- UK inflation report due 7am BST

- Core, services inflation figures key

- Markets 96% priced for November BoE rate cut

- GBP/USD showing tentative signs of bottoming

Overview

GBP/USD is at risk of breaking out of the narrow trading range it’s been sitting in over the past fortnight with the UK consumer price inflation (CPI) report for September released later in the session. With so much uncertainty regarding signals from labour market data given poor response rates, this is the only UK data point that can still generate meaningful volatility in the pound.

Core, services figures to drive direction

The economic calendar below shows how various inflation measures are expected to print relative to a month ago.

While there will be ample headlines if the headline CPI annual rate comes in below the Bank of England’s 2% target as forecast, market reaction is likely to be determined by the core inflation rate which strips out volatile price movements. It’s forecast to rise 0.3% over the month and 3.4% for the year, the latter down two-tenths on the pace seen in August.

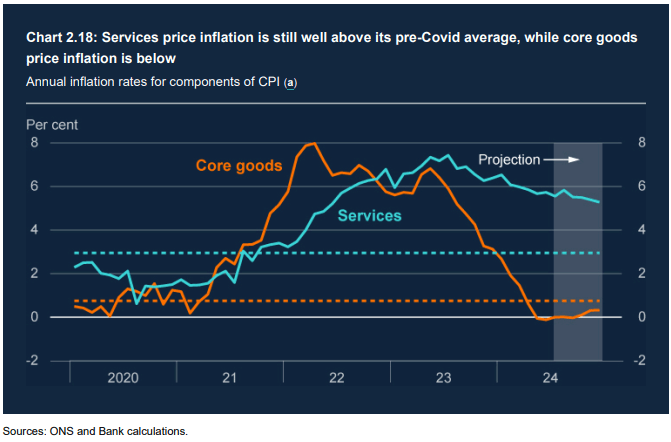

It's not shown on the calendar, but the services inflation rate is arguably the most important of all given the linkages to wage pressures. It rose 5.2% in the year to August after printing 5.5% in July. A continuation of that trend is important for the path of UK interest rates given the BoE expects services inflation to sit near 5.3% by year-end.

Source: BoE

Inflation report more important than usual

Before the inflation report, swaps markets are near fully priced for the BoE to deliver the second rate cut of the easing cycle, putting the probability of a 25 basis point move in early November around 96%. Further out, another cut is fully priced by February.

Earlier this month, BoE Governor Andrew Bailey told the Guardian newspaper the central bank could become "a bit more activist" in reducing rates depending on incoming inflation data, putting increased emphasis on Wednesday’s update. Prior to his verbal intervention, markets were divided on whether the BoE would cut rates before year-end.

GBP/USD bottoming?

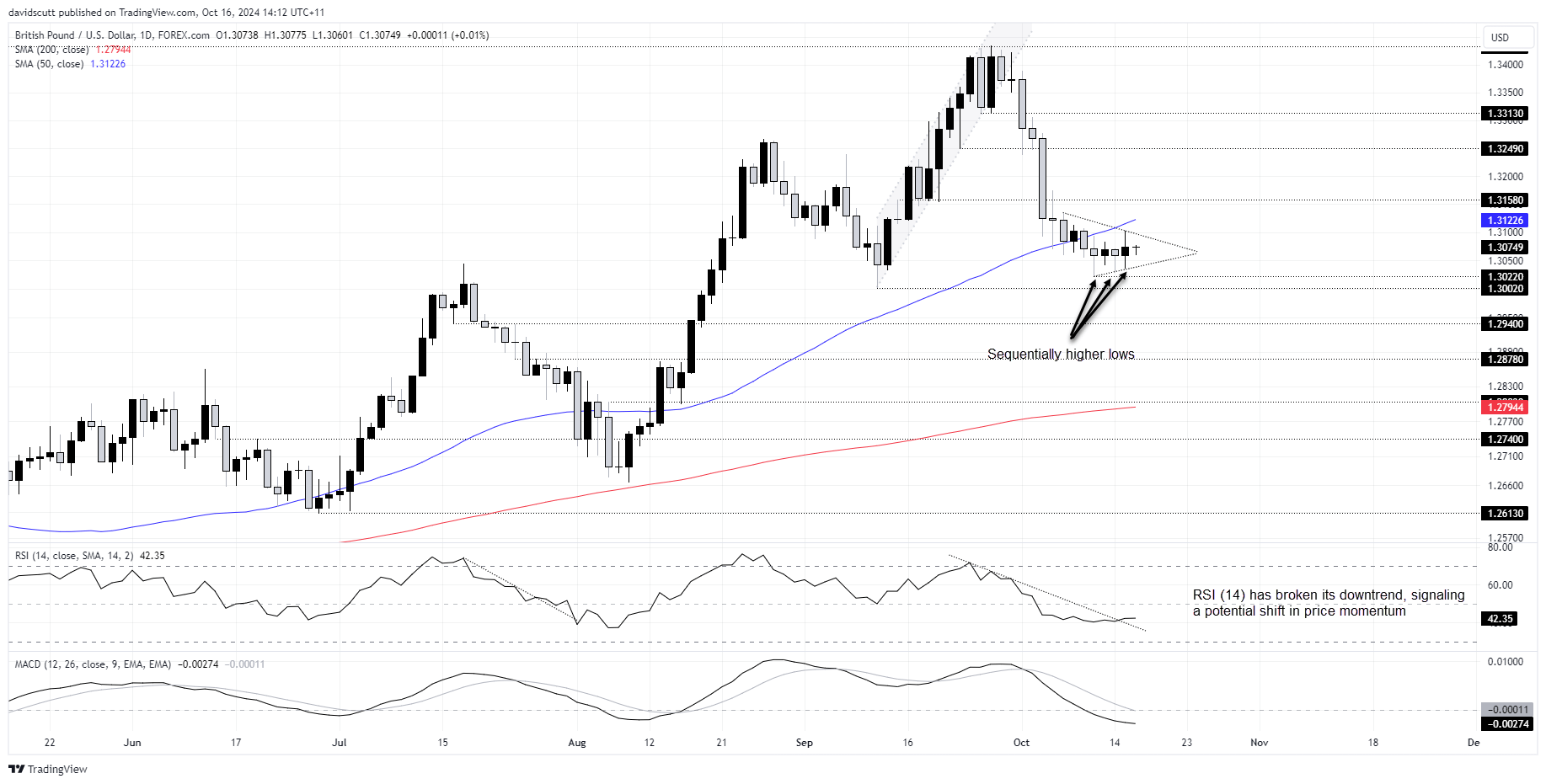

GBP/USD is showing tentative signs of bottoming before the report, continuing to attract buying below 1.3040, each time at incrementally higher levels which have helped form a triangle pattern.

RSI (14) has broken its downtrend, signalling a potential shift in price momentum. MACD has yet to confirm, suggesting traders should keep an open mind on whether to favour selling rips or buying dips.

On the downside, minor support is located at 1.3022 and 1.3002. Nothing meaningful is found until 1.2940 and 1.2878. Above, the 50-day moving average has a chequered track record of being respected but is worth putting on the radar. Sellers may also be lurking at 1.3158 and 1.3249.

-- Written by David Scutt

Follow David on Twitter @scutty