British Pound Outlook: GBP/USD

GBP/USD gives back the advance following the Federal Reserve interest rate decision as Bank of England (BoE) officials no longer vote for a rate hike, and the advance from the monthly low (1.2600) may continue to unravel as the exchange rate struggles to hold above the 50-Day SMA (1.2686).

GBP/USD Forecast: Pound Susceptible to Test of Monthly Low After BoE

GBP/USD trades to a fresh weekly low (1.2659) as the BoE votes 8-1 to keep the benchmark interest rate at 5.25%, with one official pushing for a rate cut as the ‘Bank Rate needed to become less restrictive now to enable a smooth transition in the policy stance.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Nevertheless, it seems as though the majority of the BoE will continue to endorse a wait-and-see approach in managing monetary policy as the Monetary Policy Committee (MPC) remains ‘prepared to adjust monetary policy as warranted by economic data,’ and developments coming out of the UK may continue to sway GBP/USD as the ‘Committee would keep under review for how long Bank Rate should be maintained at its current level.’

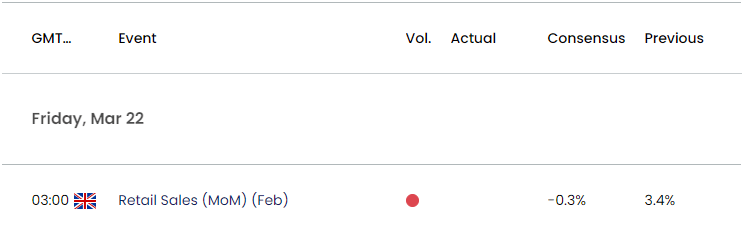

UK Economic Calendar

In turn, the update to the UK Retail Sales report may produce headwinds for the British Pound as household consumption is expected to fall 0.3% in February, and signs of a slowing economy may push the BoE to adjust the forward guidance for monetary policy as ‘inflation had been expected to fall temporarily to the 2% target in 2024 Q2.’

However, a stronger-than-expected Retail Sales print may curb the recent decline GBP/USD as it raises the BoE’s scope to keep UK interest rates on hold, and the exchange rate may face range bound conditions over the remainder of the month should it track the flattening slope in the 50-Day SMA (1.2686).

With that said, the recent weakness in GBP/USD may end up short lived should it attempt to trade back above the moving average, but the advance from the monthly low (1.2600) may continue to unravel as the Relative Strength Index (RSI) continues to move away from overbought territory.

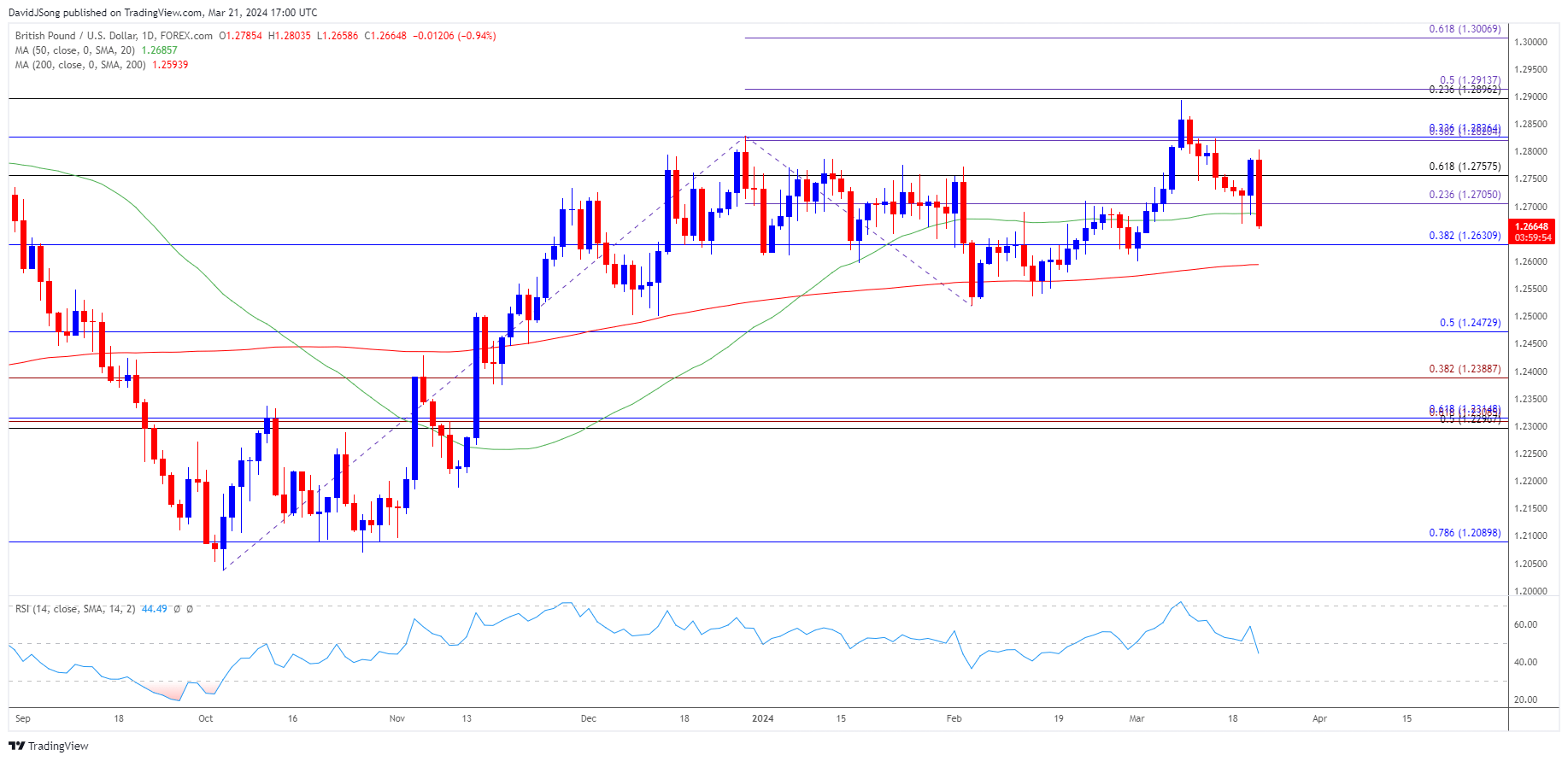

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- Keep in mind, GBP/USD registered a fresh yearly high (1.2894) earlier this month to briefly push the Relative Strength Index (RSI) above 70, but the oscillator may continue to show the bullish momentum abating as it moves away from overbought territory.

- The recent decline in GBP/USD may lead to a test of 1.2630 (38.2% Fibonacci retracement) but failure to defend the monthly low (1.2600) may push the exchange rate towards the February low (1.2518).

- Nevertheless, GBP/USD may track the flattening slope in the 50-Day SMA (1.2686) should it continue to hold above the monthly low (1.2600), with a move above 1.2710 (23.6% Fibonacci extension) bringing the 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement) region on the radar.

Additional Market Outlooks

US Dollar Forecast: EUR/USD Bounces Along 50-Day SMA with Fed on Tap

US Dollar Forecast: AUD/USD Approaches Monthly Low After RBA Meeting

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong