US Dollar Outlook: EUR/USD

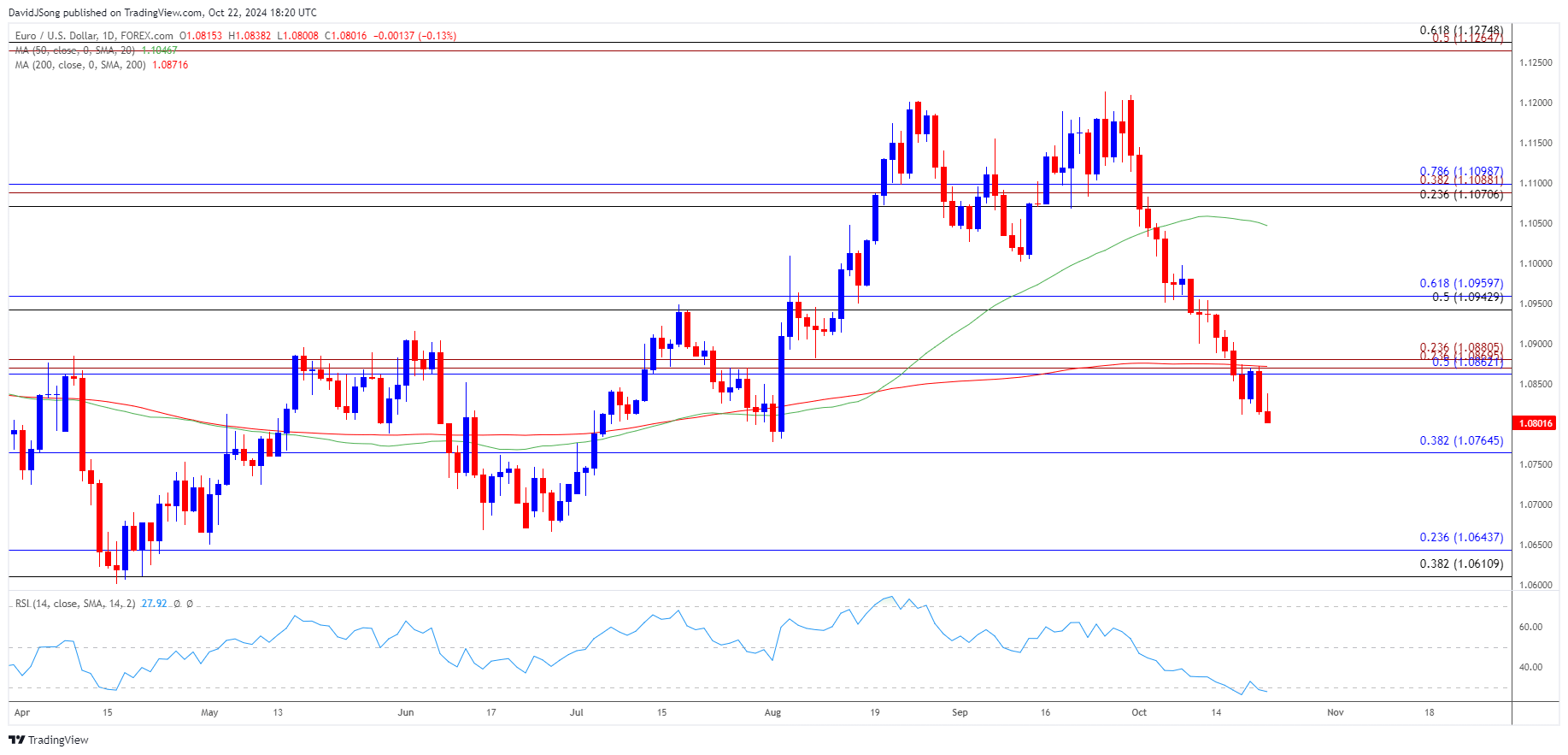

EUR/USD slips to a fresh monthly low (1.0800) to push the Relative Strength Index (RSI) back into oversold territory, and the exchange rate may continue to give back the advance from the August low (1.0778) as long as the oscillator holds below 30.

EUR/USD Weakness Pushes RSI Back into Oversold Zone

EUR/USD seemed to be stuck in a narrow range following the European Central Bank (ECB) rate cut as it snapped the bearish price sequence prior to the meeting, but the renewed weakness in the exchange rate may persist amid hints of a growing dissent within the Federal Reserve.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

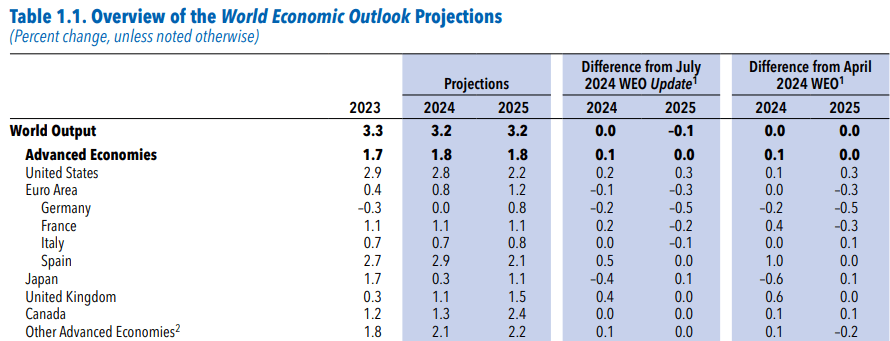

In light of the remarks from Dallas Fed President Lorie Logan, it remains to be seen if the Federal Open Market Committee (FOMC) will deliver another 50bp rate cut as fresh forecasts coming out of the International Monetary Fund (IMF) reveal that ‘in the United States, projected growth for 2024 has been revised upward to 2.8 percent, which is 0.2 percentage point higher than the July forecast, on account of stronger outturns in consumption and nonresidential investment.’

International Monetary Fund (IMF) World Economic Outlook Projections

Source: IMF

Meanwhile, the IMF lowered its growth outlook for the Euro Area, with economic activity ‘expected to pick up to a modest 0.8 percent in 2024 as a result of better export performance, in particular of goods.’

In turn, the ECB may come under pressure to further support the Euro Area as the Governing Council acknowledges that the ‘disinflationary process is well on track,’ while the FOMC may adopt a more gradual approach in unwinding its restrictive policy amid little signs of a looming recession.

With that said, waning speculation for another 50bp Fed rate cut may drag on EUR/USD as the ECB moves towards a neutral policy faster than its US counterpart, but the exchange rate may consolidate over the remainder of the month should it struggle to clear the August low (1.0778).

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD extends the decline from the start of the month following the failed attempt to push back above the 1.0860 (50% Fibonacci retracement) and 1.0880 (23.6% Fibonacci extension) region, and the move below 30 in the Relative Strength Index (RSI) is likely to be accompanied by a further decline in the exchange rate like the price action from earlier this month.

- A breach below the August low (1.0778) opens up 1.0770 (38.2% Fibonacci retracement), with the next area of interest coming in around the July low (1.0710).

- Nevertheless, the oversold RSI reading may end up short lived if EUR/USD struggles to test the August low (1.0778) but need a close above the 1.0860 (50% Fibonacci retracement) and 1.0880 (23.6% Fibonacci extension) region to bring the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) area back on the radar.

Additional Market Outlooks

Bank of Canada (BoC) Rate Decision Preview (OCT 2024)

US Dollar Forecast: AUD/USD Falls Toward September Low

US Dollar Forecast: USD/JPY Vulnerable on Failure to Test August High

USD/CAD Rally Eyes August High as RSI Pushes into Overbought Zone

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong