- FTSE analysis: UK stocks track Chinese markets and commodities higher

- Rising commodity and metal prices should support mining stocks

- FTSE analysis: Technical levels and factors to watch

The FTSE rallied from a weaker start to post a solid-looking hammer candle on the daily time frame, while US equities struggles as investors watched to see whether Nvidia would rebound or remain lower after Friday’s big reversal. There was little in the way of economic news, with many traders sitting on their hands ahead of the US CPI report on Tuesday. Rallying markets in China and the recent gains in metals prices helped to support commodity stocks, many of which are constituents of the FTSE. Crude oil prices also rebounded, fuelling a rebound in energy stocks.

FTSE analysis: UK stocks track Chinese markets and commodities higher

Chinese markets closed higher overnight as can be seen from the China A50 index, after the nation’s consumer price index rebounded by 0.7% in February and reached its highest level in 11 months. The rebound in inflation was driven by a surge in consumption during the holiday season. However, PPI declined by 2.7% year-over-year, stretching the downtrend for the 17th consecutive month. However, despite threats of deflation, investors bought Chinese and Hong Kong shares amid hopes of government support, after Beijing set a 5% growth target.

London-listed stocks with exposure to China rallied, while also helping the UK 100 was rising metal prices as copper joined gold and silver in gaining ground. Crude also rebound amid hopes of stronger demand from China.

So, after underperforming global indices the FTSE may finally stage a rally to join global peers in hitting record highs. A lot will now depend on the whether the gains in China can hold. The bulls will be hoping that commodity-linked stocks could find sustainable support from signs of a recovery in the world’s second largest economy.

Last week, China saw its exports jump at the start of the year by 7.1% in US dollar terms in the January-February period from a year earlier. This was well above forecasts and significantly higher than December’s gain. Imports grew 3.5% during the same period. The trade surplus reached a record $125 billion, as a result.

The rise in Chinese exports suggest global demand is recovering for goods from the world’s second-largest economy. If sustained, this should be good news for European and Chinese stocks.

FTSE analysis: Technical levels and factors to watch

With the rise in commodities and signs of improvement in China's markets, there's hope that the FTSE 100 index, which heavily relies on resources, could soon catch up to the global stock market surge, having trailed behind US and European counterparts recently.

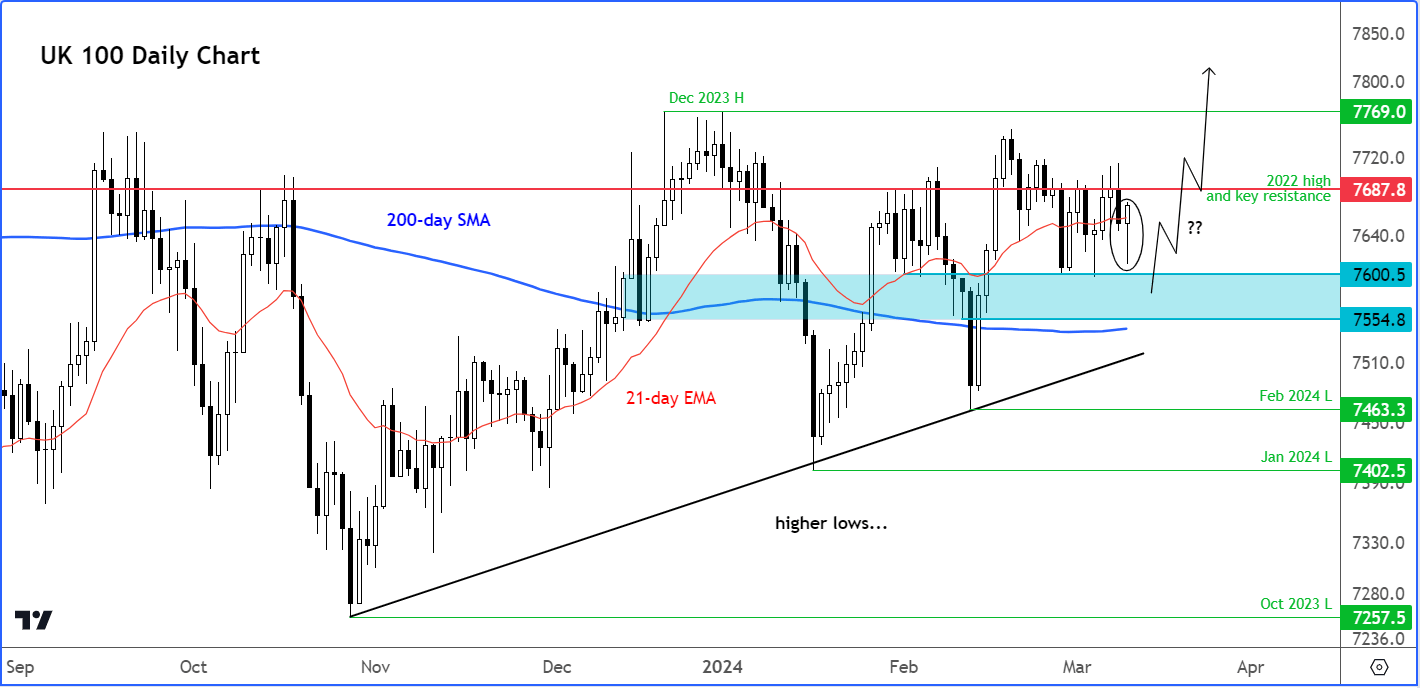

The index now needs to show a strong bullish signal, to indicate its readiness for a significant upward movement. Today’s hammer candle would appease the bulls, but we are still awaiting a clean break above strong resistance in the 7685/90 resistance area. It is crucial for the index to decisively surpass this level before we can anticipate a more lasting breakout this time around.

Nevertheless, the overall trend remains bullish, supported by the formation of higher lows over the past few months and the index trading above its 200-day moving average. In the short term, maintaining support within the 7550-7600 range is vital to uphold investor confidence and preserve the bullish momentum.

It is also worth keeping an eye on gold and silver prices, as there are a couple of previous metals miners in the FTSE. Gold has already been hitting record highs and now silver is looking quite strong, too

Source for all charts used in this article: TradingView.com