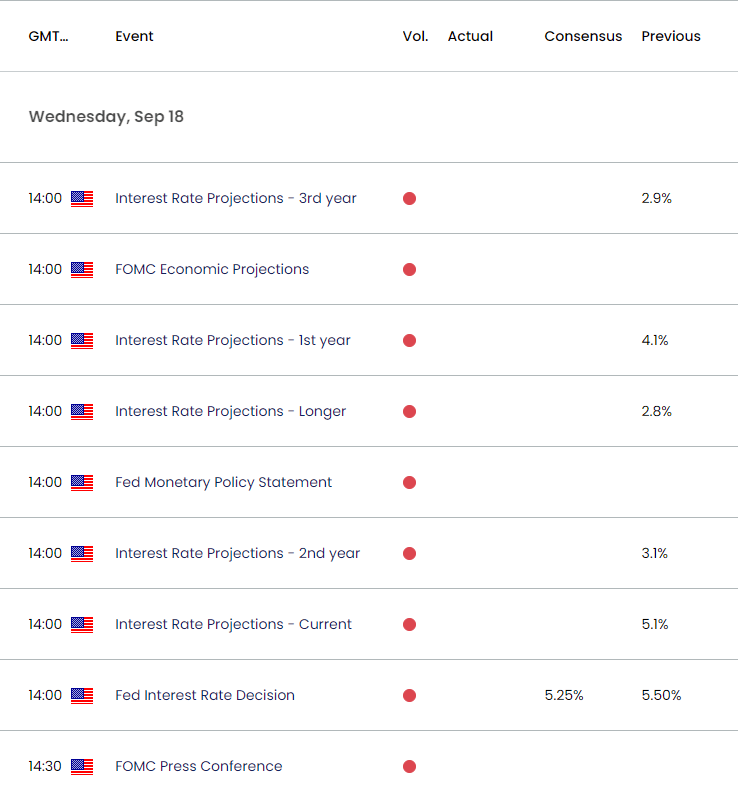

Federal Open Market Committee (FOMC) Interest Rate Decision

The Federal Reserve stuck to its restrictive policy in July, with the central bank keeping US interest rates within its current threshold of 5.25% to 5.50%.

US Economic Calendar – July 31, 2024

It seems as though the Federal Open Market Committee (FOMC) is in no rush to alter the course for US monetary policy as Chairman Jerome Powell and Co. ‘do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent.’

In turn, the FOMC may continue to combat inflation as the committee pledges to ‘make our decisions meeting by meeting,’ with the central bank going onto say that ‘monetary policy will adjust in order to best promote our maximum-employment and price-stability goals.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

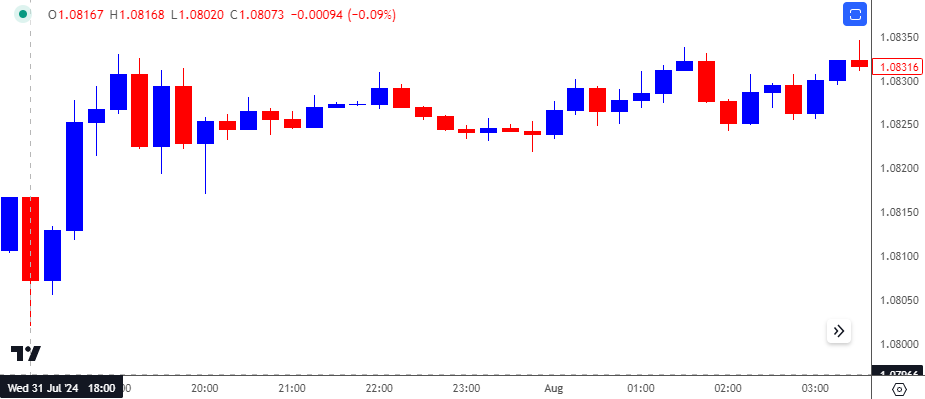

EUR/USD Chart – 15 Minute

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

EUR/USD dipped to a session low of 1.0802 following the announcement but the exchange rate pushed higher during the press conference with Chairman Powell to close the day at 1.0826. EUR/USD struggled to retain the advance following the Fed rate decision as it slipped to a fresh weekly low (1.0778) the next day, but the weakness was short-lived as the exchange rate closed the week at 1.0910.

Looking ahead, the FOMC is expected to reduce US interest rates by 25bp rate in September, and central bank may also adjust its forward guidance as the central bank is slated to update the Summary of Economic Projections (SEP).

With that said, fresh developments coming out of the Fed may drag on the US Dollar should the central bank prepare US households and businesses for a rate-cutting cycle, but more of the same from Chairman Powell and Co. may generate a bullish reaction in the Greenback as the dot-plot from the June meeting showed that ‘the appropriate level of the federal funds rate will be 5.1 percent at the end of this year.’

Additional Market Outlooks

US Dollar Forecast: USD/JPY Clears December Low with Fed on Tap

GBP/USD Bull-Flag Starts to Unfold ahead of Fed and BoE Rate Decision

Gold Price Breakout Pushes RSI Toward Overbought Zone

US Dollar Forecast: USD/CAD Pushes Above September Opening Range

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong