- FED Rate Cut Concerns

- BOE Rate Cut Barriers

- GBPUSD Key Levels

Fed Rate Cut Concerns

Wall Street stocks have suffered due to a disappointing earnings season, the lowest flash manufacturing PMI record of the year, declining inflation, and leading economic indicators. The next crucial indicators are the US GDP for the second quarter of 2024, followed by PCE data on Friday, which will provide further confirmation on monetary policy decisions.

Fed’s Bill Dudley has raised alarms about the need to cut rates as soon as possible to mitigate recession risks. Additionally, the tightening spread between 2-year and 10-year bond yields signals another recession risk, possibly opening the door for a sooner-than-expected rate cut.

BOE Rate Cut Barriers

Recent economic figures from the UK have shown a solid upturn in private sector activity, according to flash PMI data, with the sharpest increase in new business in the past 15 months. The post-election environment is boosting the manufacturing and services sectors, with manufacturing showing particular strength.

As the UK economy aligns with the BOE’s 2% inflation rate target and increasing GDP rates, the primary challenge for the BOE’s next rate cut lies in the historical strength of the labor market. The BOE must ensure the sustainability of the 2% inflation rate level, reducing the chances of the rate exceeding the 2% mark.

Market Volatility

With the Fed rate decision on the horizon next week, heightened market volatility and anticipation are expected, primarily driven by the state of the US Dollar.

Technical Outlook

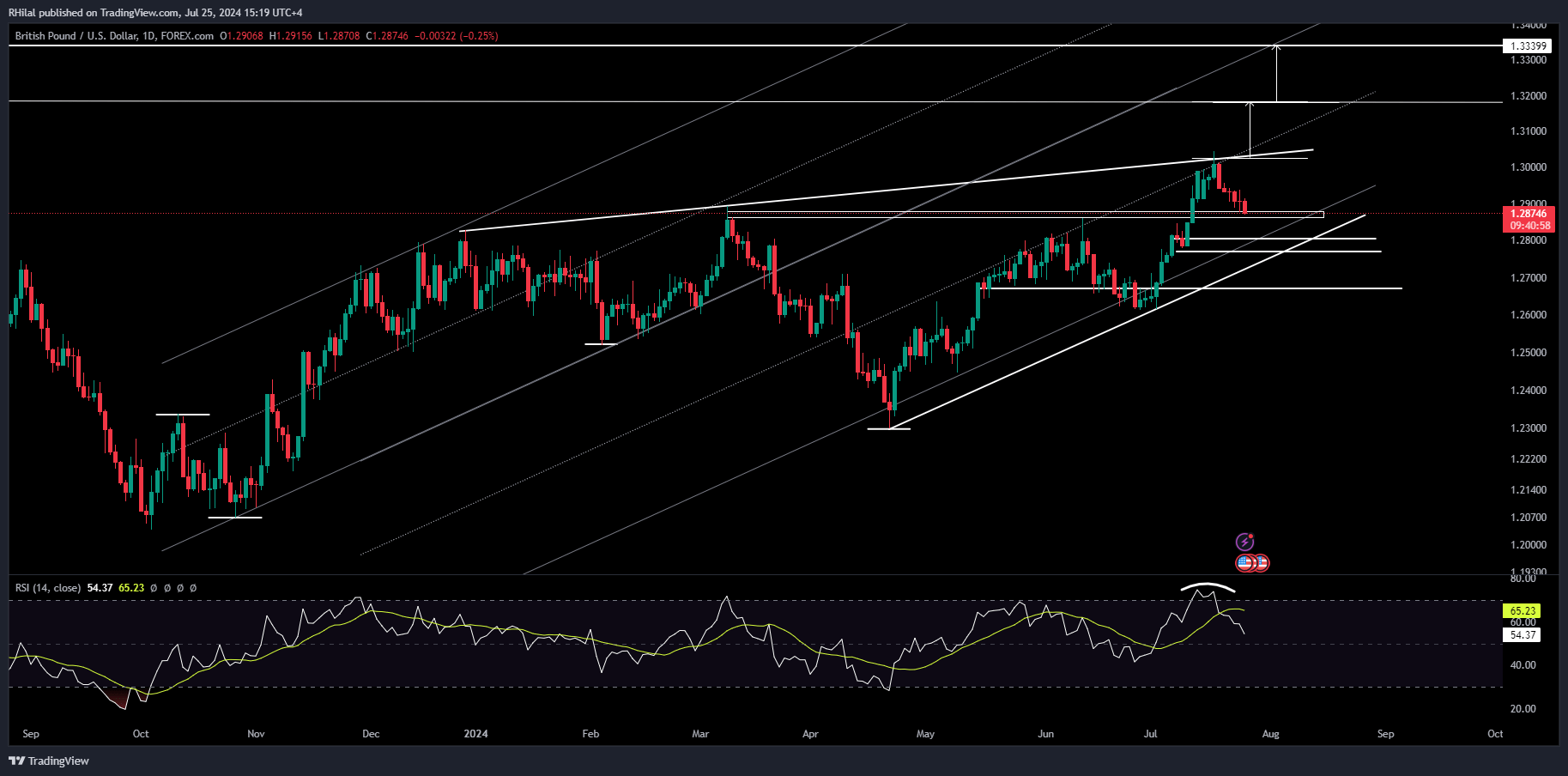

GBPUSD Outlook: GBPUSD – Daily Time Frame – Log Scale

Source: Tradingview

Source: Tradingview

The GBPUSD is trading below the 1.29 barrier after extending its bullish momentum near the 1.3030 mark. The current trading level of the pound aligns with a support zone extending from the highs of March 2024 and June 2024 near 1.2860.

Bearish Scenario

A further close below 1.2850 could drive the pound towards the lower border of its consolidating price action, near the June 2024 lows at levels 1.28, 1.2770, and 1.2660 respectively.

Bullish Scenario

A positive rebound could push the GBPUSD back towards the 1.3 mark. A close above the 1.3030 level could potentially drive the pair towards the July 2023 highs between 1.3140 and 1.3180.

Further upward breaks could potentially align with a resistance level near 1.3330.

--- Written by Razan Hilal, CMT