Weekly Technical Trade Levels on USD Majors, Commodities & Stocks

- Technical setups we’re tracking into the close of the month / quarter

- Next Weekly Strategy Webinar: Monday, October 25 at 8:30am EST

- Review the latest Weekly Strategy Webinars on my YouTube playlist.

In this webinar we take an in-depth look at the technical trade levels for the US Dollar (DXY), Euro (EUR/USD), British Pound (GBP/USD), Australian Dollar (AUD/USD), Japanese Yen (USD/JPY), Canadian Dollar (USD/CAD), Gold (XAU/USD), Crude Oil (WTI), S&P 500 (SPX500), Nasdaq (NDX) and Dow Jones (DJI). These are the levels that matter on the technical charts heading into the close of the month / quarter.

Japanese Yen Price Chart – USD/JPY Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/JPY on TradingView

USD/JPY has been testing a key resistance zone for the past four weeks at 147.69-148.73- a region defined by the 2022 high-week close and the high-close. Despite breakouts in the US Dollar and the 10-year treasury yields, USD/JPY has remained capped by this key threshold. Looking for a reaction of this zone – watch the weekly close.

A topside breach exposes the 1989 high / 1986 low at 151.90-152. Initial support rests along the 2020 parallel (currently ~145.70s) backed by near-term bullish invalidation at the 145-handle. Stay nimble here into the close of the month.

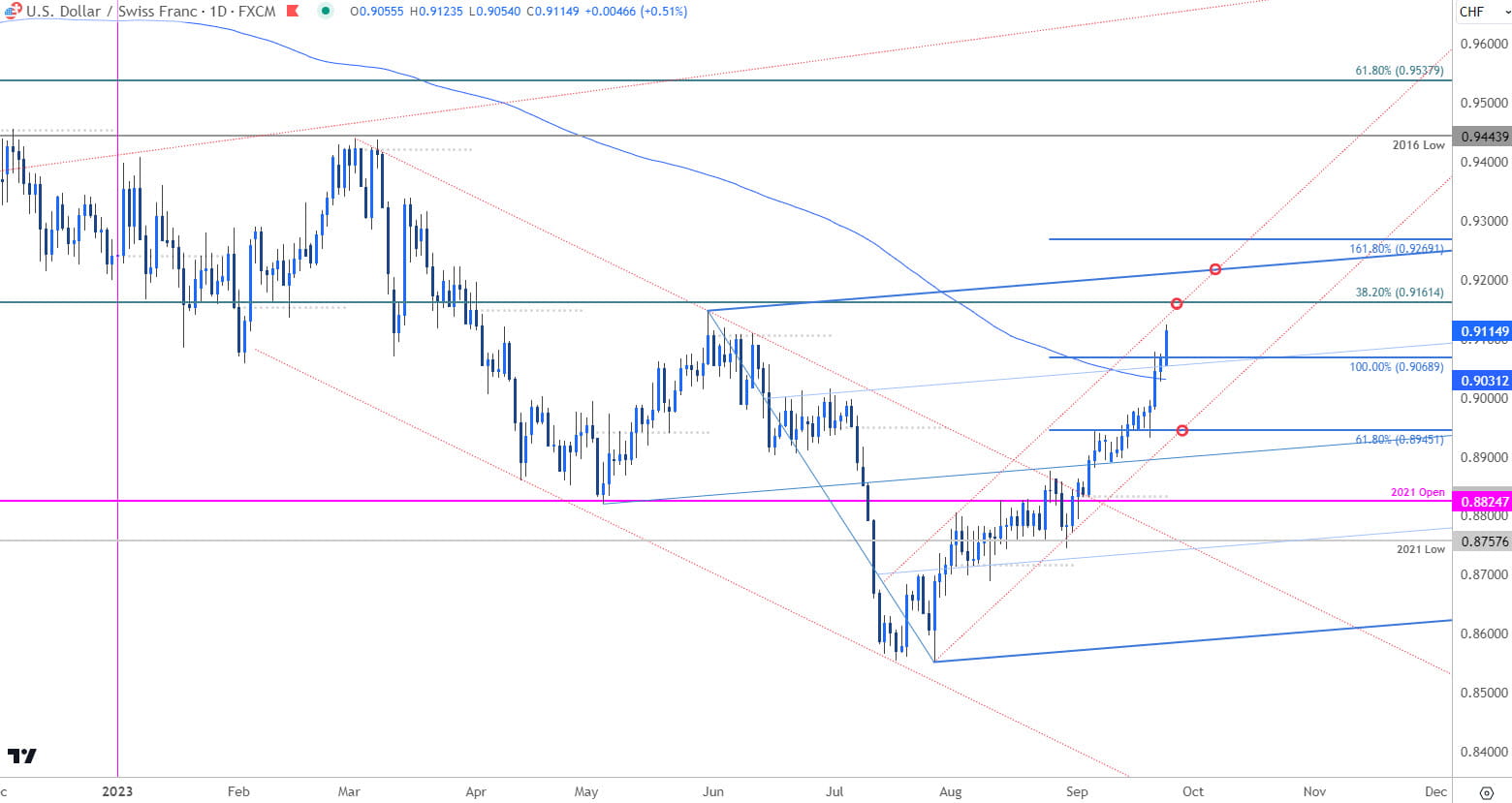

Swiss Franc Price Chart – USD/CHF Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CHF on TradingView

Lots of questions today on the USD/CHF breakout - a quick reference of the daily chart highlights channel resistance into the 38.2% Fibonacci retracement of the 2022 decline at 9161 with the highlighted slope confluence just higher near ~9210. Initial support rests at 9069 backed closely by the 200-day moving average at 9031. Broader bullish invalidation now raised to 8945.

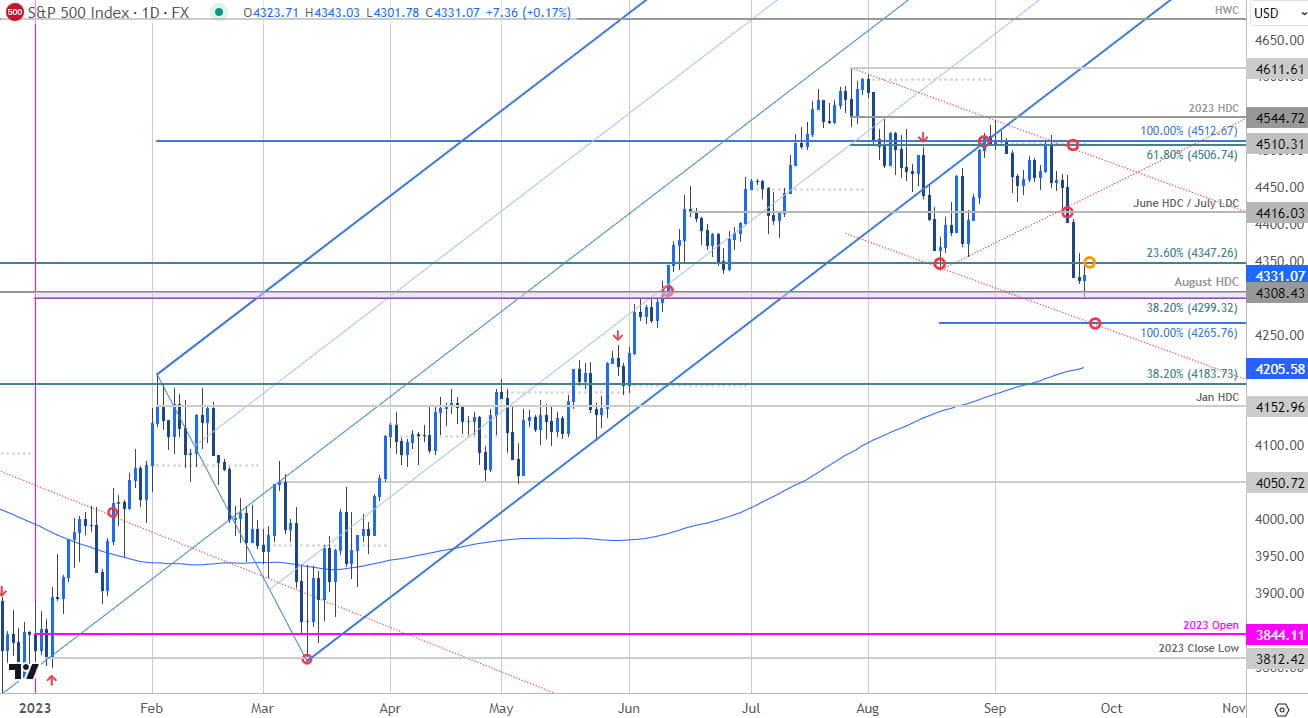

S&P 500 Price Chart – SPX500 Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; SPX500 on TradingView

The S&P 500 broke a multi-month consolidation pattern post-FOMC with the index plunging into confluent support at 4299-4308- a region defined by the 38.2% retracement of the yearly range and the August high-day close. A more significant support zone is seen just lower at the lower parallel / 100% extension near 4265- both levels of interest for possible downside exhaustion near-term. Initial resistance 4347 with bearish invalidation now lowered to 4416.

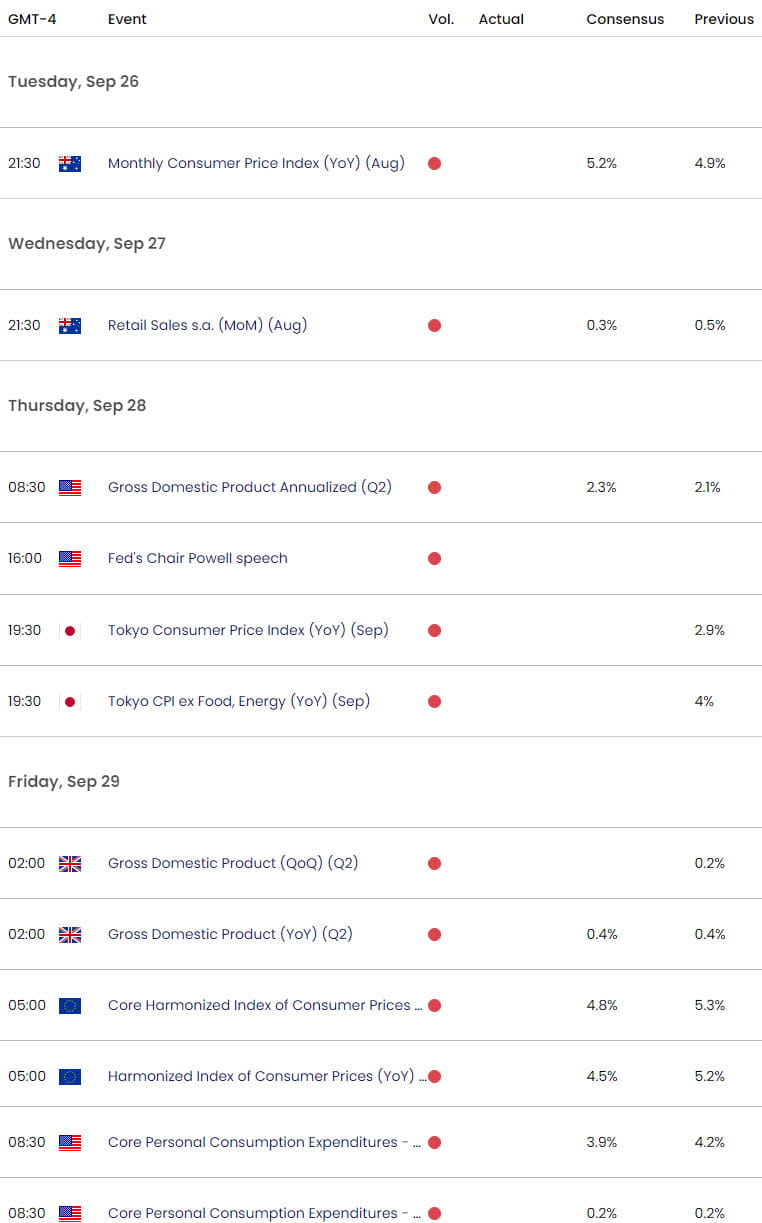

Economic Calendar – Key Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex