In the last couple of days, the GBP/USD has edged lower thanks to a small recovery in US dollar. The greenback was firmer again at the time of writing thanks to a stronger-than-expected retail sales print. However, the tide may have turned on the US dollar following the recent data releases and raised expectations over the Fed cutting rates in September. Therefore, my GBP/USD forecast remains bullish, and I reckon the $1.30 handle could be taken out soon.

GBP/USD forecast: What has been driving the cable higher recently?

As hinted above, it remains to be seen whether investors will take today’s stronger US retail sales data seriously given how volatile the data tends to be. Plus, other, more important, US data, has started to weaken, namely CPI. Indeed, there’s no doubt that the recent rally in the cable has been driven by a weaker US dollar and falling bond yields. In the previous couple of weeks, we saw several macro pointers come out weaker-than-expected from the world’s largest economy, including the unexpected drop to 3% in US consumer inflation. In the UK, political uncertainty has eased with the Labour party sweeping to power, which has helped to provide the pound some support.

GBP/USD forecast: Technical analysis

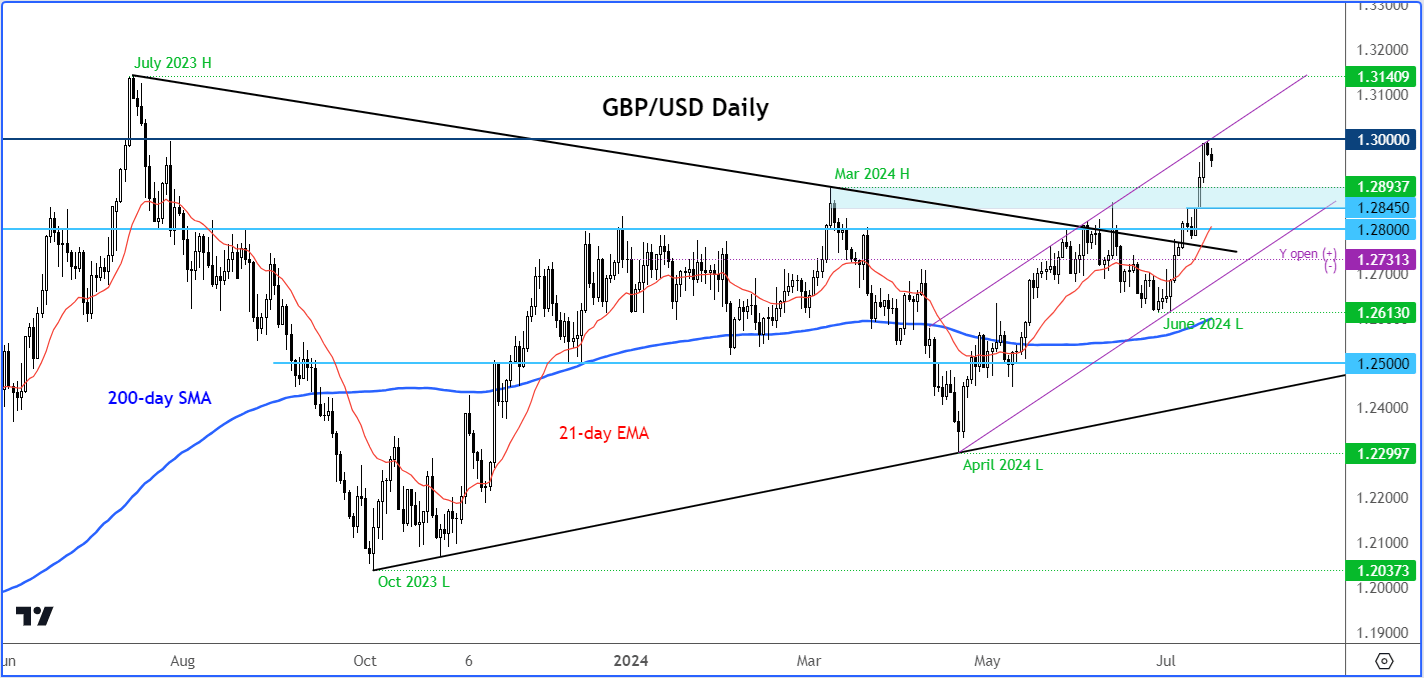

Source: TradingView.com

After surging though its bearish trend line that had persisted since June 2021, the GBP/USD has hit resistance just ahead of the 1.30 handle. It has found resistance from the upper trend of its bullish channel. In other words, it is retracing inside a large upswing. This means that a potential test of a nearby support level could lead to a bounce in the next couple of days or so. With that in mind, the area between 1.2845 to 1.2893 (shaded in light blue on the chart) marks a key support area where the cable might resume its bullish trend from. It is possible we could see an even a larger retracement. But for as long as rates don’t break out of the bullish channel to the downside, the path of least resistance would remain to the upside. As such, a breakout above the 1.3000 handle is highly likely in my opinion in the not-too-distant future.

Therefore, the technical GBP/USD forecast mirrors the positive macro backdrop, keeping us bullish on the cable as things stand.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R