Weekly Technical Trade Levels on USD Majors, Commodities & Stocks

- Technical setups we are tracking into the weekly open / April close – Fed rate decision, NFPs on tap

- Next Weekly Strategy Webinar: Monday, May 6 at 8:30am EST

- Review the latest Weekly Strategy Webinars or Stream Live on my YouTube playlist.

In this webinar we take an in-depth look at the technical trade levels for the US Dollar (DXY), Euro (EUR/USD), British Pound (GBP/USD), Australian Dollar (AUD/USD), Canadian Dollar (USD/CAD), Japanese Yen (USD/JPY), Swiss Franc (USD/CHF), Gold (XAU/USD), Crude Oil (WTI), S&P 500 (SPX500), Nasdaq (NDX), and Dow Jones (DJI). These are the levels that matter on the technical charts heading into the weekly open.

Japanese Yen Price Chart – USD/JPY Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/JPY on TradingView

The BoJ’s fingerprints are all over this recent plunge with USD/JPY threatening to snap a seven-week winning streak with a decline of more than 3.5% off multi-decade highs. IF a more significant high is in place, rallies should be capped by the high-close at 158.44 with initial weekly support eyed at the 1989 high / 1986 low / 38.2% retracement of the December rally at 151.90-152.59. Keep in mind we get the releases of the FOMC interest rate decision and Non-Farm Payrolls into the May-open. Stay nimble here and watch the weekly close for guidance. Review my latest update on the post-BoJ USD/JPY technical breakdown for a closer look at the near-term trade levels.

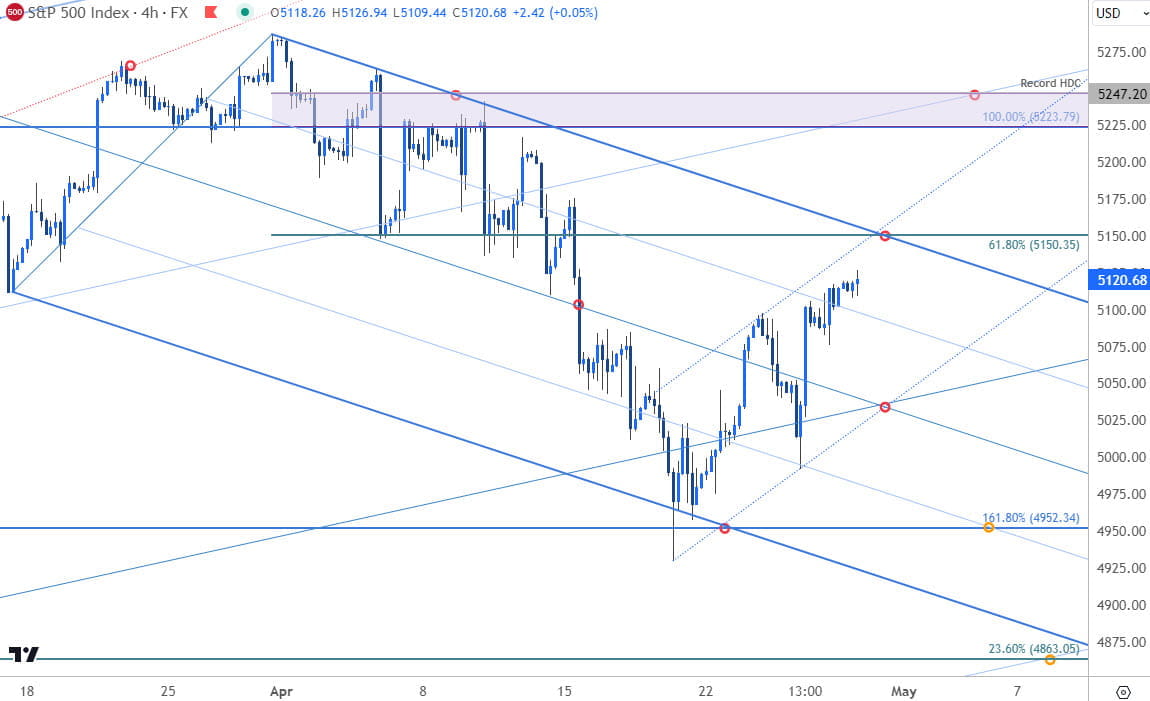

S&P 500 Price Chart – SPX500 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; S&P 500 on TradingView

We’ve been tracking this rebound off support since last week and the S&P 500 is now approaching downtrend resistance near the 61.8% retracement of the recent decline- looking for possible topside exhaustion / price inflection just higher IF reached. A topside breach / close above would expose another run-on key resistance at 5223/47. Near-term support now at the highlighted slope confluence near ~5030 with a break below 4952 needed to mark resumption of the monthly downtrend towards the 23.6% retracement at 4863- look for a larger reaction there IF reached.

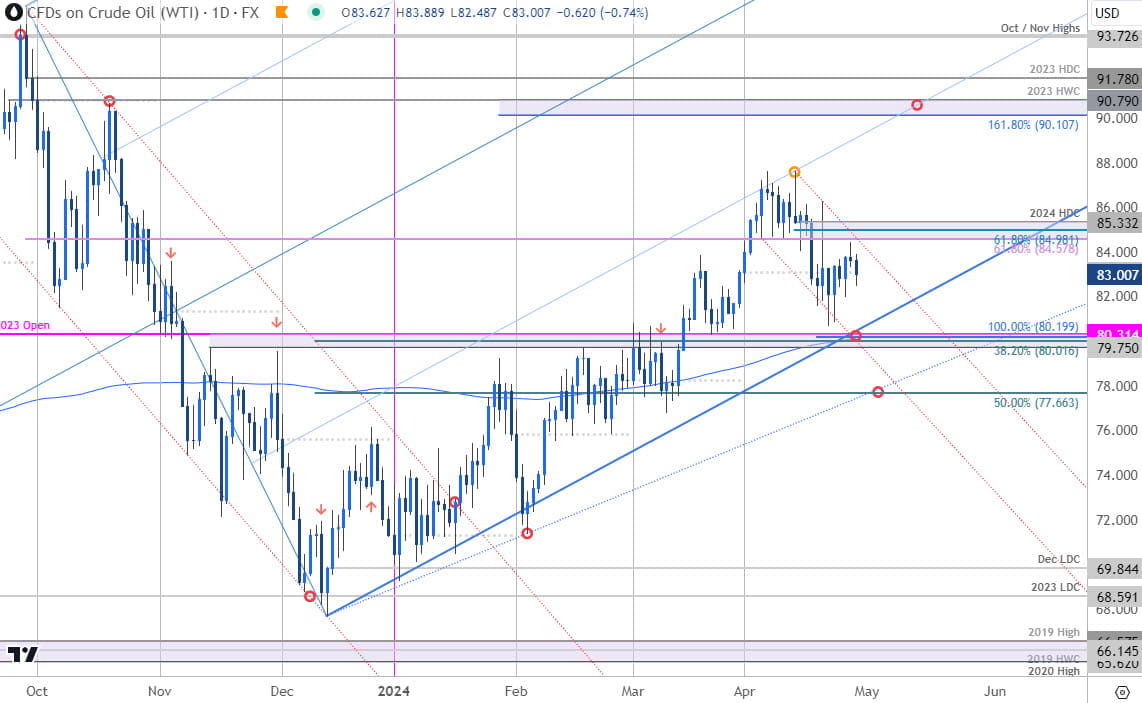

Oil Price Chart – WTI Daily (USOil)

Chart Prepared by Michael Boutros, Technical Strategist; WTI on TradingView

Crude prices have rebounded off the monthly lows, but the trade remain vulnerable near-term from a technical standpoint while below key resistance at 84.57-85.33. The threat remains for a deeper correction within the yearly uptrend with support eyed at 79.75-80.19. Broader bullish invalidation remains at 77.66 with a breach / close above this key hurdle ultimately needed to mark uptrend resumption towards 90.10/79.

Economic Calendar – Key USD Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex