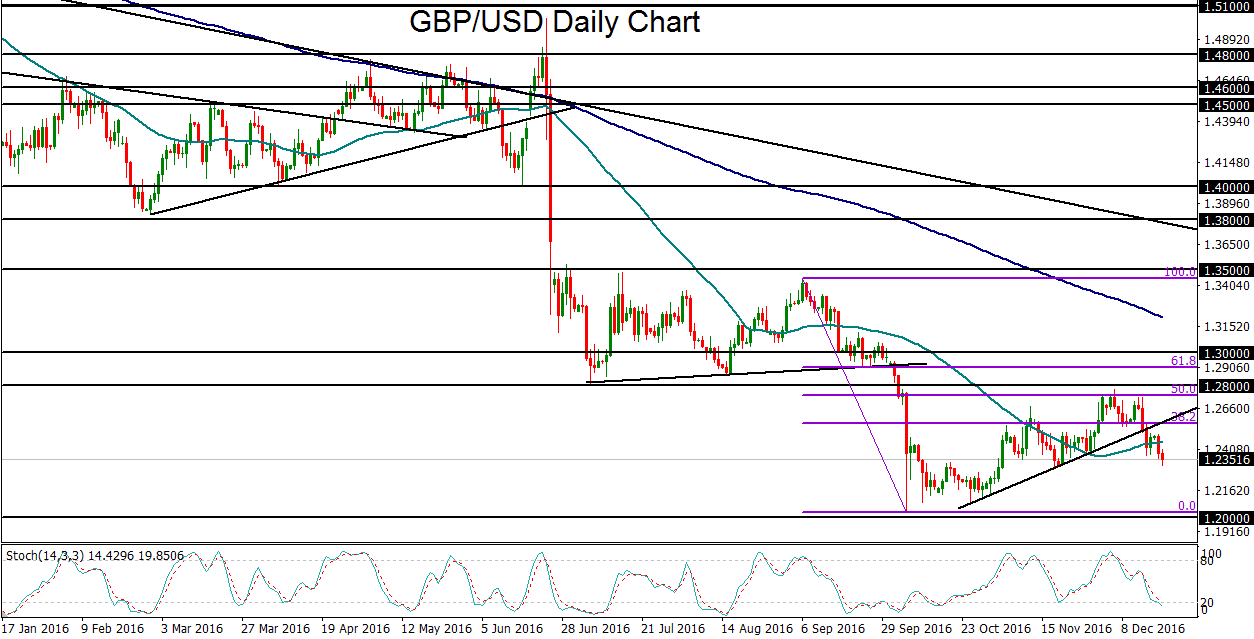

GBP/USD followed-through modestly to the downside on Tuesday to hit a new one-month low amid continuing strength in the US dollar. This new low follows a clean breakdown last week below a key uptrend line, which has opened the way back down towards October’s multi-decade lows near 1.2000.

The US dollar has proven to be exceptionally resilient in recent weeks, as the promise of accelerated economic growth under an impending Trump Administration and an increasingly hawkish Federal Reserve have buoyed the dollar as rival currencies have lagged. The dollar has most notably strengthened against both the euro and yen in recent weeks as the monetary policy divergence between the Fed and its counterparts in Europe and Japan has long been apparent.

With respect to sterling, the divergence between Fed policy and that of the Bank of England (BoE) is currently not as stark, but is still sufficient to cast a bearish bias on GBP/USD, especially with the launch of the formal process to separate the UK and European Union (Brexit) looming on the horizon. Last week, the BoE kept its official bank rate unchanged at the record low 0.25%, as widely expected. A neutral policy stance remains as the central bank balances inflation, growth, and a pending triggering of Article 50 (separation from the EU). Highlighting this neutral policy, Governor Mark Carney stated that the BoE can now respond “in either direction.”

In sharp contrast, the Fed last week gave a slightly hawkish surprise by revealing expectations for three further rate hikes in 2017 instead of the previously expected two.

From a price perspective, this contrast in policy between the Fed and BoE could prompt a further GBP/USD slide, potentially towards new multi-decade lows. After the breakdown below the noted uptrend support line, the currency pair’s momentum has tentatively shifted from rebound to bearish trend resumption. Such a resumption would be triggered and confirmed at the key 1.2000 psychological support target.

The US dollar has proven to be exceptionally resilient in recent weeks, as the promise of accelerated economic growth under an impending Trump Administration and an increasingly hawkish Federal Reserve have buoyed the dollar as rival currencies have lagged. The dollar has most notably strengthened against both the euro and yen in recent weeks as the monetary policy divergence between the Fed and its counterparts in Europe and Japan has long been apparent.

With respect to sterling, the divergence between Fed policy and that of the Bank of England (BoE) is currently not as stark, but is still sufficient to cast a bearish bias on GBP/USD, especially with the launch of the formal process to separate the UK and European Union (Brexit) looming on the horizon. Last week, the BoE kept its official bank rate unchanged at the record low 0.25%, as widely expected. A neutral policy stance remains as the central bank balances inflation, growth, and a pending triggering of Article 50 (separation from the EU). Highlighting this neutral policy, Governor Mark Carney stated that the BoE can now respond “in either direction.”

In sharp contrast, the Fed last week gave a slightly hawkish surprise by revealing expectations for three further rate hikes in 2017 instead of the previously expected two.

From a price perspective, this contrast in policy between the Fed and BoE could prompt a further GBP/USD slide, potentially towards new multi-decade lows. After the breakdown below the noted uptrend support line, the currency pair’s momentum has tentatively shifted from rebound to bearish trend resumption. Such a resumption would be triggered and confirmed at the key 1.2000 psychological support target.

Latest market news

Today 09:59 AM

Today 12:31 AM

Yesterday 10:31 PM