British Pound Outlook: GBP/USD

GBP/USD attempts to retrace the decline following the softer-than-expected UK Consumer Price Index (CPI) even as the US Retail Sales report shows a 1.0% rise in July versus forecasts for a 0.3% reading.

GBP/USD Forecast: Test of Weekly High in Focus

Keep in mind, GBP/USD snapped the series of higher highs and lows carried over from last week as the UK CPI printed at 2.2% July versus forecasts for a 2.3% reading, while the core rate of inflation narrowed to 3.3% from 3.5% per annum during the same period to mark the lowest reading since September 2021.

It remains to be seen if the Bank of England (BoE) will respond to the CPI report as the central bank plans to ‘decide the appropriate degree of monetary policy restrictiveness at each meeting,’ and GBP/USD may face headwinds head of the next BoE meeting on September 19 as positive developments coming out of the US dampen bets for a Federal Reserve rate-cut.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Nevertheless, GBP/USD may test the weekly high (1.2873) as the market reaction to the US Retail Sales report unravels, and the UK Retail Sales report may keep the exchange rate afloat as the update is anticipated to show a rebound in household spending.

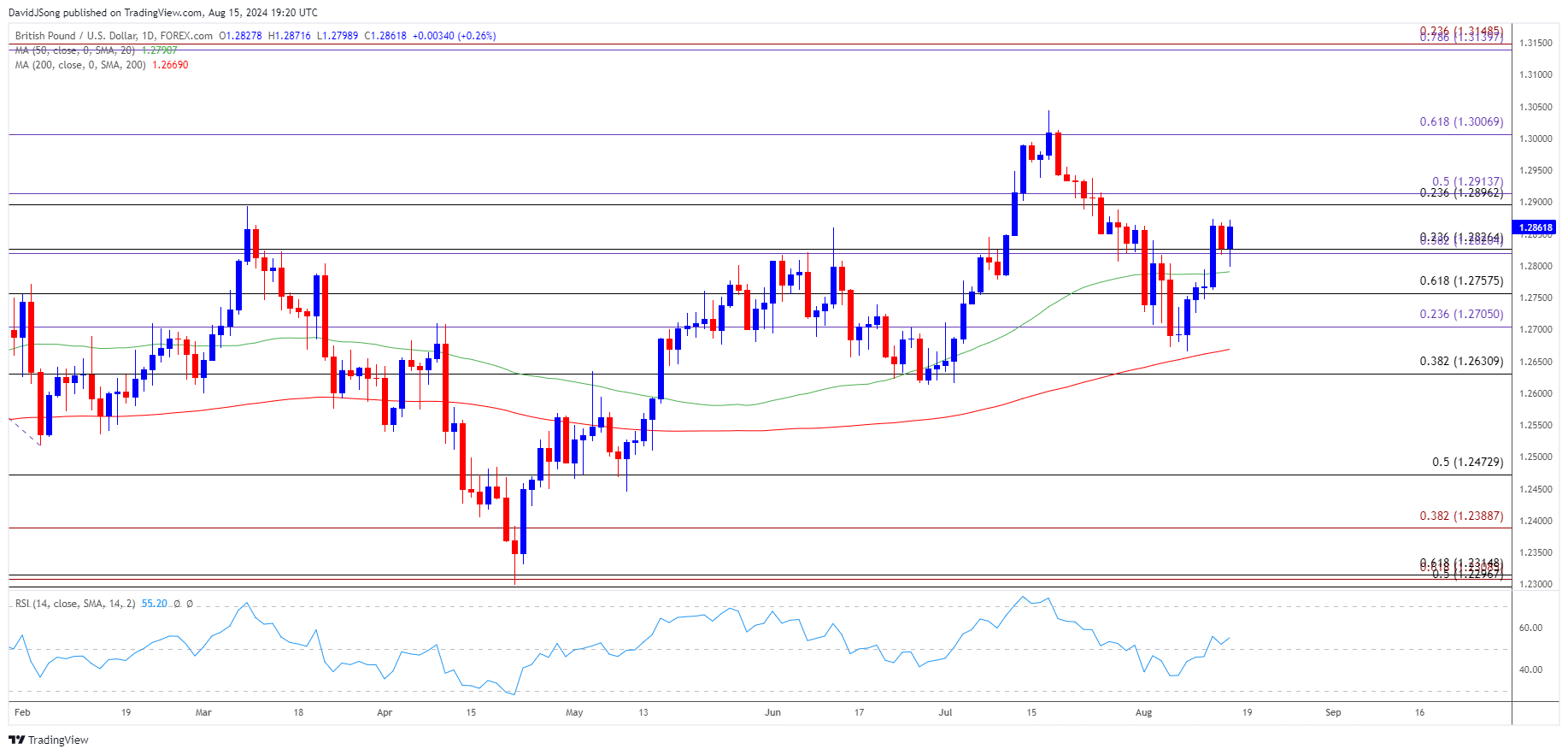

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- The advance from the monthly low (1.2665) appears to be stalling as GBP/USD struggles to clear the weekly high (1.2873), and lack of momentum to hold above 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement) zone may send the exchange rate back towards 1.2710 (23.6% Fibonacci extension).

- Next area of interest comes in around the monthly low (1.2665) but a breach above the weekly high (1.2873) may push GBP/USD towards the 1.2900 (23.6% Fibonacci retracement) to 1.2910 (50% Fibonacci extension) region.

- Need a break/close above 1.3010 (61.8% Fibonacci extension) to bring the July high (1.3045) on the radar, with the next area of interest coming in around 1.3140 (78.6% Fibonacci extension) to 1.3150 (23.6% Fibonacci extension).

Additional Market Outlooks

US Dollar Forecast: AUD/USD Bullish Price Series Persists

US Dollar Forecast: EUR/USD Eyes Monthly High with US CPI on Tap

NZD/USD Rate Outlook Hinges on RBNZ Interest Rate Decision

US Dollar Forecast: USD/JPY Continues to Defend January Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong