Key Events for the Week Ahead

- UK Claimant Count Change on Tuesday

- FOMC Member Speeches on Tuesday, Thursday, and Friday

- UK CPI and US CPI on Wednesday

The first wave of volatility is expected on the GBPUSD chart next week from labor market reports and inflation data. This follows the BOE kicking off its easing cycle last week and in anticipation of the rate cut probability for September.

The second wave of volatility is expected with FOMC member speeches providing insights into Fed rate cut expectations, along with the US Consumer Price Inflation data.

Technical Outlook

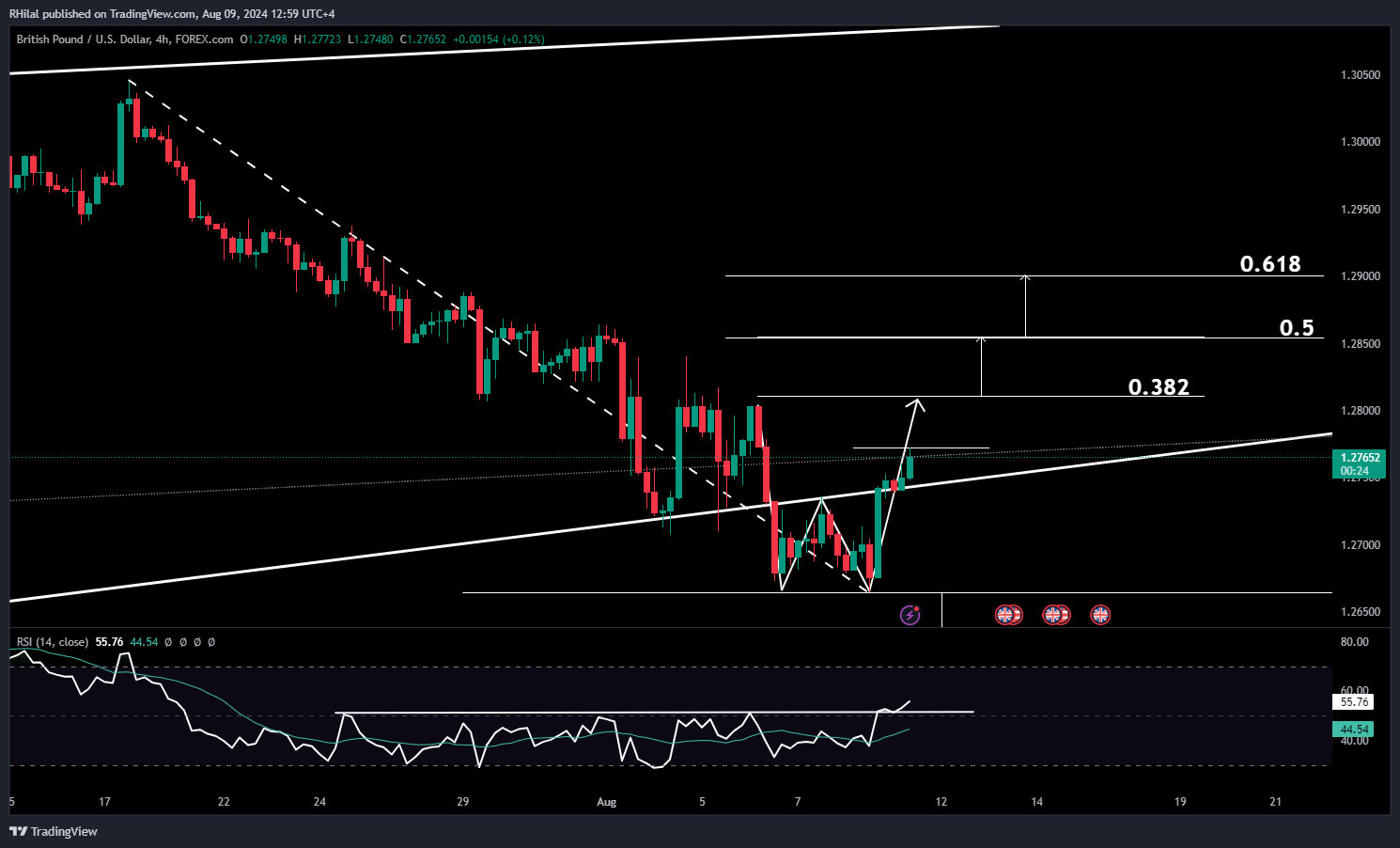

GBPUSD Outlook: GBPUSD – 4H Time Frame – Log Scale

Source: Tradingview

From a 4-hour time-frame perspective, a potential double bottom is forming at the week's low of 1.2665, paving the way towards the 1.28 level above the latest high of 1.2770.

From a momentum perspective, the Relative Strength Index (RSI) has broken out of its bottom range, adding further bullish momentum to the current trend. Projected levels beyond 1.28 are 1.2850 and 1.29, which align with the 50% and 61.8% Fibonacci retracement levels of the downtrend between July 2024 and August 2024, respectively.

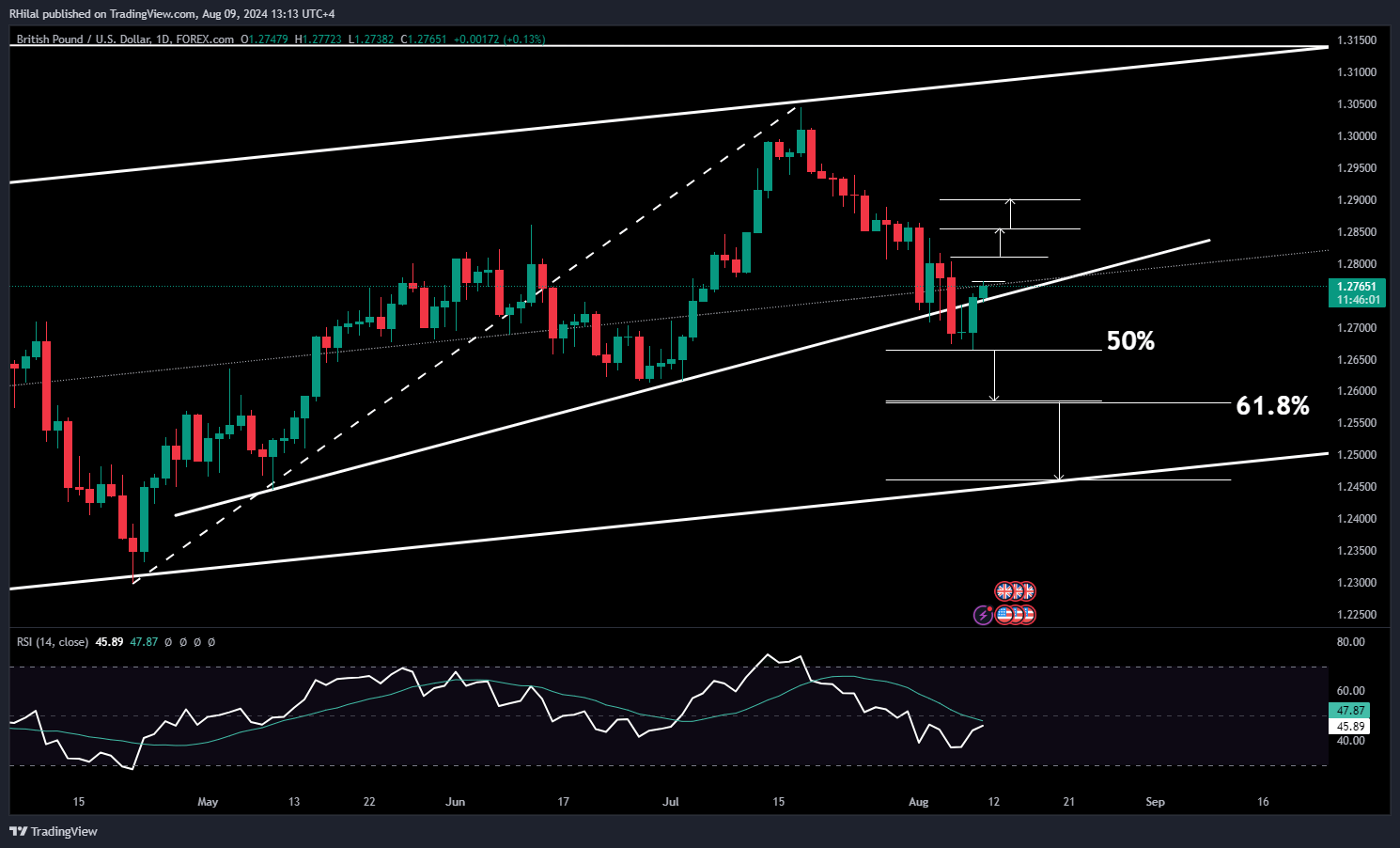

GBPUSD Outlook: GBPUSD – Daily Time Frame – Log Scale

Source: Tradingview

From a daily perspective, the relative strength momentum is near the neutral level, suggesting a potential reversal back down towards the 1.26 zone.

A close below the 1.2660 low, which aligns with the 50% Fibonacci retracement level of the uptrend extending from the April 2024 low to the July 2024 high, could lead the trend towards potential support at the 61.8% retracement level at 1.2580, followed by 1.2460 if the trend continues lower.

--- Written by Razan Hilal, CMT