Last month, the Federal Reserve changed a grand total of about twelve words in its most recent monetary policy statement (see “FOMC recap: Powell’s snoozer leaves traders looking ahead to BOE and NFP” for more), so traders were understandably unexcited for the release of today’s FOMC minutes. Layer on an imminent monetary policy update from Fed Chair Powell to kick off the Jackson Hole Summit on Friday, and expectations for any market-moving headlines were extremely low.

While the release has hardly been earth-shattering, there were at least some insightful tidbits for traders to mull over (emphasis mine):

- MANY FED OFFICIALS SAW ANOTHER HIKE LIKELY APPROPRIATE `SOON'

- FURTHER GRADUAL INCREASES IN INTEREST RATES CONSISTENT WITH SUSTAINED EXPANSION

- FED SAW TRADE, HOUSING, EMERGING MARKETS AS DOWNSIDE RISKS

- TRADE POLICIES COULD HAVE SIGNIFICANT NEGATIVE EFFECTS ON GROWTH

- SOME FED OFFICIALS SAW STRONG ECONOMIC MOMENTUM AS UPSIDE RISK

- SEVERAL OFFICIALS CITED EVIDENCE THAT YIELD CURVE INVERSIONS OFTEN PRECEDE RECESSIONS

The headlines about another rate hike coming “soon” and “further gradual increases” were already completely priced in to the market, with market-implied odds of a September rate hike exceeding 90% heading into the meeting. As a result, traders were far more interested in the “downside risks” of trade, housing, and emerging markets that the central bank cited.

Astute readers will note that since the FOMC met in late July, we’ve seen no meaningful sign of a thaw in US-China trade relations, another raft of weaker-than-expected housing data, and the complete collapse of the Turkish lira, a key emerging market currency; in other words, all three “downside risks” identified by the FOMC have deteriorated over the last three weeks, and that’s without even mentioning the continued flattening of the yield curve, which several policymakers also expressed concern about.

Not surprisingly, an interest rate increase next month is still viewed as a “done deal” (at least as close as these things get), but the central bank will be keeping a close eye on trade, housing, emerging markets, and yield curve data in determining whether it will raise interest rates again in December. As we go to press, traders still view such a move as more likely than not, with the CME’s FedWatch tool showing a 66% probability of a second rate hike in December.

Market Reaction

All in all, the market impact of today’s minutes has been relatively limited as traders wait for Friday’s update from Chairman Powell before drawing strong conclusions. That said, we’ve seen US stock indices extend their losses, the yield on the benchmark 10-year Treasury bond hold steady near 2.82% and the US dollar tick lower.

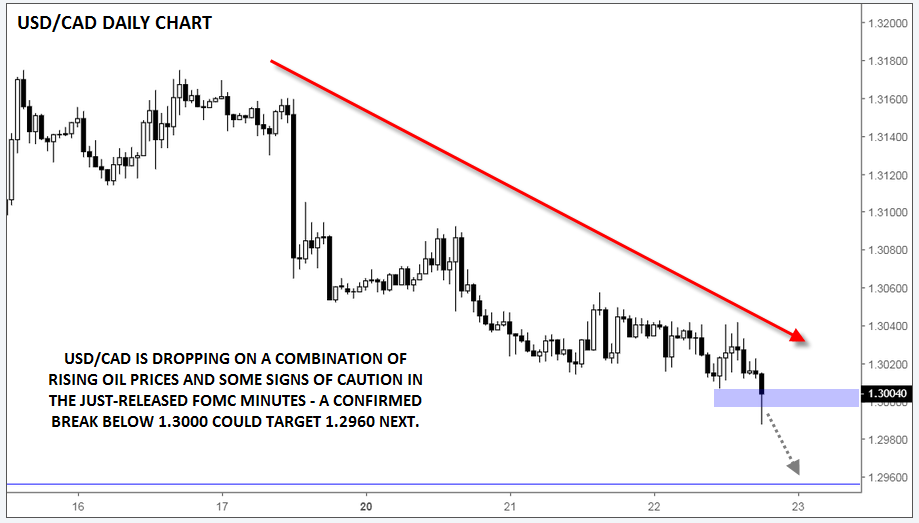

USD/CAD has seen a big move today, with the greenback dipping in the wake of the Fed minutes and the loonie catching a bid on rising oil prices. As the hourly chart below shows, USD/CAD is testing key psychological support at 1.3000, with a confirmed break below that level potentially opening the door for a continuation down toward 1.2960 next (see “USD/CAD Tanks After CA Inflation Surprise, Will Bears Target < 1.30 Next?” for more on the pair).

Source: TradingView, FOREX.com