British Pound Outlook: GBP/USD

GBP/USD takes out the July low (1.2659) even as the Bank of England (BoE) implements a 25bp rate-hike, and the exchange rate may continue to give back the advance from the June low (1.2369) as it carves a series of lower highs and lows during the first week of August.

GBP/USD Post-BoE Weakness Undermines Rebound from June Low

GBP/USD trades below the 50-Day SMA (1.2728) for the first time since June after registering a fresh yearly high (1.3143) during the previous month, and the exchange rate may continue to reflect a bearish price series as it fails to respond to the positive slope in the moving average.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

It seems as though the 6-3 vote for a 25bp rate-hike is dragging on GBP/USD as ‘one member preferred to maintain Bank Rate at 5%,’ but it seems as though the majority of the Monetary Policy Committee (MPC) will take additional steps to combat inflation as ‘two members preferred to increase Bank Rate by 0.5 percentage points.’

Bank of England (BoE) Monetary Policy Report (MPR)

Source: BoE

The update to the quarterly Monetary Policy Report (MPR) suggests the BoE will pursue a more restrictive policy as ‘the market-implied path for Bank Rate in the United Kingdom rises to a peak of just over 6%,’ and the recent weakness in GBP/USD may turn out to be temporary as the ‘Committee continued to judge that the risks around the modal inflation forecast were skewed to the upside.’

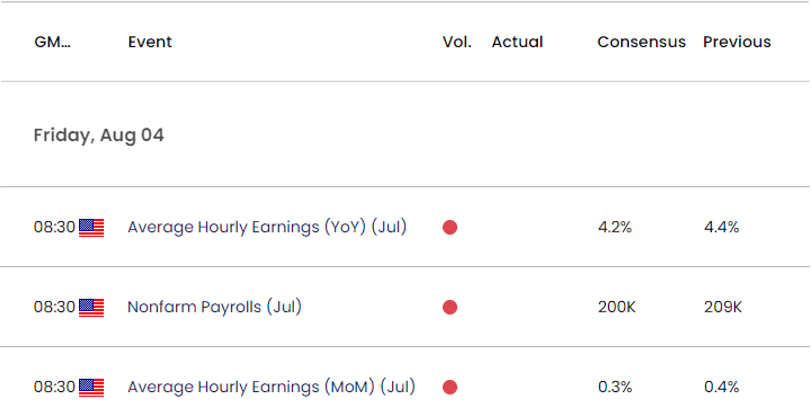

US Economic Calendar

Nevertheless, data prints coming out of the US may sway GBP/USD as Non-Farm Payrolls (NFP) are projected to increase 200K in July, and another rise in employment may push the Federal Reserve to further combat inflation as the economy shows little indications of a looming recession.

In turn, evidence of a tight labor market may drag on GBP/USD as it fuels speculation higher US interest rates, but a weaker-than-expected NFP print may generate a bearish reaction in the Greenback as it puts pressures on the Federal Open Market Committee (FOMC) to end its hiking-cycle.

With that said, the US NFP report may influence the near-term outlook for GBP/USD as the Fed also keeps the door open to implement a more restrictive policy, but the exchange rate may continue to give back the advance from the June low (1.2369) as it trades below the 50-Day SMA (1.2728) for the first time since June.

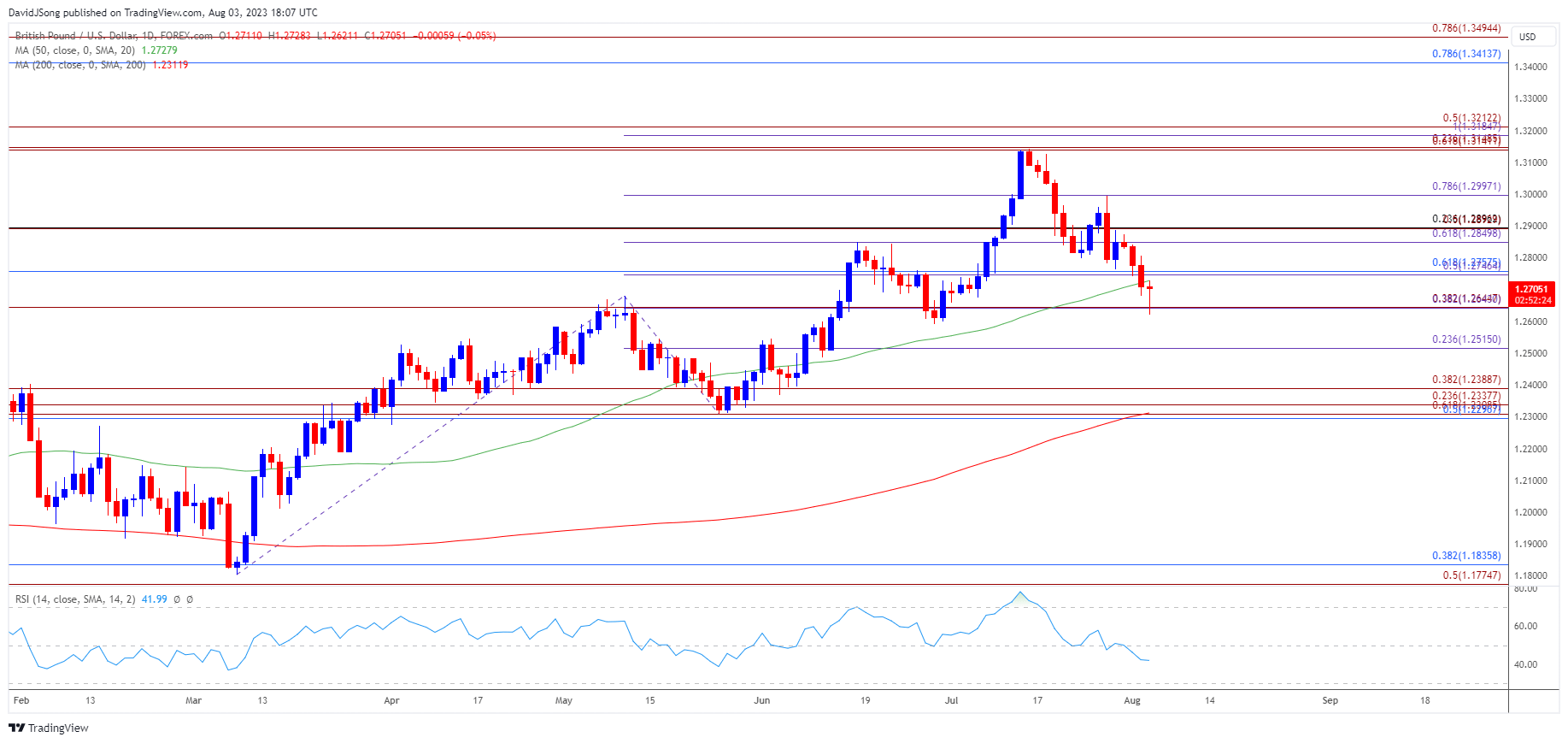

British Pound Price Chart – GBP/USD Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD clears the July low (1.2659) after registering a fresh yearly high (1.3143) during the previous month, with the exchange rate trading below the 50-Day SMA (1.2728) for the first time since June as it extends the series of lower highs and lows from earlier this week.

- Lack of response to the positive slope in the moving average may lead to a further decline in GBP/USD, with a close below the 1.2640 (38.2% Fibonacci extension) to 1.2650 (38.2% Fibonacci extension) area bringing 1.2520 (23.6% Fibonacci extension) on the radar.

- Next area of interest comes in around the June low (1.2369), but failure to close below the 1.2640 (38.2% Fibonacci extension) to 1.2650 (38.2% Fibonacci extension) area may curb the recent weakness in GBP/USD.

- Need a move back above the 1.2850 (61.8% Fibonacci extension) to 1.2900 (23.6% Fibonacci retracement) region to negate the bearish price series, with the next area of interest coming in around the 1.3000 (78.6% Fibonacci extension) handle.

Additional Market Outlooks

EUR/USD Dips Below 50-Day SMA Ahead of US NFP Report

AUD/USD Post-RBA Weakness Brings Test of July Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong