GBP/USD Key Points

- GBP/USD is the weakest US dollar cross after this morning’s cooler-than-expected UK CPI report

- Traders are increasing bets on a BOE rate cut in June, though services inflation would need to resume falling first.

- GBP/USD is testing a key support confluence in the 1.2500-25 zone.

GBP/USD Fundamental Analysis

The US economic calendar is barren today, but that doesn’t mean there’s no relevant data for forex traders to chew over.

The most prominent release during today’s European session was the UK Consumer Price Index (CPI) report for January, which showed that prices rose 4.0% y/y, below the 4.2% rise economists had anticipated. The “core” (ex-food and -energy) CPI reading also came in cooler than expected at 5.1% y/y vs. 5.2% eyed.

Coming within 24 hours of yesterday’s hotter-than-expected US CPI report, it’s not hard to draw a clear distinction between the pace of price changes on both sides of the Atlantic, and the potential implications for central bank policy. Indeed, traders have racheted up bets that the BOE will cut interest rates in June from around 40% before today’s inflation reading to above 70% as we go to press.

That said, traders may be overreacting to today’s inflation report, as the services measure of inflation that the Bank of England is more focused on actually ticked up from 6.4% last month to 6.5% in today’s report. BOE Governor Bailey and company will want to see that measure resume 2023’s downward march before feeling comfortable cutting interest rates.

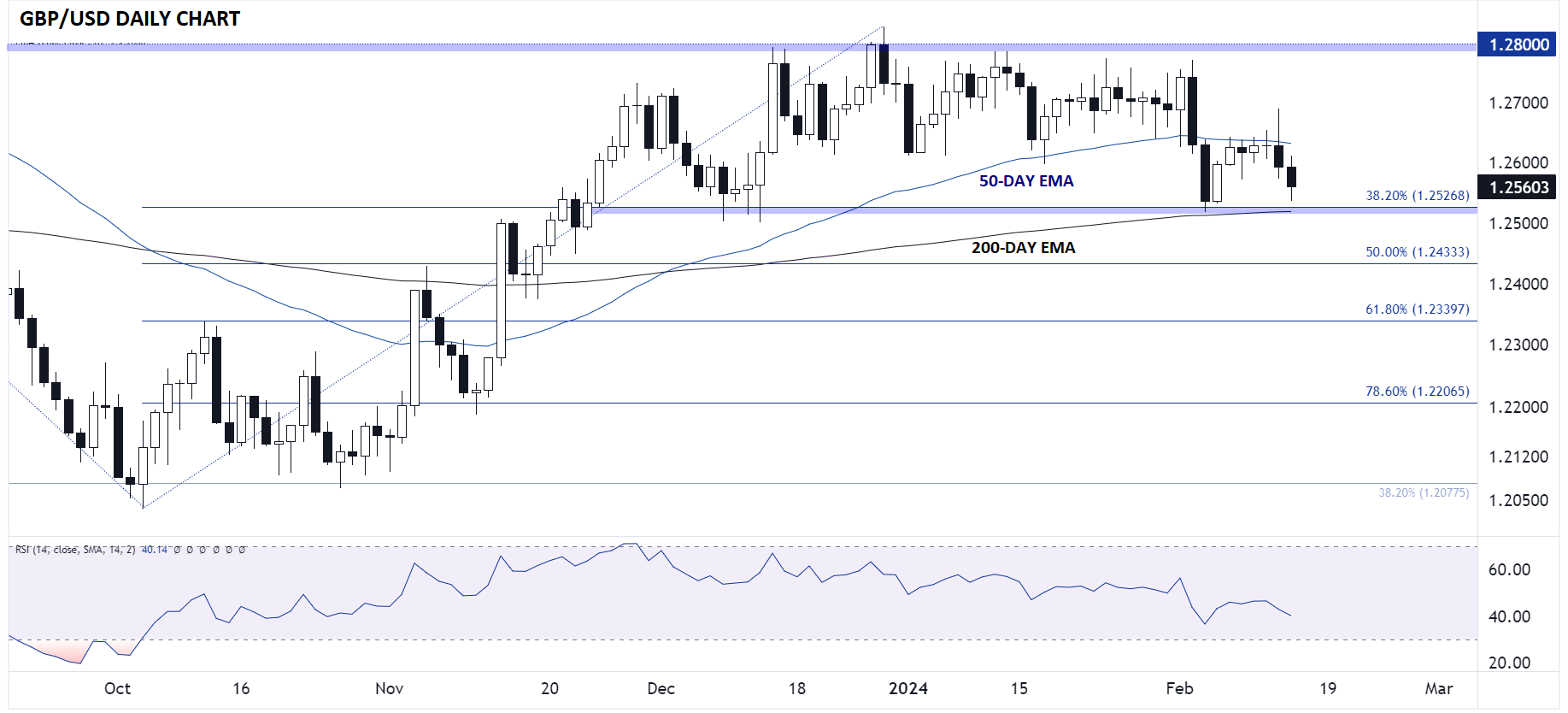

British Pound Technical Analysis – GBP/USD Daily Chart

Source: TradingView, StoneX

Turning our attention to the chart, GBP/USD bounced back through most of last week’s trade and was trading solidly above its 50-day EMA before reversing sharply to the downside on the back of yesterday’s US CPI report. That price action created a large “bearish engulfing candle” on the daily chart, showing a major shift from buying to selling pressure and foreshadowing today’s continued selling.

As of writing, GBP/USD is testing a critical support area in the 1.2500-25 zone, marked by the confluence of the 3-month low, 38.2% Fibonacci retracement of the Q4 rally, and the rising 200-day EMA. Bears have their work cut out for them to break this support confluence, but if they can overcome it, GBP/USD could quickly fall toward the next Fibonacci retracements at 1.2430 or 1.2340 next.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX