British Pound Outlook: GBP/USD

GBP/USD slipped below the opening range for August after struggling to trade back above the 50-Day SMA (1.2775), and data prints coming out of the UK may drag on the British Pound as the Consumer Price Index (CPI) is anticipated to show slowing inflation.

GBP/USD Outlook Mired by Failure to Defend Monthly Opening Range

GBP/USD may no longer respond to positive slope in the moving average as it registers a fresh monthly low (1.2617), and the exchange rate may continue to give back the advance from the June low (1.2369) as a head-and-shoulders formation seems to be taking shape.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

UK Economic Calendar

At the same time, the UK CPI may drag on GBP/USD as both the headline and core rate of inflation are expected to narrow in July, and signs of easing price growth may encourage the BoE to deliver another 25bp rate-hike as the central bank winds down its hiking-cycle.

However, a higher-than-reading for UK inflation may generate a bullish reaction in the British Pound as two members of the Monetary Policy Committee (MPC) voted for a 50bp rate-hike at the August meeting, and a growing number of BoE officials may favor a more restrictive policy as Governor Andrew Bailey and Co. pledge to ‘ensure that CPI inflation returns to the 2% target sustainably in the medium term.’

With that said, the update to the UK CPI may sway GBP/USD as the BoE continues to combat inflation, but the exchange rate may struggle to retain the advance from the June low (1.2369) as a head-and-shoulders formation seems to be taking shape.

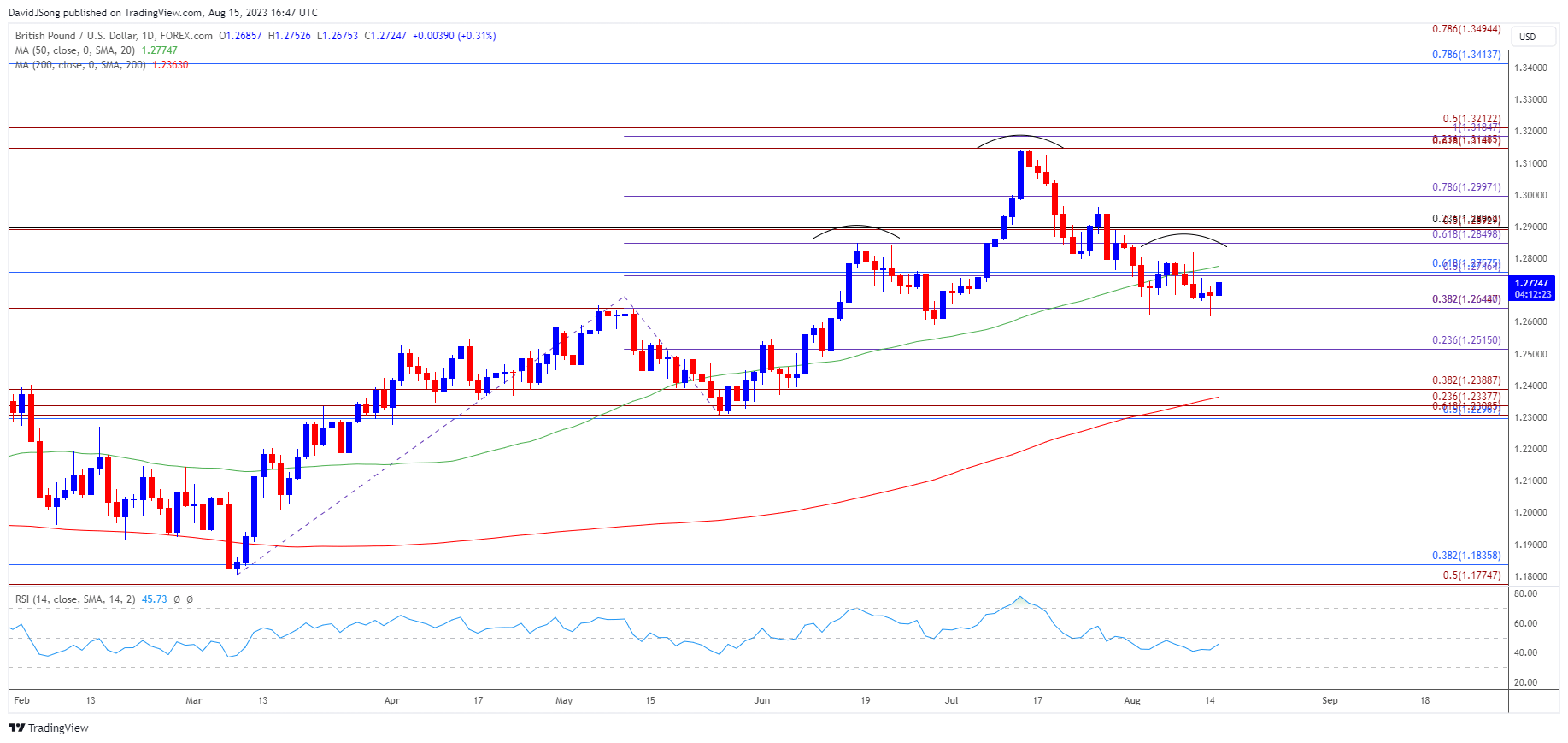

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD fails to retain the opening range for August, with the exchange rate registering a fresh monthly low (1.2617) as it struggled to trade back above the 50-Day SMA (1.2775).

- GBP/USD may no longer respond to the positive slope in the moving average as a head-and-shoulders formation seems to be taking shape, with a close below the 1.2640 (38.2% Fibonacci extension) to 1.2650 (38.2% Fibonacci extension) region raising the scope for a move towards 1.2520 (23.6% Fibonacci extension).

- Next area of interest comes in around 1.2300 (50% Fibonacci retracement) to 1.2390 (38.2% Fibonacci extension), which incorporates the June low (1.2369), but the failed attempts to close below the 1.2640 (38.2% Fibonacci extension) to 1.2650 (38.2% Fibonacci extension) region may negate the reversal pattern.

- Need a close above the 1.2750 (50% Fibonacci retracement) to 1.2760 (61.8% Fibonacci retracement) area to bring the 1.2850 (61.8% Fibonacci extension) to 1.2900 (23.6% Fibonacci retracement) region back on the radar, with the next zone of interest coming in around the 1.3000 (78.6% Fibonacci extension) handle.

Additional Market Outlooks

USD/CAD Outlook: RSI Nearing Overbought Zone with Canada CPI on Tap

USD/JPY Breaks Above Monthly Opening Range to Eye Yearly High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong