Asian Indices:

- Australia's ASX 200 index rose by 56.3 points (0.77%) and currently trades at 7,408.50

- Japan's Nikkei 225 index has risen by 192.99 points (0.007%) and currently trades at 27,694.85

- Hong Kong's Hang Seng index has risen by 479.97 points (2.31%) and currently trades at 21,292.14

- China's A50 Index has risen by 146.79 points (1.08%) and currently trades at 13,765.82

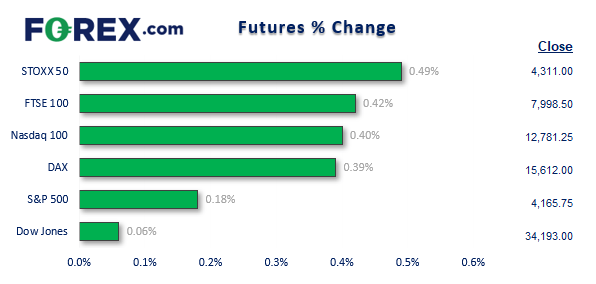

UK and Europe:

- UK's FTSE 100 futures are currently up 33.5 points (0.42%), the cash market is currently estimated to open at 8,031.33

- Euro STOXX 50 futures are currently up 21 points (0.49%), the cash market is currently estimated to open at 4,301.04

- Germany's DAX futures are currently up 60 points (0.39%), the cash market is currently estimated to open at 15,566.34

US Futures:

- DJI futures are currently up 18 points (0.05%)

- S&P 500 futures are currently up 50.75 points (0.4%)

- Nasdaq 100 futures are currently up 7.25 points (0.17%)

The Australian dollar faced selling pressure overnight after a measure of inflation expectations fell, and another soft employment report fanned hopes of a less-aggressive RBA tightening cycle Australian unemployment rose to an 8-month high, whilst a notable decline in full-time jobs, lower participation rate and employment/population ratio suggested we’re at or near a turning point in the economy.

Japan’s trade reached a record deficit as export growth slumped to 3.5% y/y, down for 11.5% previously with imports also at a 2-year low. With demand down and exports weighing on domestic growth, it’s hard to see why the BOJ would want to do anything rash that inadvertently strengths their currency (such as the BOJ abandoning YCC). For now, I doubt the new BOJ governor will be as hawkish as markets want him to be.

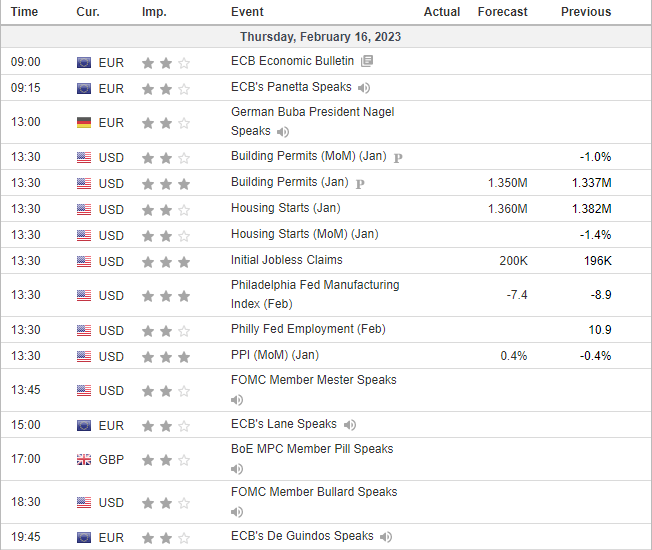

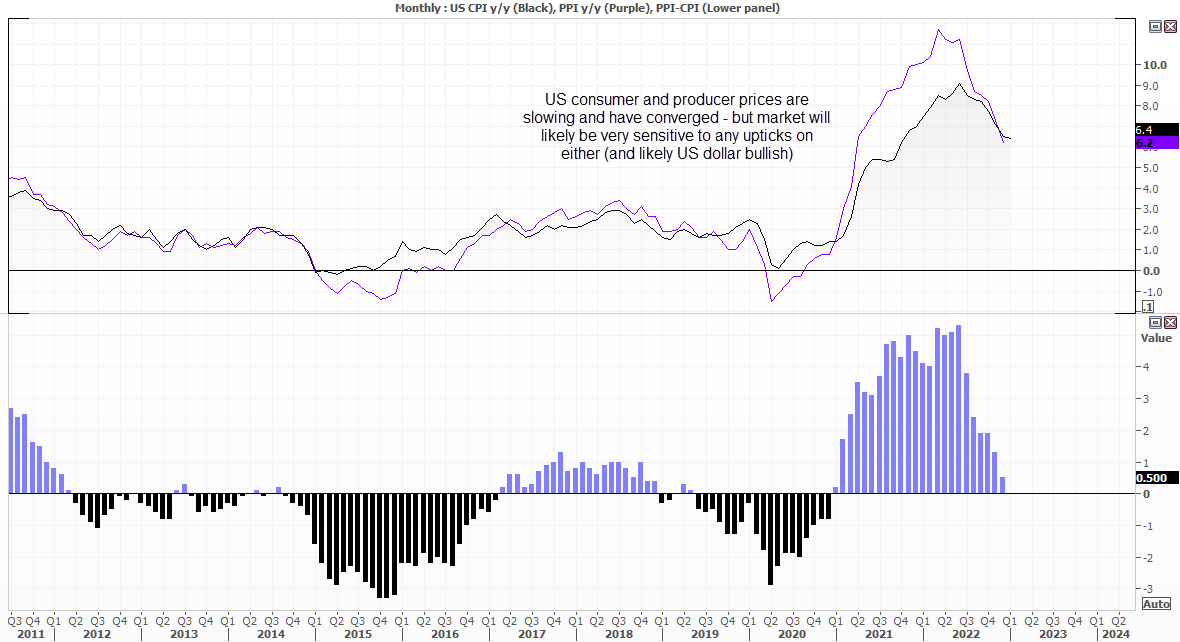

US producer prices, manufacturing and housing data in focus

No miracles will be expected for US housing data given the Fed’s hikes, but it will be interesting to see if the Philadelphia Fed Manufacturing Index contracts at a much faster pace, like the NY State Empire equivalent did yesterday. And with US retail sales hitting a near 2-year high and inflation hotter than expected, all evidence points towards a soft landing for the US and a case for more hikes. And that view could be bolstered if US producer prices come in hotter than expected today – and it could further support the US dollar on hawkish bets.

There are also central bankers speaking and an economic bulletin, although none of today’s data is considered top-tier.

- The European council release their first economic bulletin of the year at 09:00 GMT

- BOC governor Tiff Macklem and Deputy governor Carolyn Rogers speak at the House of Commons Standing Committee on Finance at 16:00

- At 17:00 GMT, BOE chief economist Huw Pill speaks on the UK economy at the Wawrick think tank

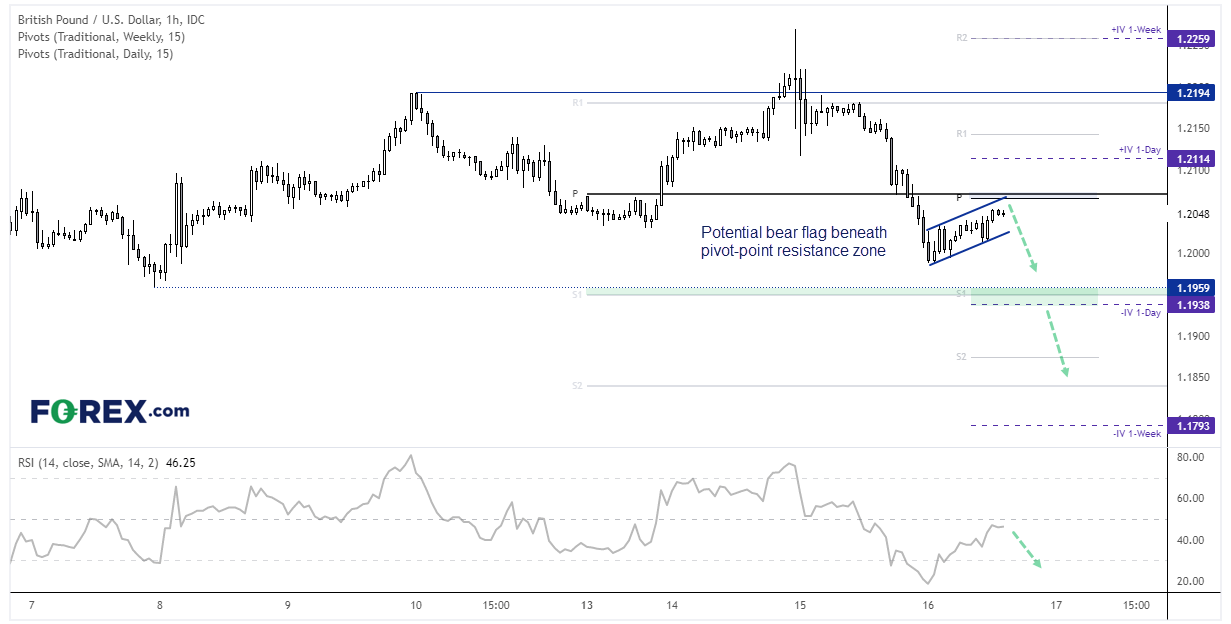

GBP/USD 1-hour chart:

Yesterday’s soft-than-expected inflation report for the UK came as a welcomed surprise, which helped the pound quickly erase all of Tuesday’s hot employment gains. After briefly trading below 1.20, GBP/USD has produced a countertrend move in the form of a potential bear channel / flag. Given the relative hawkishness of the Fed and strong US data, my bias for GBP/USD to break below 1.20. So I’m now looking for evidence of a swing high around or below the weekly and daily pivot points (a break above which invalidates the bearish bias).

Note that the downside band of 1-day implied volatility is just beneath the daily and weekly S1 pivots, and the downside band for 1-week IV is just below 1.1800.

Economic events up next (Times in GMT)