GBP/USD Outlook

GBP/USD pulls back after clearing the opening range for January, but the exchange rate may attempt to retrace the decline from the December high (1.2828) as it continues to trade within the ascending channel from last year.

GBP/USD Forecast: Ascending Channel Remains Intact Ahead of UK CPI

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

GBP/USD registered a fresh monthly high (1.2787) following the kneejerk reaction to the stronger-than-expected US Consumer Price Index (CPI), and the exchange rate may retain a bullish trend over the remainder of the month as it appears to be bouncing back from channel support.

UK Economic Calendar

Looking ahead, the update to the UK Consumer Price Index (CPI) may have a greater impact on GBP/USD rather than the state of the labor market as the Bank of England (BoE) pledges to ‘ensure that CPI inflation returns to the 2% target sustainably in the medium term,’ and signs of easing price growth may produce headwinds for the British Pound as it encourages the central bank to retain the current policy at its next meeting on February 1.

However, a stronger-than-expected CPI print may prop up GBP/USD amid the 6 to 3 split within the Monetary Policy Committee (MPC), and a growing number of BoE officials may vote for higher UK interest rates as ‘it was too early to conclude that services price inflation and pay growth were on a firmly downward path.’

Until then, speculation surrounding the BoE and Federal Reserve may sway GBP/USD as both central banks appear to be at the end of their hiking-cycle, and it remains to be seen if Chairman Jerome Powell and Co. will further adjust the forward guidance at the next interest rate decision on January 31 as the central bank forecasts lower US interest rates in 2024.

With that said, data prints coming out of the UK may sway GBP/USD in the days ahead as the BoE continues to combat inflation, while recent price action raises the scope for a test of the December high (1.2828) as it clears the opening range for 2024.

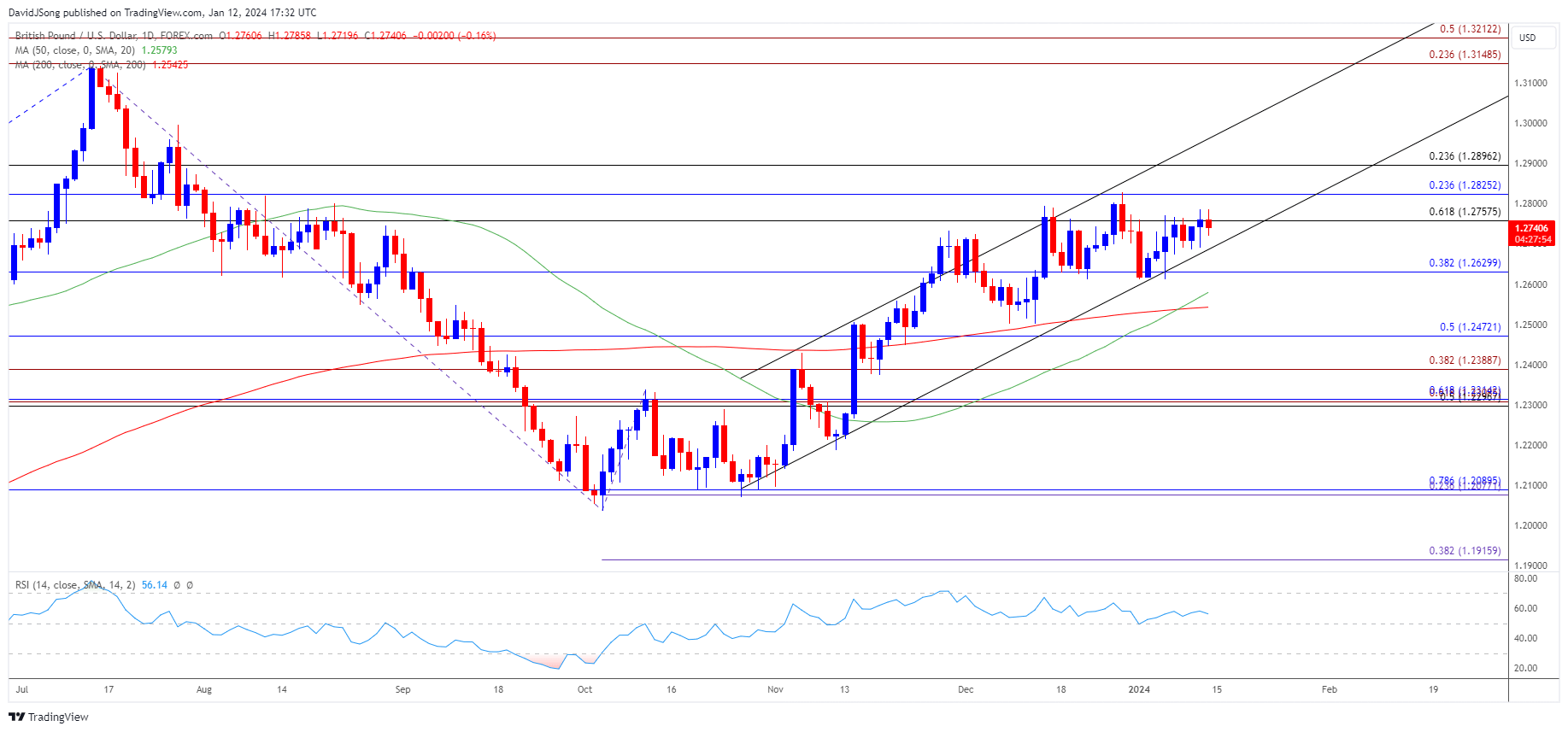

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD pulls back from a fresh monthly high (1.2787) after clearing the opening range for 2024, and the exchange rate may threaten the ascending channel from last year as it struggles to break/close above the 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement) region.

- A breach below 1.2630 (38.2% Fibonacci retracement) may lead to a test of the monthly low (1.2611), and lack of respond to the positive slope in the 50-Day SMA (1.2579) may push GBP/USD towards the December low (1.2500).

- At the same time, GBP/USD may attempt to retrace the decline from the December high (1.2828) as it holds above channel support but, need a break/close above the 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement) region to open up the 1.2900 (23.6% Fibonacci retracement) handle.

Additional Market Outlooks

US Dollar Forecast: EUR/USD 2024 Opening Range Break in Focus

US Dollar Forecast: AUD/USD Susceptible to Test of 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong