report may fuel the recent series of higher highs and lows in the exchange rate as it raises the Fed’s scope to carry out a rate-cutting cycle.

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD extends the rebound from the weekly low (1.3088) to push the Relative Strength Index (RSI) back towards overbought territory, with a move back above 1.3210 (50% Fibonacci extension) bringing the August high (1.3267) on the radar.

- A break/close above 1.3310 (100% Fibonacci extension) opens up 1.3410 (78.6% Fibonacci retracement) but GBP/USD may struggle to retain the advance from earlier this week if it fails to extend the recent series of higher highs and lows.

- The bullish price series in GBP/USD may unravel if it fails to hold above the 1.3140 (78.6% Fibonacci extension) to 1.3150 (23.6% Fibonacci extension) region, with a breach below the weekly low (1.3088) raising the scope for a move back towards 1.3310 (100% Fibonacci extension).

Additional Market Outlooks

US Non Farm Payrolls (NFP) Report Preview (AUG 2024)

Euro Forecast: EUR/USD Opening Range for September in Focus

US Dollar Forecast: USD/JPY Rally Persists After Defending Weekly Low

Canadian Dollar Forecast: USD/CAD Rebound Emerges Ahead of March Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong