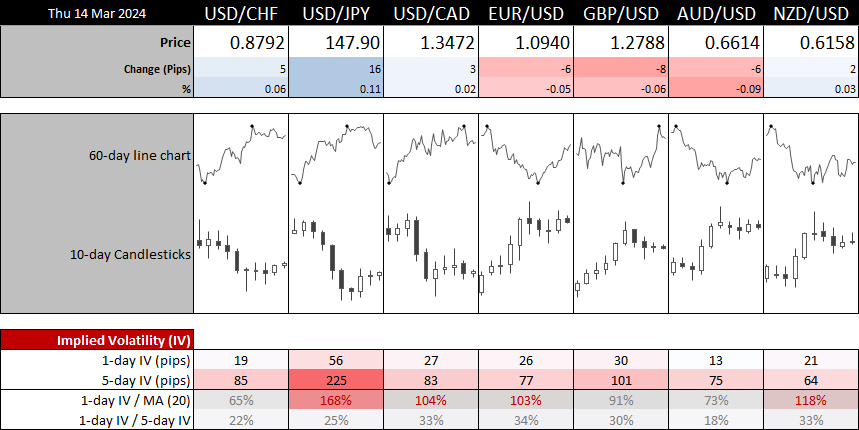

Markets have a close eye on US producer prices and retail sales data later today, as it could be used to confirm or deny this week’s hotter CPI report. And that seems to be suppressing volatility more than usual in today’s Asian session, not helped by the lack economic data this session.

To expect a binary outcome for the US dollar (and therefore key assets) we need to see both retail sales and PPI lean in the same direction. Hot data pushes further back on Fed cuts and likely support the US dollar, to the detriment of gold and its peer currencies (particularly commodity currencies such as AUD/USD, NZD/USD and USD/CAD). Whereas a soft set of figures from retail PPI could prompt another round of USD selling, crush yields and support gold on its way to a fresh record high.

I’m keeping an eye out to see if WTI crude oil to break above $80. It is trading close enough to assume at least an attempted breakout could occur, but the key to a sustainable breakout is volume. Yesterday’s bearish range expansion into the $80 resistance was on low volume, so bulls need to enter with conviction if they want any breakout to last.

Events in focus (GMT):

- 07:30 – Swiss PPI

- 08:00 – Spanish CPI

- 09:00 – International Energy Agency report

- 09:30 – ECB’s Elderson speaks

- 10:00 – China loan growth

- 12:30 – US producer prices, retail sales, jobless claims

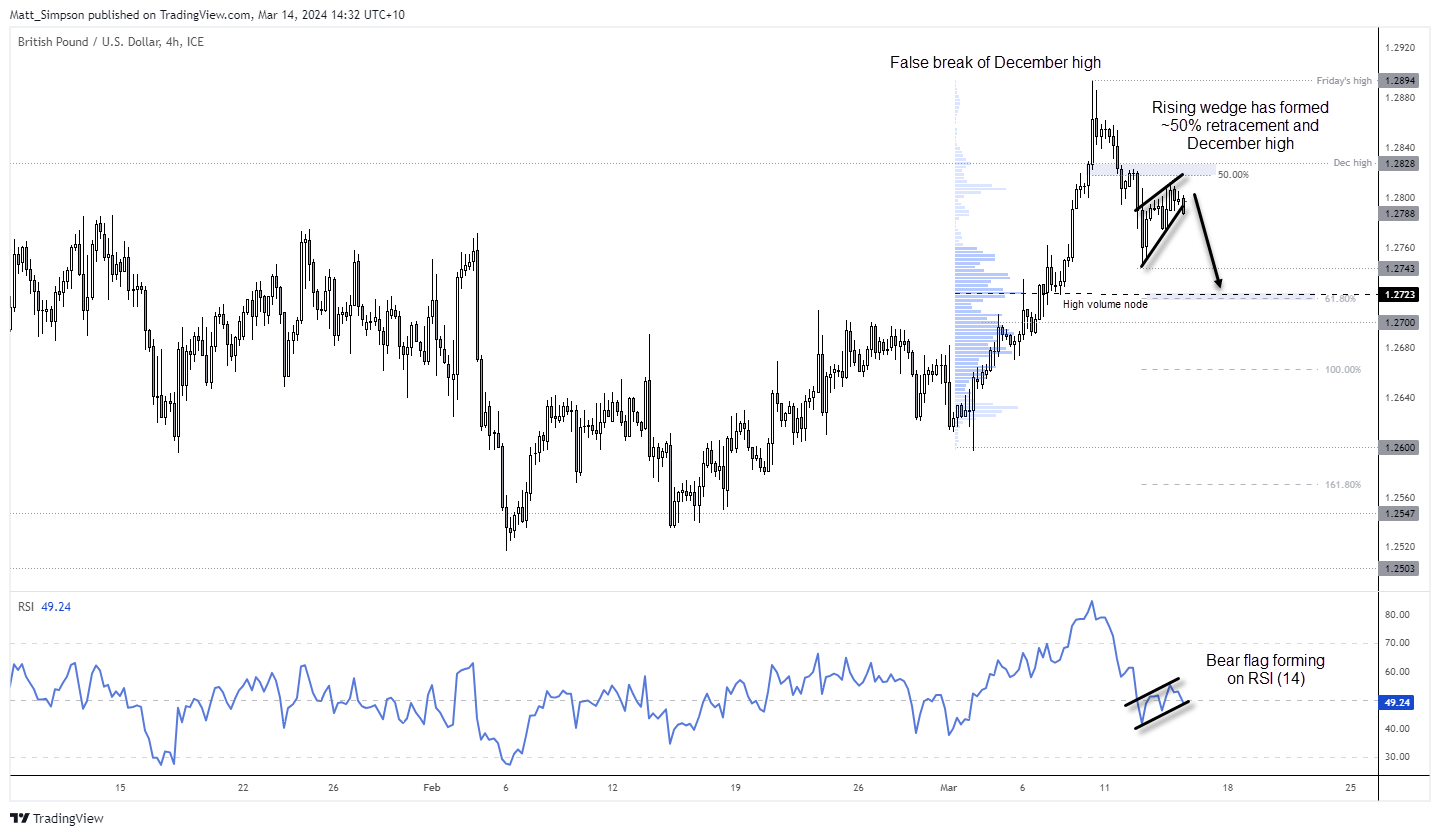

GBP/USD technical analysis:

The British pound has caught my eye for an interesting short opportunity. GBP/USD saw a strong rally above the December high on Friday, only for prices to come crashing back beneath it on Monday. It is reminiscent of a miniature blowoff top.

But what has really caught my eye is the bearish continuation pattern forming beneath the December high (a rising wedge beneath the level which is now a false breakout). And that bearish wedge has met resistance at a 50% retracement level. The wedge projects a pattern near its base at 1.2743, but given the sharp reversal at the highs I suspect we might see a much deeper pullback.

The 61.8% projection from Friday’s high lands near the high-volume node around 1.2723, making it a potential target or support level should prices break beneath the 1.2743 low.

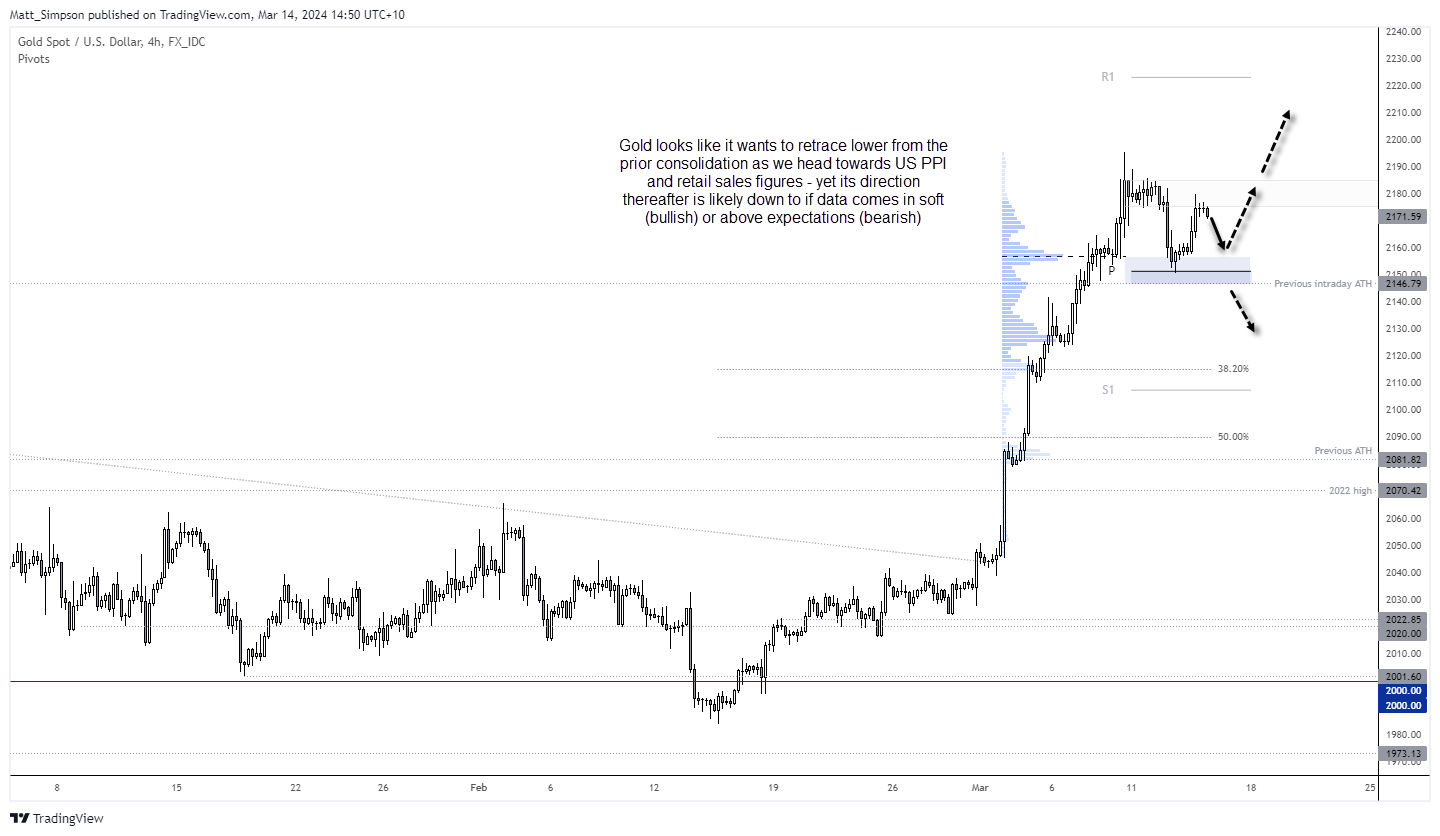

Gold technical analysis:

It was the hot US inflation report that finally snapped gold’s 9-day rally, and it could be today’s PPI report that decides which way gold goes from here. The post-CPI pullback fell nicely into the 2147-2156 support zone, an area which if broken assumes a much deeper correction for gold. But given the strong rally to its record high, I find it hard to envisage a single dip lower – as they usually come in three’s at a minimum.

It looks like momentum is trying to turn lower, so perhaps short gold into PPI data could be the way. But gold bears likely need a strong set of producer prices to push gold materially lower. Conversely, should PPI and retail sales figures roll over, then a break to a new record high could be on the cards.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge