Weekly Technical Trade Levels on USD Majors, Commodities & Stocks

- Technical setups we are tracking into the weekly open – FOMC, BoE & NFPs on tap

- Next Weekly Strategy Webinar: Monday, February 5 at 8:30am EST

- Review the latest Weekly Strategy Webinars on my YouTube playlist.

In this webinar we take an in-depth look at the technical trade levels for the US Dollar (DXY), Euro (EUR/USD), British Pound (GBP/USD), Australian Dollar (AUD/USD), Canadian Dollar (USD/CAD), Japanese Yen (USD/JPY), Swiss Franc (USD/CHF), Gold (XAU/USD), Crude Oil (WTI), S&P 500 (SPX500), Nasdaq (NDX), and the Dow Jones (DJI). These are the levels that matter on the technical charts heading into the weekly open with the FOMC / BoE interest rate decisions and US non-farm payrolls (NFPs) on tap.

Canadian Dollar Price Chart – USD/CAD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/CAD on TradingView

We highlighted this rebound in USD/CAD into the yearly open with our focus on possible topside exhaustion on stretch towards resistance. We noted, “Bearish invalidation now lowered to the 2023 yearly open at 1.3545 with a beach / close above 1.3623/40 ultimately needed to mark uptrend resumption.” A four-week rally has been testing resistance for the past two-weeks and the focus is on possible inflection off this zone with the long-bias vulnerable while below 1.3545. Key weekly support rests at 1.3316- losses should be limited to this threshold IF price USD/CAD is heading higher on this stretch.

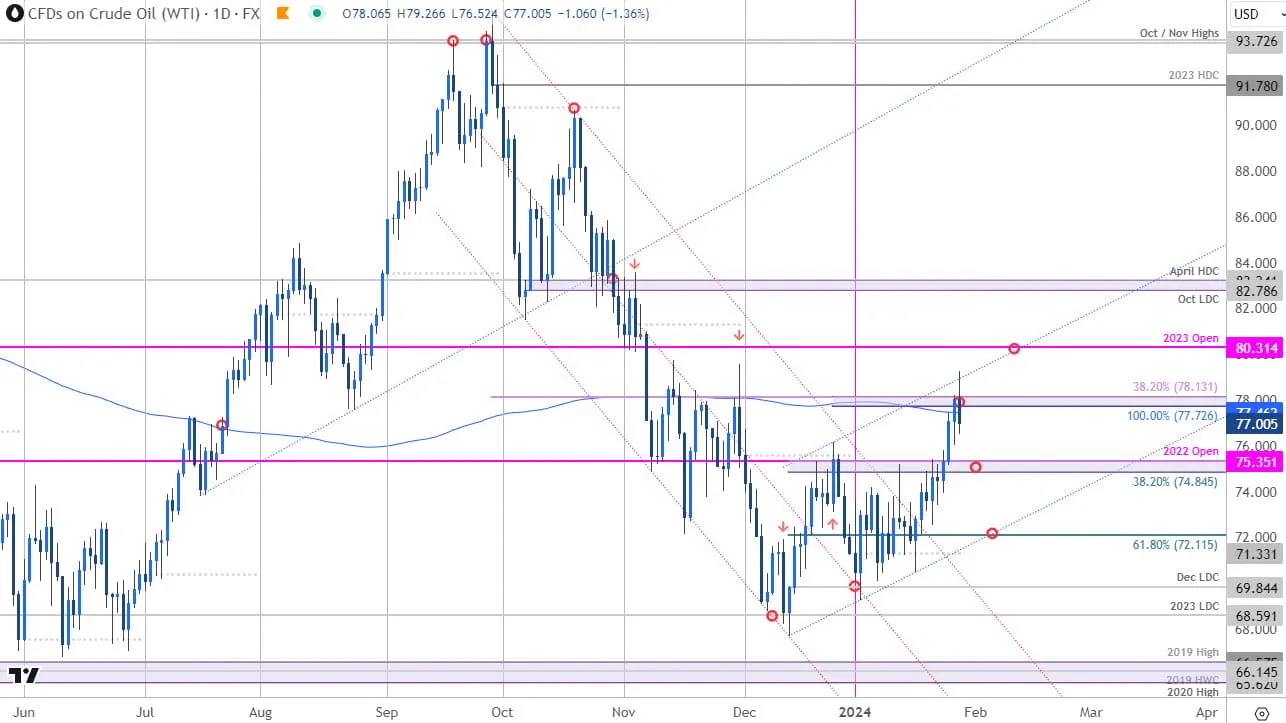

Oil Price Chart – Crude Daily (WTI)

Chart Prepared by Michael Boutros, Technical Strategist; WTI on TradingView

Oil prices responded to a major lateral confluence zone we’ve been tracking for months weeks now at 77.72-78.13 – a region defined by the 100% extension of the December advance and the 38.2% retracement of the September decline. Looking for a reaction up here.

Initial support now rest back at 74.84-75.35 backed by key support / bullish invalidation at the 61.8% Fibonacci retracement at 72.11. A topside breach / close above this pivot zone is needed to keep the immediate advance viable towards subsequent resistance objective s at the 2023 yearly open (80.31) and the October low-day close (LDC) / April high-day close (HDC) at 82.78-83.24.

Economic Calendar – Key USD Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex