April Forex Seasonality Key Points

- GBP/USD has historically seen its strongest gains in April.

- USD/JPY tends to fall in April, and with rates testing 34-year highs and Japanese policymakers considering intervention, seasonality and policy risks point to the downside.

- USD/CAD, by far, has seen its worst performance in April and is testing resistance at its 4-month highs near 1.3600.

The beginning of a new month marks a good opportunity to review the seasonal patterns that have influenced the forex market over the 50+ years since the Bretton Woods system was dismantled in 1971, ushering in the modern foreign exchange market.

As always, these seasonal tendencies are just historical averages, and any individual month or year may vary from the historic average, so it’s important to complement these seasonal leans with alternative forms of analysis to create a long-term successful trading strategy.

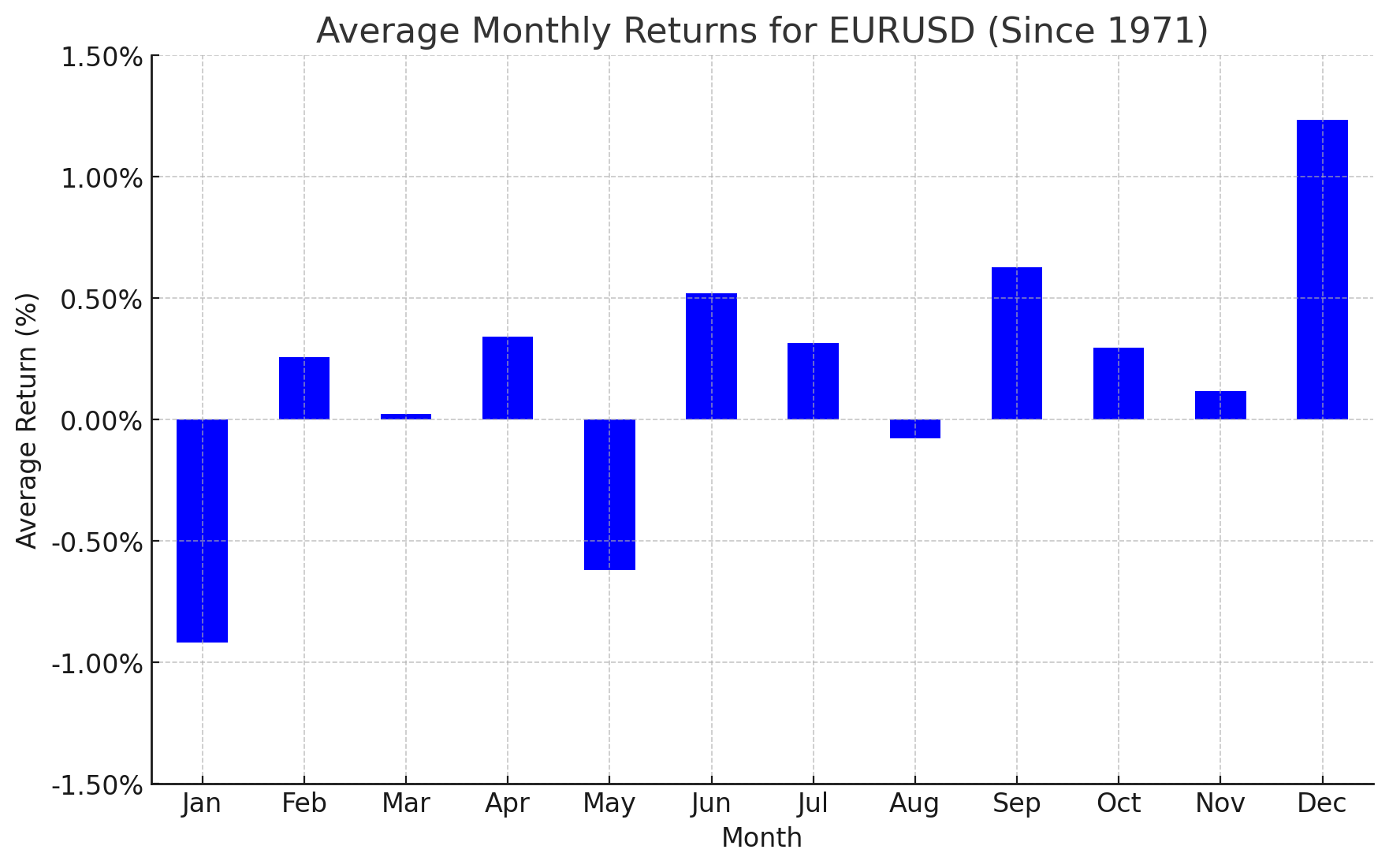

Euro Forex Seasonality – EUR/USD Chart

Source: TradingView, StoneX

Historically, April has been a bullish month for EUR/USD, with an average return of 0.34% over the last 50+ years. With the world’s most widely-traded currency pair tracking toward an essentially unchanged March, after an essentially flat February, FX traders will be hoping that volatility picks up in one direction or another!

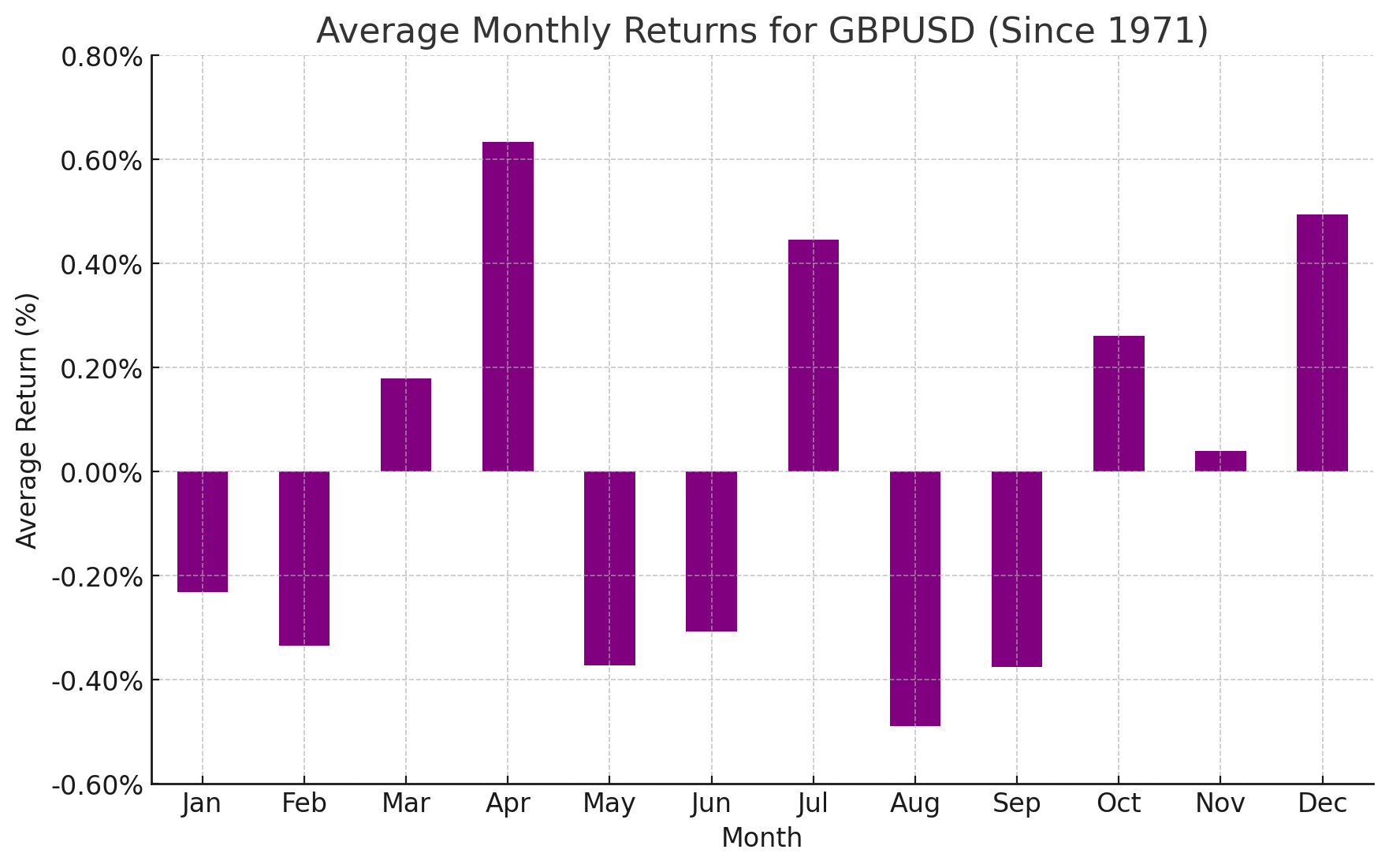

British Pound Forex Seasonality – GBP/USD Chart

Source: TradingView, StoneX

Looking at the above chart, GBP/USD has historically seen its strongest bullish performance of any month in April, with average returns in excess of 0.6% since 1971. Through the first three months of the year, GBP/USD has been following its historical seasonality to a “T”, with losses in January and February and March tracking toward a roughly flat month, so this will be a key pair to watch in the coming month.

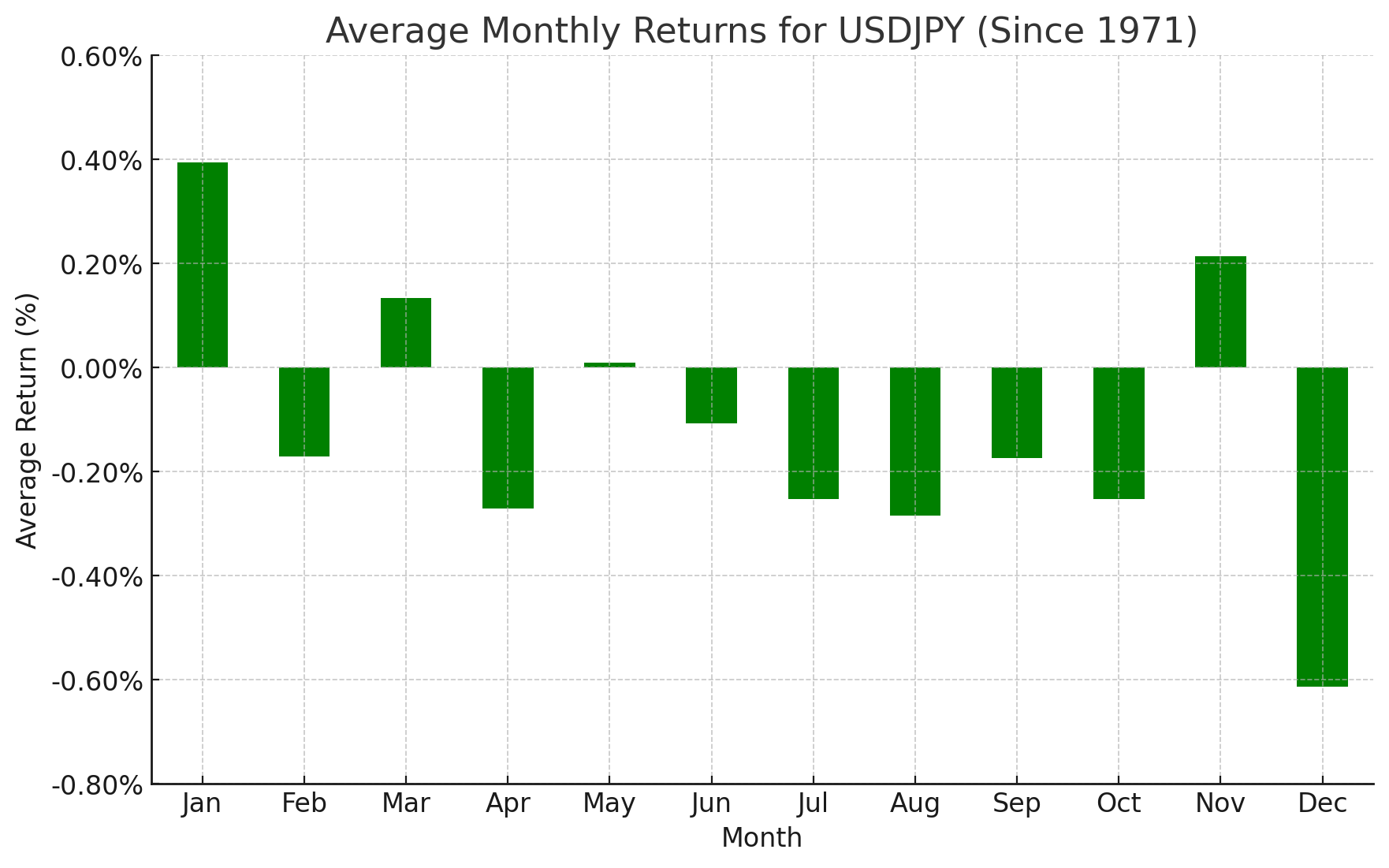

Japanese Yen Forex Seasonality – USD/JPY Chart

Source: TradingView, StoneX

USD/JPY’s strong start to 2024 carried over through March, though if the historical tendency tracks through April, the pair could see a pullback in the coming weeks. Notably, USD/JPY is testing its 34-year high near 152.00 as of writing, and Japanese policymakers appear poised to intervene directly into the market to strengthen the yen (likely pushing USD/JPY lower) if it rises much further. This alignment of fundamental policy goals and bearish seasonality strengthens the likelihood of a USD/JPY drop in April.

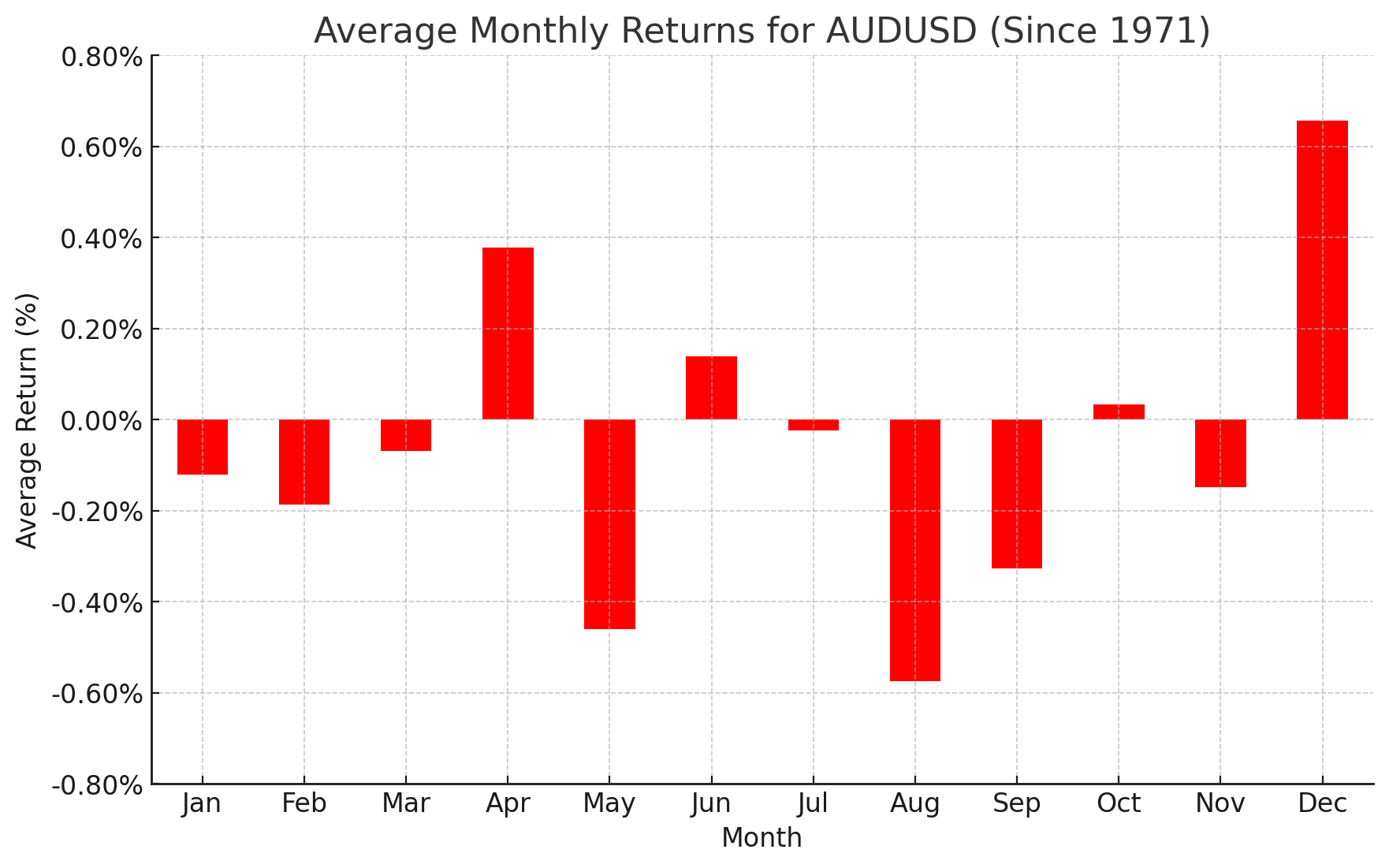

Australian Dollar Forex Seasonality – AUD/USD Chart

Source: TradingView, StoneX

The Australian dollar is another currency pair that is tracking its long-term seasonality closely so far in 2024. The pair fell in both January and February and as of writing, is on track to finish March near unchanged. With that as the backdrop, April has historically been the second most bullish month for AUD/USD, with average returns of 0.38% since 1971.

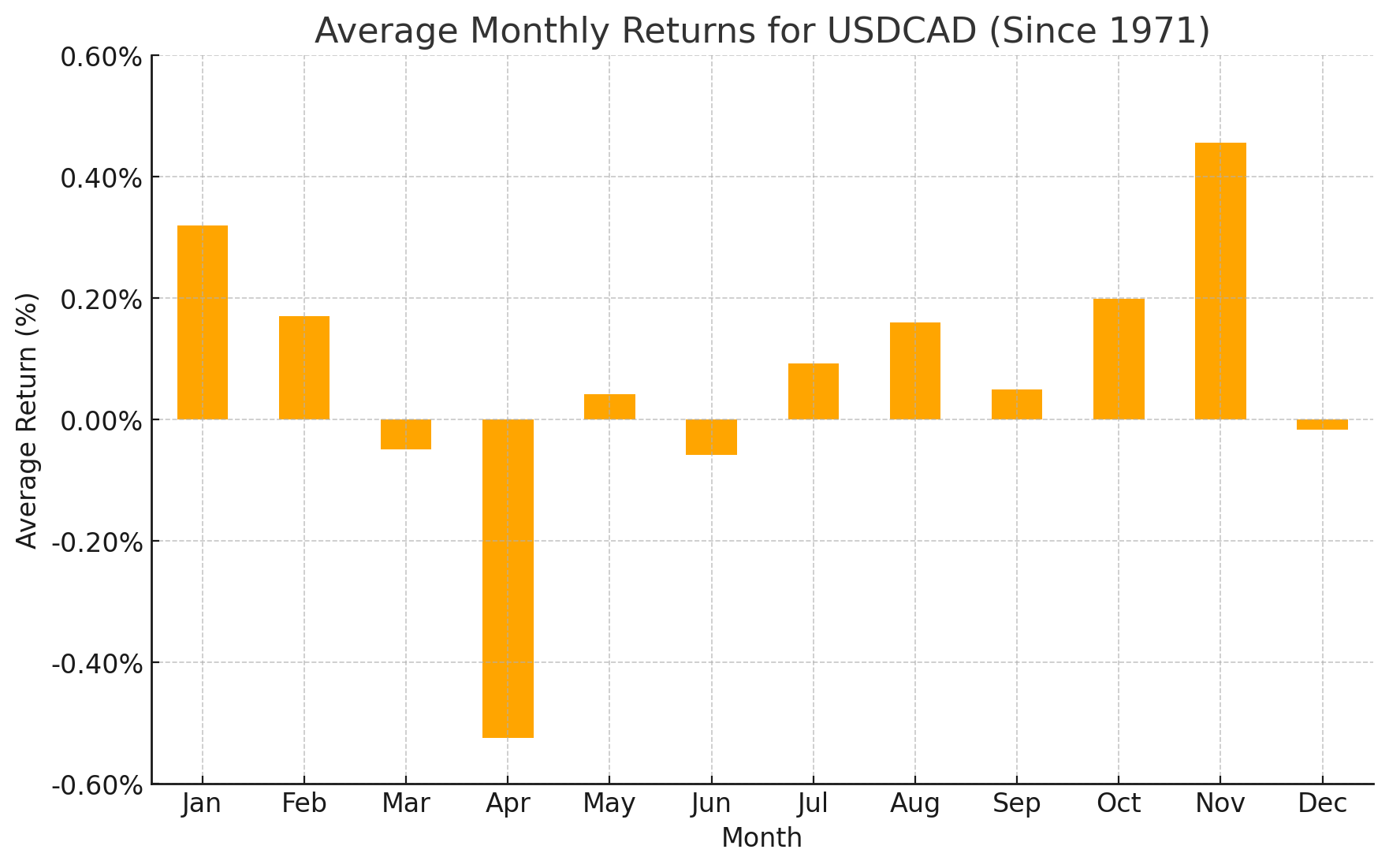

Canadian Dollar Forex Seasonality – USD/CAD Chart

Source: TradingView, StoneX

Well, there’s a standout! Going back to 1971, April has been by far the most bearish month for USD/CAD, with the pair showing an average loss of more than -0.5% over that period. As of writing, USD/AD is probing its highest levels since last November near 1.3600, so it will be interesting to see if that resistance level caps rates over the next month.

As always, we want to close this article by reminding readers that seasonal tendencies are not gospel – even if they’ve tracked relatively closely so far this year – so it’s important to complement this analysis with an examination of the current fundamental and technical backdrops for the major currency pairs.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX