GBP/USD rises ahead of the Chancellor’s Budget

- The Chancellor has to balance voters against the market

- A 2p national insurance rate cut could be on the cards

- GBP/USD rises to a monthly high

GBP/USD is rising to a monthly high ahead of the Chancellor's Spring budget, where Jeremy Hunt has to balance wooing voters while managing tight public finances.

The budget comes as the ruling Conservative party has a low position in the polls ahead of a possible election later this year.

While the Chancellor is under pressure to announce significant tax cuts to boost the Conservative party's popularity, he had limited fiscal headroom to do so given that the UK tipped into recession at the end of 2023 and as the BoE pushed back on rate cut expectations causing borrowing costs to rise.

While Jeremy Hunt has said that he won't make any significant tax cuts, he will reportedly cut National Insurance tax by 2p. Cutting National Insurance could be less inflationary than cutting income tax, given that only the working population will benefit from the cut. Tax cuts are still considered inflationary and could raise the pound. Any surprise moves, such as a cut in income tax, which would be more headline-grabbing, could also boost the sterling.

The pound will be keen to see that any moves by the chancellor are funded to avoid the chaos unleashed into the financial markets after the Liz Truss’ budget 18 months earlier, where massive unfunded measures were announced, sending GBP/USD to a record low.

As well as the Spring Budget, Federal Reserve chair Jerome Powell is due to testify before Congress. Should he adopt a more hawkish stance, the U.S. dollar could rise, canceling out any potential gains in the pound.

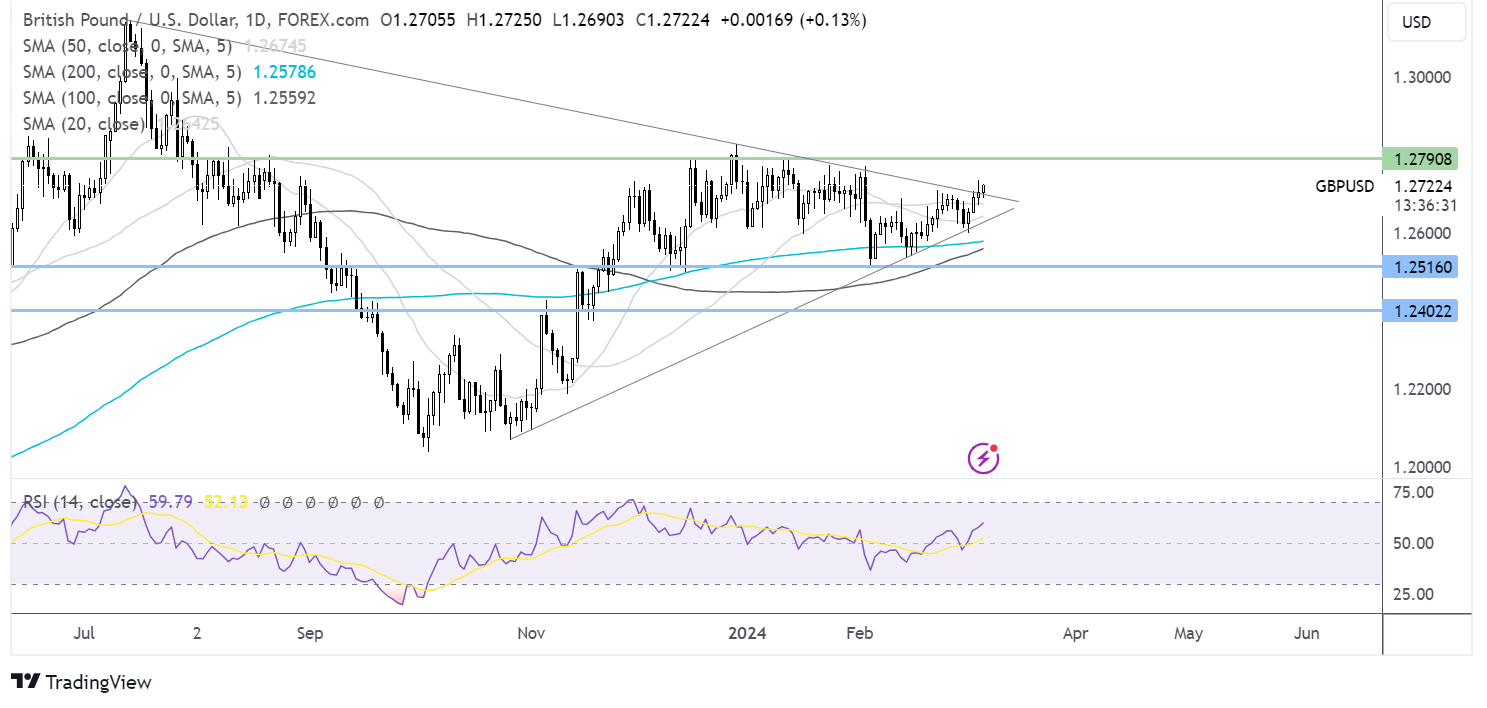

GBP/USD forecast – technical analysis

GBP/USD is breaking out the symmetrical triangle at 1.27, trading at a one month high. Buyers, supported by the breakout and the RSI above 50, could look to test 1.2770, the February high, ahead of 1.28, the round number, and 1.2830, the December high.

On the downside, support can be seen at 1.26, the March low, ahead of 1.2570, the 200 SMA. Below here, 1.2520 comes into focus, the 2024 low.

EUR/USD awaits Fed Chair Powell’s testimony

- Fed Chair likely to maintain hawkish tilt

- ADP payrolls are set to rise 150k vs 107K

- Eurozone retail sales are expected at 0.1% vs -1.1% previously

- EUR/USD inches towards 1.09

EUR/USD is rising amid a weak U.S. dollar as the market looks ahead to more cues on US monetary policy.

The focus will squarely be on Federal Reserve chair Jerome Powell's two-day testimony before Congress, where he is widely expected to maintain his hawkish stance on interest rates.

His testimony comes as inflation continues to cool and after several Federal Reserve officials warned the bank is in no hurry to cut interest rates given the strength of the US economy and that inflation is still above target.

According to the CME Fed watch tool, the market is pricing in a 25 basis point rate cut in June.

ADP payrolls will also be in focus and are expected to rise 150K in February from 107K. The data comes ahead of Friday's non-farm payroll report. Strong figures would support the Fed’s downplaying the need for an immediate rate cut.

Meanwhile, the euro will be focused on eurozone retail sales figures, which are expected to rise 0.1% MoM in January after tumbling 1.1% in the previous month. The data comes ahead of the ECB rate decision tomorrow, where the central bank is widely expected to leave rates at the record 4% level. Investors will be watching closely for clues on when the ECB could start to cut rates.

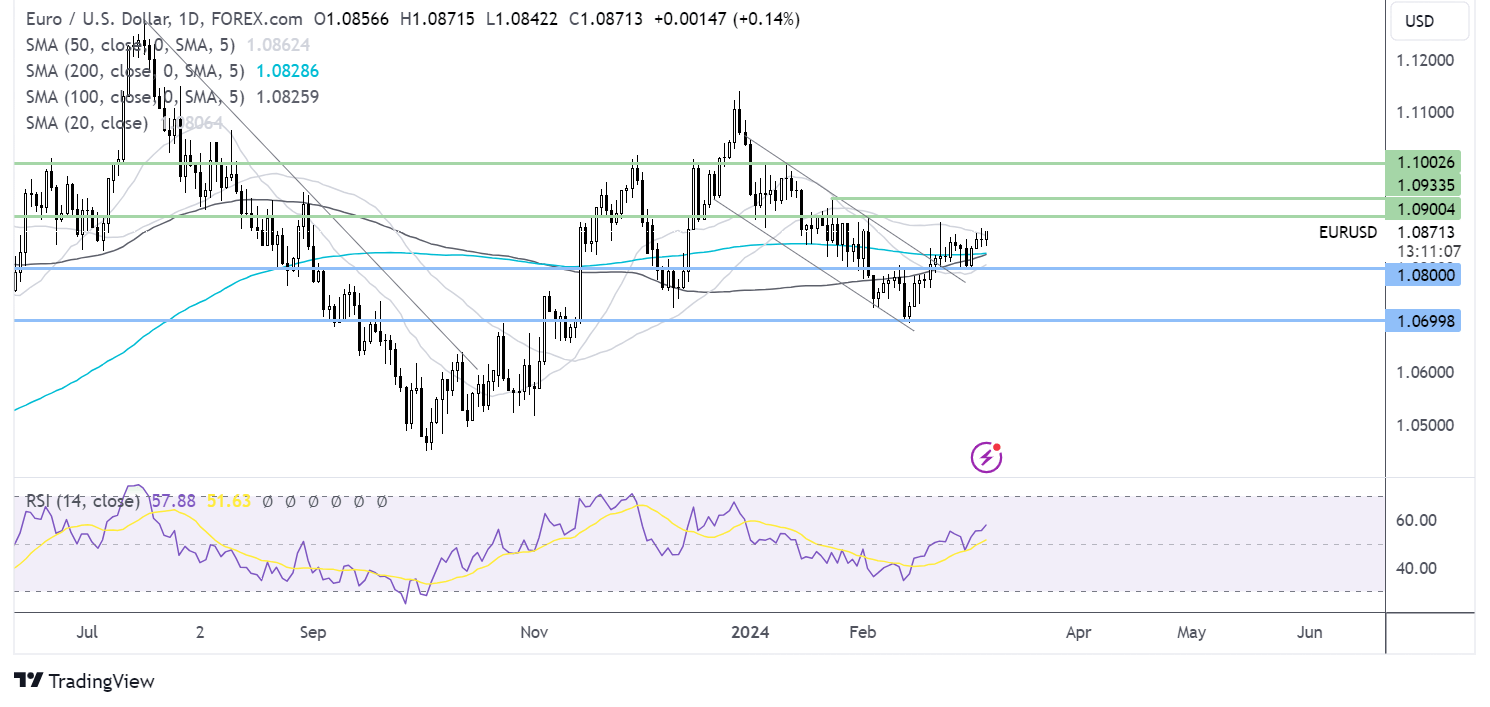

EUR/USD forecast – technical analysis

EUR/USD is extending its rebound from the 1.08 low. The rise above the 200 SMA and the RSI above 50 keeps buyers hopeful of further gains. Buyers will look for a rise towards 1.09, the February high, ahead of 1.0930, the late January high, and 1.10.

On the downside, support can be seen at 1.0825, the 200 SMA, ahead of 1.08, the March low. A break below here could open the door to 1.07, the 2024 low.