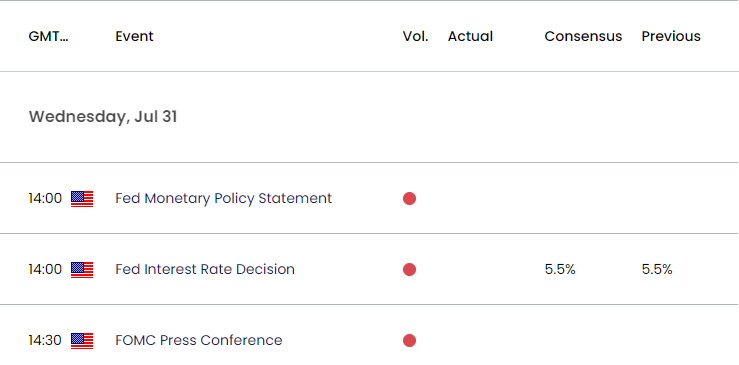

Federal Open Market Committee (FOMC) Interest Rate Decision

The Federal Reserve kept US interest rates at the current threshold of 5.25% to 5.50% in June, with the update to the Summary of Economic Projections (SEP) revealing that ‘the median participant projects that the appropriate level of the federal funds rate will be 5.1 percent at the end of this year.’

US Economic Calendar – June 12, 2024

The Federal Open Market Committee (FOMC) warned that ‘the inflation data received earlier this year were higher than expected,’ with the central bank going onto say that ‘we do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent.’

It seems as though the FOMC is in no rush to switch gears as the central bank pledges to ‘make our decisions meeting by meeting,’ but the fresh forecasts suggest Chairman Jerome Powell and Co. will continue to prepare US households and businesses for a less restrictive policy as ‘it will likely be appropriate to begin dialing back policy restraint at some point this year.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

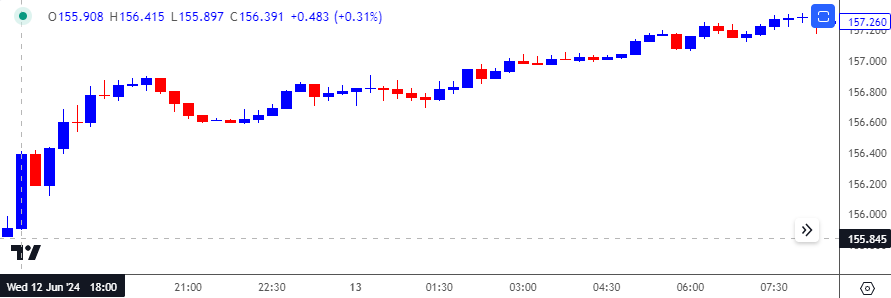

USD/JPY Price Chart – 15 Minute

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

USD/JPY rallied following the Fed decision as the central bank adjusted its forecast from the March meeting where ‘the median participant projects that the appropriate level of the federal funds rate will be 4.6 percent at the end of this year.’ However, USD/JPY struggled to retrace the decline from earlier in the session as the exchange rate close the day at 156.73.

Looking ahead, the FOMC is expected to retain the current policy in July, and more of the same from the committee may generate a similar reaction to the June meeting as market participants push out bets for a Fed rate-cut.

However, the FOMC may further adjust the forward guidance for monetary policy as Fed officials project lower US interest rates in 2024, and the US Dollar may face headwinds should the central bank show a greater willingness to deliver a rate-cut at its next meeting in September.

Additional Market Outlooks

AUD/USD Forecast: RSI Recovers from Oversold Zone

US Dollar Forecast: GBP/USD Tests Former Resistance Zone for Support

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong