Weekly Technical Trade Levels on USD Majors, Commodities & Stocks

- Technical setups we are tracking into the weekly / monthly / quarterly open- NFP on tap

- Next Weekly Strategy Webinar: Monday, October 7 at 8:30am EST

- Review the latest Video Updates or Stream Live on my YouTube playlist.

In this webinar we take an in-depth look at the technical trade levels for the US Dollar (DXY), Euro (EUR/USD), British Pound (GBP/USD), Australian Dollar (AUD/USD), Canadian Dollar (USD/CAD), Japanese Yen (USD/JPY), Swiss Franc (USD/CHF), Gold (XAU/USD), Silver, (XAG/USD), AUD/CAD, Crude Oil (WTI), S&P 500 (SPX500), Nasdaq (NDX) and the Dow Jones (DJI). These are the levels that matter on the technical charts heading into the weekly open.

British Pound Price Chart– GBP/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

The British Pound is testing Fibonacci resistance for a fifth consecutive-day at the 78.6% retracement of the 2021 decline at 1.3414- looking for a breakout of this multi-day consolidation for guidance here with the immediate rally vulnerable while below.

A topside breach exposes the 2019 high at 1.3515 and the 1.36-handle. Initial support rests with the August high-day close (HDC) / 2021 low-week close (LWC) at 1.3260/73 with broader bullish invalidation now raised to 1.3091. Review my latest British Pound Short-term Outlook for a closer look at the near-term GBP/USD technical trade levels.

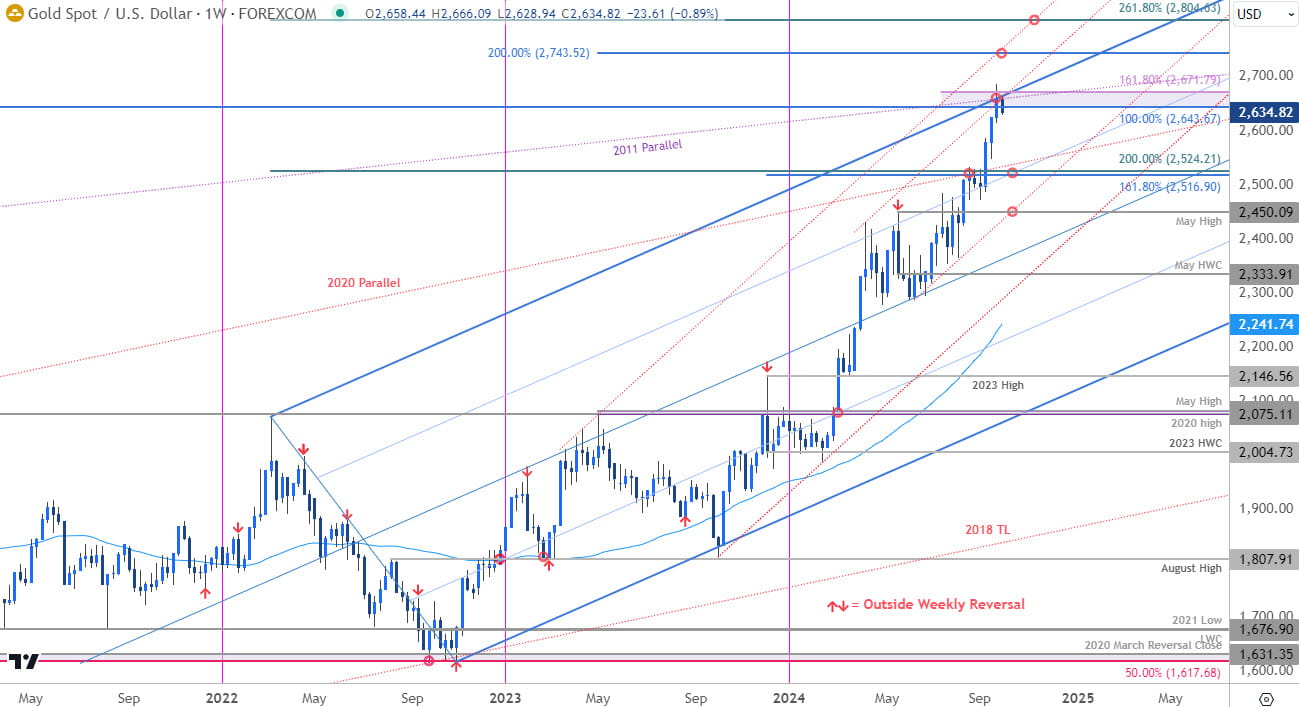

Gold Price Chart – XAU/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Gold held below a key resistance pivot into the close last week at 2643/71- a region defined by the 100% extension of the 2015 advance, the 1.618% extension of the June advance, and a host of short & long-term slope considerations. Bottom line- looking for a possible inflection off this mark into the start of the month with the immediate rally vulnerable while below.

Initial weekly support back at 2516/24 with broader bullish invalidation steady at the May high near 2450- losses should be limited to this level IF gold prices are heading higher on this stretch. A topside breach / close above this 2671 would keep the focus on subsequent resistance objectives at 2743 and the 2.618% extension of the 2022 range at 2804.

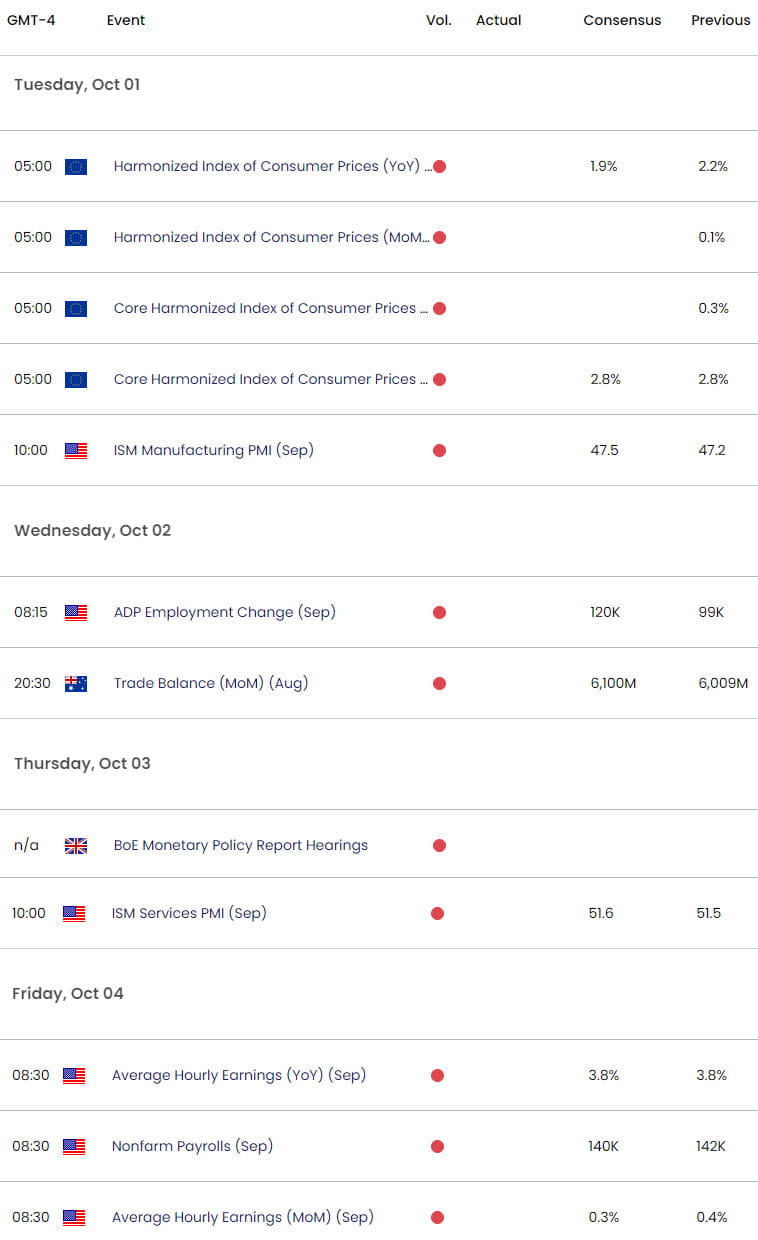

Economic Calendar – Key USD Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex