The Week Ahead: FOMC, BOJ and BOE on tap

This week we saw USD/JPY break above 150 and the US 10-year yield probe 5% - two key levels traders have been watching with bated breath. And whilst equity markets have not had the best week in a while, Armageddon is yet to be unleashed. Still, that’s not to say things are rosy, because the longer yields remain high the worse it could get for sentiment (and there are no immediate signs that yields have reached ‘the’ top). We have a busy calendar with what would usually be ‘red flag’ days, including central bank meetings with the FOMC, BOJ and BOE. There’s a reasonable chance we’ll see no action across all three, but the bigger response for global markets could be if the BOJ widen or abandon their yield curve control (YCC).

The week that was:

- A mix of below-par earnings, higher yields and concerns over the Middle East conflict sent Wall Street to 5-month lows by Thursday’s close

- China’s equity markets failed to embrace the rare budget revision from Xi Jinping, which prompted a mediocre 1-day rally from near 2-year lows

- Notorious bond bears Bill Ackman disclosed on Twitter that he had closed his short position, and ‘Bond King’ Bill Gross said he was now bullish on bonds and expected a US recession by the year end, sending yields lower from their cycle highs

- Yet any signs of a recession is yet to show up in the official figures, with US Q3 GDP being upwardly revised to a 7-quarter high of 4.3% q/q (4.1% expected, 4.1% prior)

- Flash PMIs were particularly disappointing for Europe which helped send the DAX for to a 7-mohth low, and is on track for its third consecutive bearish month (with October being the most bearish of the three)

- The ECB held their interest rate after 10 consecutive hikes, and it looks like they may be done (at least for now)

- Hot inflation figures for Australia saw money markets price in a 25bp hike in November and local banks revise forecasts for two back-to-back hikes. Yet subsequent comments from new governor Bullock leaves a question mar, with Bullock saying that the RBA had not yet decided on whether to hike and that they were still considering whether CPI was a “material” change to their outlook

- USD/JPY broke above the infamous 150 level – an apparent threshold that could lead to intervention from the BOJ. Whilst volatility certainly picked up and price action became messy, it remains above the key level at the time of writing with no apparent signs of currency intervention

- Gold retained its lure as a safe-haven asset, although having risen 10% in 10 days last week and meeting resistance near $2000, the yellow metal remain contained within a choppy range between $1950 - $2000

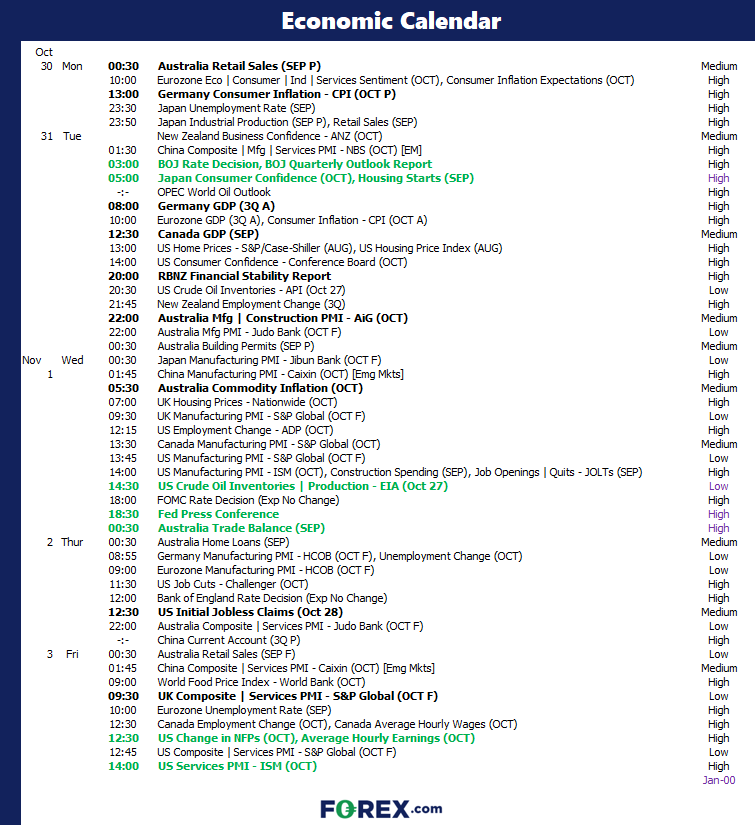

The week ahead (calendar):

The week ahead (key events and themes):

- FOMC meeting and press conference

- BOJ interest rate decision, quarterly outlook report

- China’s ‘official’ PMIs

- Bank of England rate decision

- ISM PMIs for the US

- Nonfarm payroll

- Bonds!

FOMC meeting and press conference

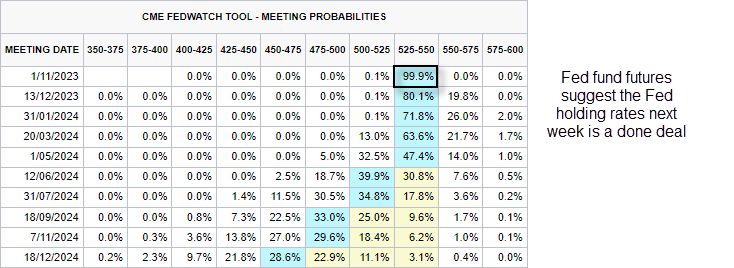

With Fed fund futures (FFF) implying a 99.91% chance of a hold, I’m inclined to say it is a done deal. Several Fed members were quick to point to the uncertainties that the Middle East conflict could bring to monetary policy, with some saying that the rise of bond yields could even do policy for them (to prevent them from hiking rates further). So if there is anything to clean from the statement or subsequent press conference, it is whether there’s any juice in the tightening tank further down the track.

The FFF curve suggests January as the most probably meeting for a hike, which is just 26%. This may not be the most lively of Fed meetings in a while.

Market to watch: EUR/USD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

BOJ interest rate decision, quarterly outlook report

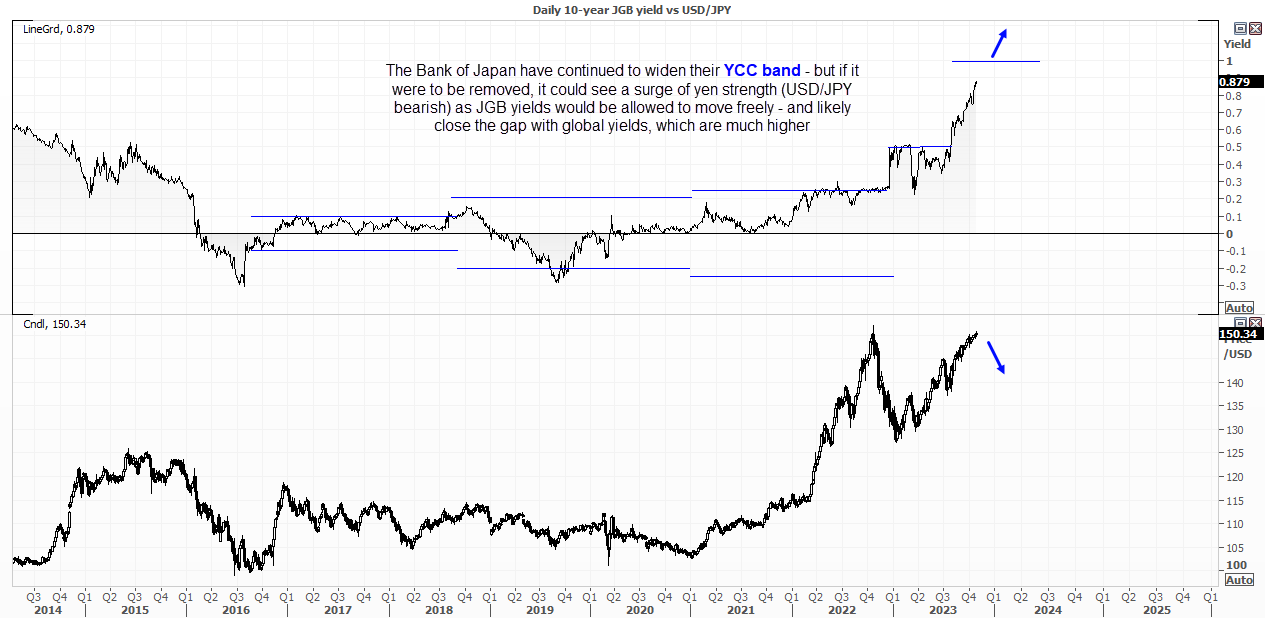

This is arguable a bigger event than the FOMC meeting, assuming any policy action occurs at all. The global bond rout has not sparred Japan’s JGBs from the selloff, which has forced Japan’s yields much higher and faster than the BOJ likely want. And whilst the BOJ continue to confirm unannounced bond-buying activity to support the market, it is not enough to contain yields. And that has seen a renewed round of calls for the BOJ to tweak or abandon yield curve control (YCC).

Will this happen next week? Maybe. Although possibly not, as the BOJ have the tendency to ignore the consensus and do what they want, when they want when they want, and not be goaded into action by market forces. And there’s also a chance that the BOJ may change policy outside of a scheduled meeting than, for the sake of surprising market. Either way, Japanese yen and Nikkei traders really should keep next week’s meeting on their radar.

Of if they do eventually abandon YCC all together, it would allows JGB yields to surge and close the gap with global yields and make Japan’s assets and currency more attractive. This could send USD/JPY markedly lower, and make headlines of 150 USD/JPY seem like a long forgotten dream

Market to watch: USD/JPY, AUD/JPY, GBP/JPY, EUR/JPY, Nikkei 225

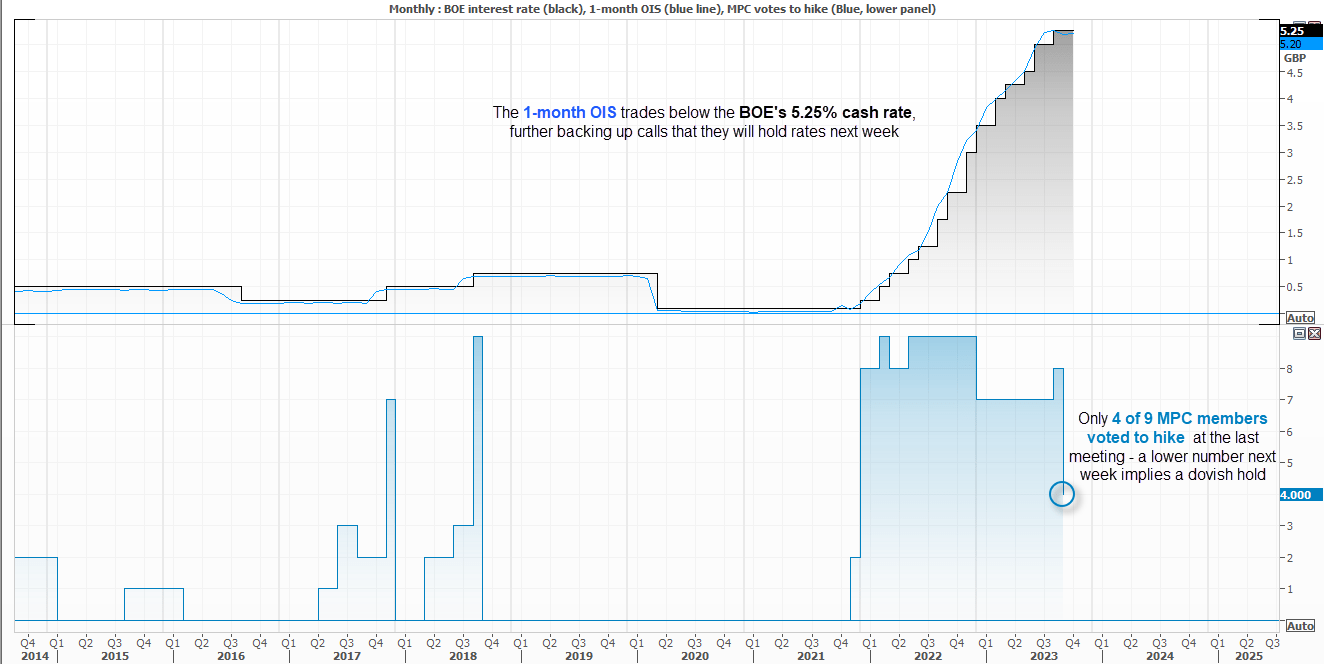

Bank of England rate decision

A Reuters poll shows that 83% of economists expect the BOE to hold interest rates at 5.25%. And recent data likely backs up that view, with flash PMIs suggesting the economy is continuing to slow, job growth printing a negative figure for a second month. Of course, the obvious fly in the ointment is that inflation remains high. This likely keeps the hawkish tone to their statement, but my assumption is we’ll have another 5-4 vote in favour of a hold.

Market to watch: GBP/USD, GBP/JPY, EUR/GBP, FTSE 100

US data: ISMs, PMIs, Nonfarm payroll

Whilst this is usually considered ‘red news’ data in terms of potential volatility, we’d likely need to see them throw some surprisingly poor numbers for them to materially impact markets given the strength of Q3 growth and the employment sector overall. Regardless, these are numbers all traders have on their radar. The ISM manufacturing and service PMIs provide a forward look at what Q4 growth could bring, so any weakness here weighs on expectations for growth headlined into the new year. The S&P global PMIs are the final revisions, which tend not to be heavily revised.

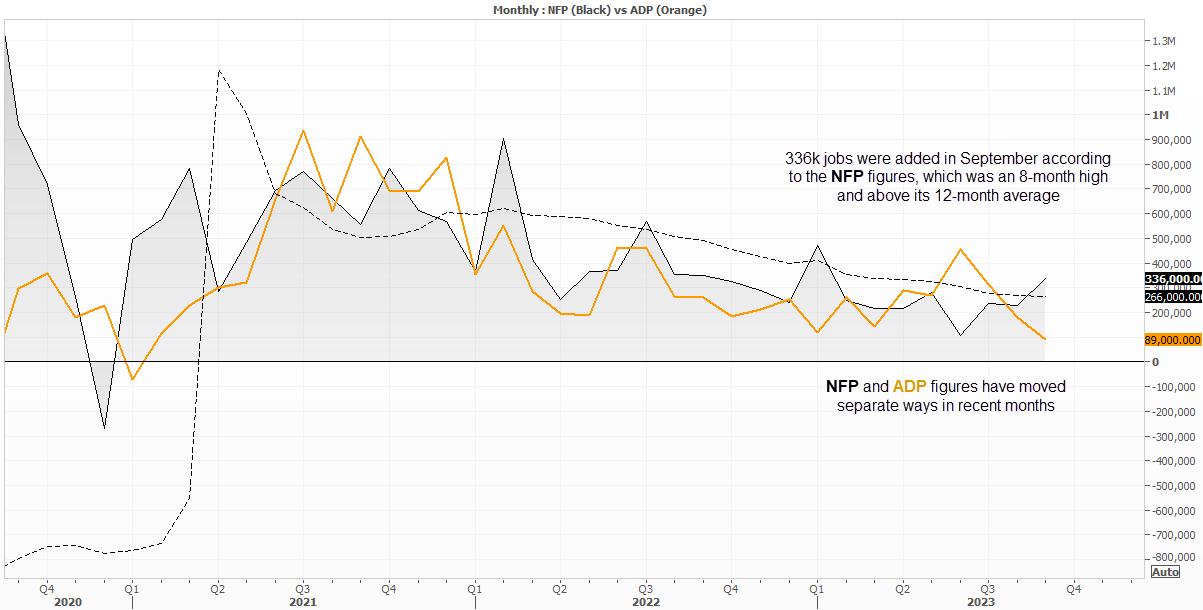

Nonfarm payrolls remains punchy as ever, with 336k job added in September. And recent ADP payroll figures have actually moved the opposite direction to NFP, making it a less useful tool to predict nonfarm job growth than usual (its track record hasn’t been great overall, to be fair). So unless we see some dire numbers from PMIs or employment, the Fed will be forced to stick to their ‘higher for longer’ narrative.

Market to watch: EUR/USD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge