EUR/USD, USD/JPY, Gold Talking Points:

- This is a busy week with US CPI data due for release on Tuesday morning, followed by the FOMC on Wednesday and European Central Bank and Bank of Japan rate decisions on Thursday.

- USD strength was on full display in the month of May and prices have held resistance in DXY at a key trendline, which has helped EUR/USD to pose a pullback. USD/JPY hasn’t yet gained acceptance above 140 and this remains of interest heading into the Bank of Japan rate decision on Thursday evening (Friday morning in Asia).

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

We’ve just begun a big week for global markets and the economic docket over the next few days is loaded with drivers. At issue remains the prospect of a pivot from the Fed and as of this writing, markets are expecting the first pause from the FOMC since the Fed’s rate hike cycle began in March of last year (per CME Fedwatch). But there is still the expectation for a hike in July, with a chance of possible cuts in the second-half of this year.

On top of the rate decision on Wednesday, the Fed is also due to issue updated guidance and projections. This opens the door for the Fed to pause hikes while warning that they’re expecting another hike later in the year, effectively pushing for a ‘hawkish hold’ theme.

Before we get to that rate decision, however, there will be the release of US CPI data for the month of May and the expectation is for a large drop in headline CPI, expected to come in at 4.1% against last month’s 4.9% print. Core CPI is expected to fall as well, albeit to a lesser degree, with expectations at 5.3% against last month’s 5.5% read. The tone of that release will set the stage for Wednesday’s FOMC rate decision.

The week doesn’t conclude there, however, as Thursday is also big, with the European Central Bank announcing a rate decision in the morning and the Bank of Japan hosting a rate decision later that night (Friday morning in Asia). And there are more drivers on Friday morning with the final read of Eurozone CPI for the month of May, followed by U of M Consumer Sentiment data out of the US at 10 AM ET.

Given the plethora of drivers on the horizon, I wanted to walk through a few macro markets below with examination of primarily longer-term charts, from daily and above, in effort of investigating possible strategy parameters.

The US Dollar

I had written about the USD trendline a couple of times already and that level held the highs throughout last week. Bulls put up a valiant effort but were unable to leave the trendline behind, with a pullback developing on Thursday and support at 103.45 holding the lows into the end of the week.

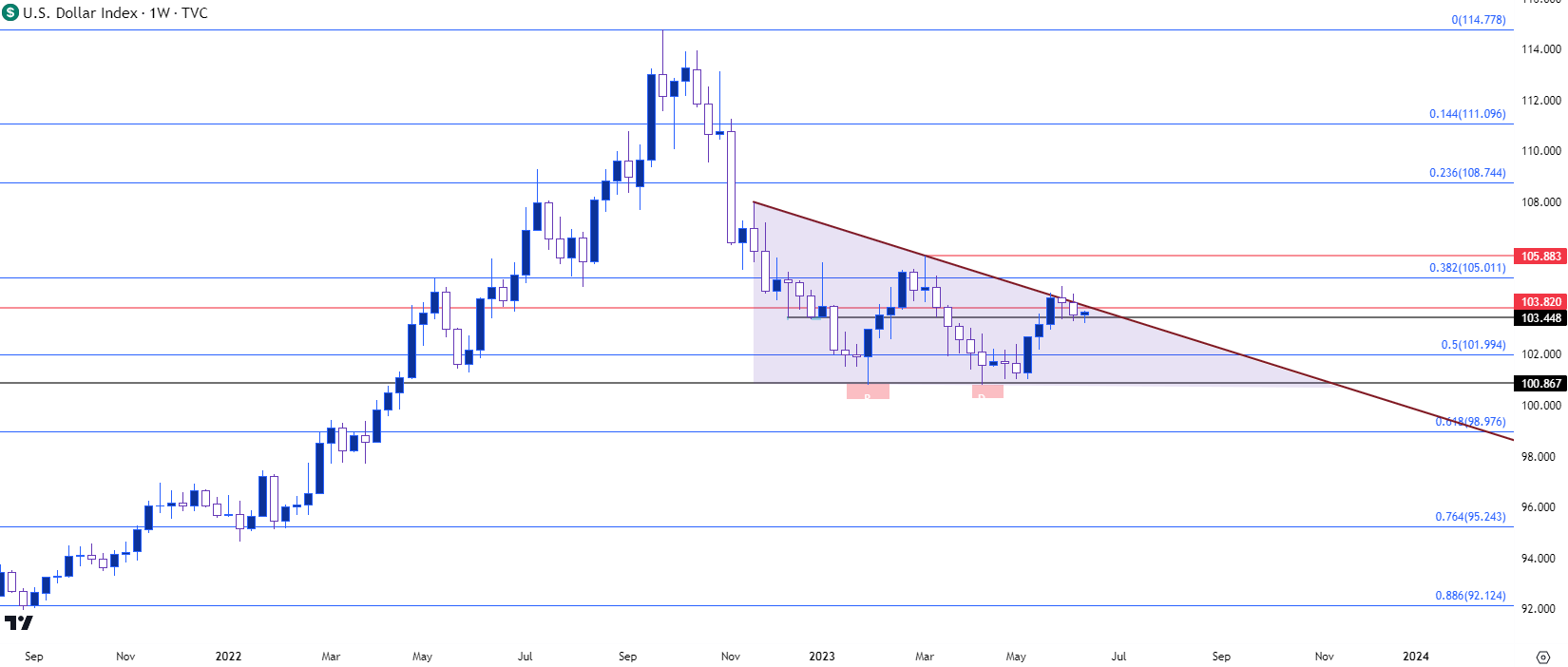

From the weekly chart, there are two different scenarios brewing. The longer-term double bottom remains a possibility as the support level at 100.87 was well-defended in April trade. This formation would need a breach of resistance at 105.88, or the neckline of the formation, to trigger. But, given the hold of the resistance trendline, there’s also a possible descending triangle in here, and that formation would need a break of the support that held over the past few months to trigger that formation, which would also negate the double bottom.

This is the type of week when new trends can be made so both scenarios are worthy of being watched, in my opinion.

US Dollar - DXY Weekly Price Chart (indicative only, not available on Forex.com platforms)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

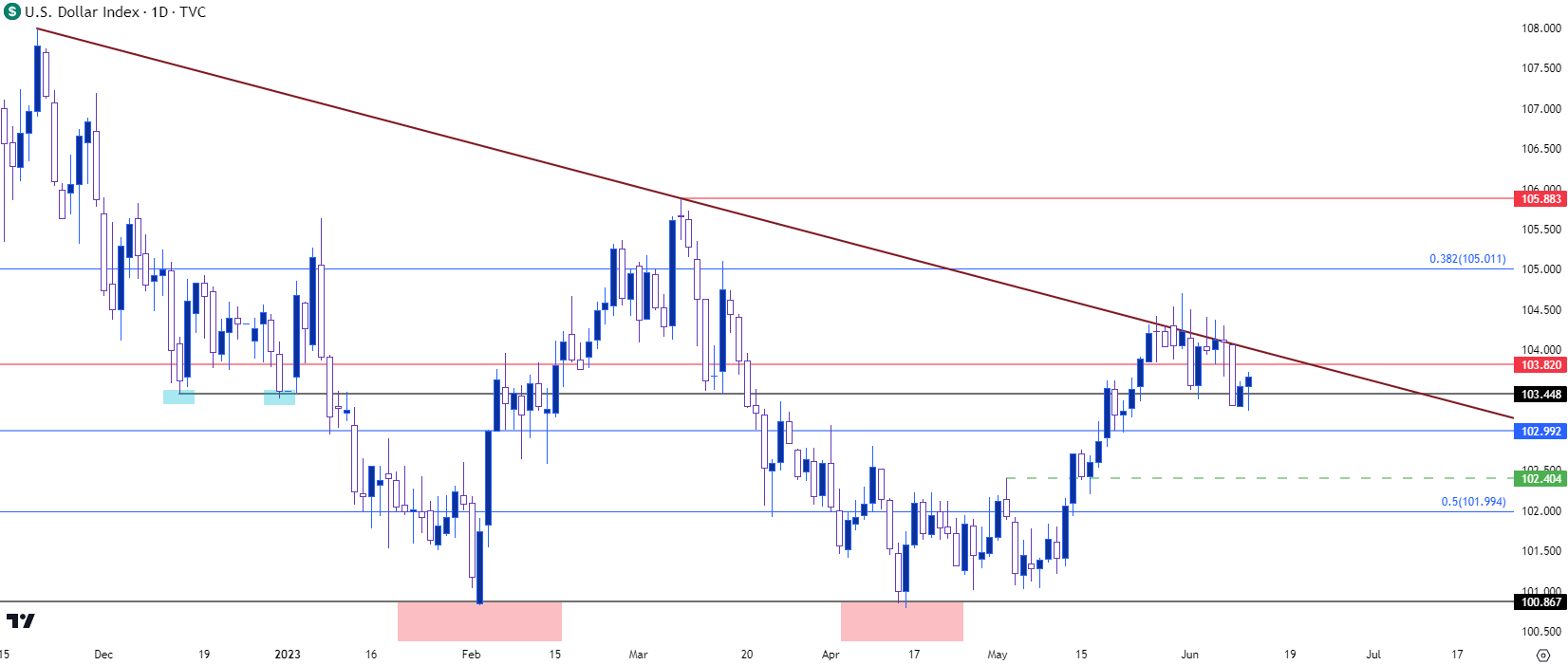

From a shorter-term basis, bulls have been largely in-charge of USD price action since early-May, with a strong trend developing until that trendline came into cap the highs. And with a trendline of that nature holding for so long, with tests on nine of ten trading days, it can be simple to take that as a bearish item. But, notably, after the Thursday fall bulls have come back into the picture to hold prices above the 103.45 level. There’s additional support structure down around 103.00 in DXY and given the Tuesday-Wednesday outlay of CPI and FOMC, the possibility exists for a test of support followed by a reversal type of scenario.

For support structure, below 103.45 is the 103 handle followed by 102.40 and a Fibonacci level around 102. On the resistance side of DXY, there’s the trendline to deal with after which the 105.01 level jumps out. And then 105.88 is the neckline of the double bottom, and a bullish break of that level opens the door for topside continuation scenarios.

US Dollar - DXY Daily Price Chart (indicative only, not available on Forex.com platforms)

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD

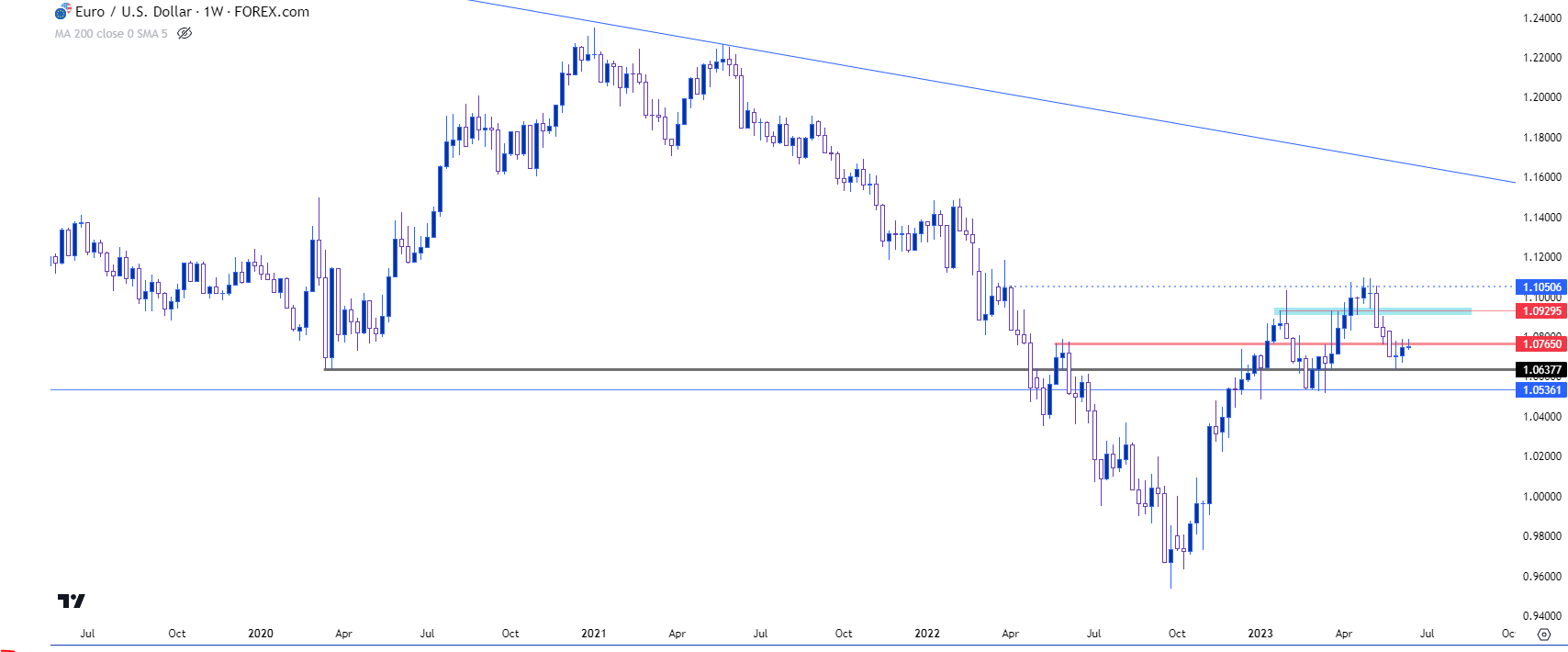

Helping to push that bullish trend in the USD was a fierce drop in EUR/USD in the month of May, all the way until support came in from the 2020 low at 1.0638. That price printed two weeks ago and since then bears have been on their back foot.

EUR/USD Weekly Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

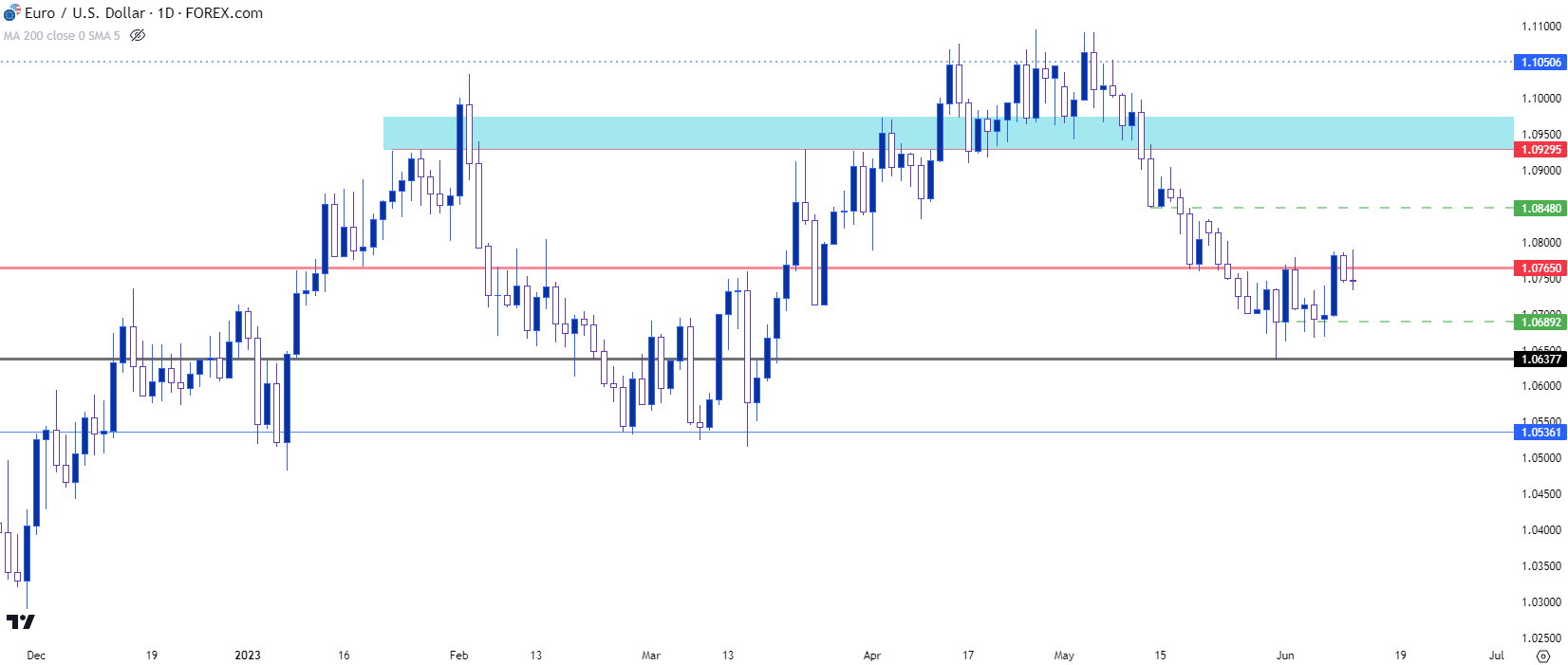

From the daily EUR/USD chart, we can see that support taking effect; first as an inflection on the final day of May, followed by a week of higher low support holding around the 1.0690 level. That helped bulls to pose a higher-high last week after the higher-low, opening the door for a deeper pullback.

Buyers haven’t seemed too emphatic, however, as there’s been a dearth of action above the 1.0787 level. Bears haven’t exactly taken advantage of the situation though, and this keeps the door open for a deeper pullback type of scenario. There’s resistance potential at prior price swings of 1.0848 and then 1.0930, the latter of which was a big spot of support before giving way last month.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

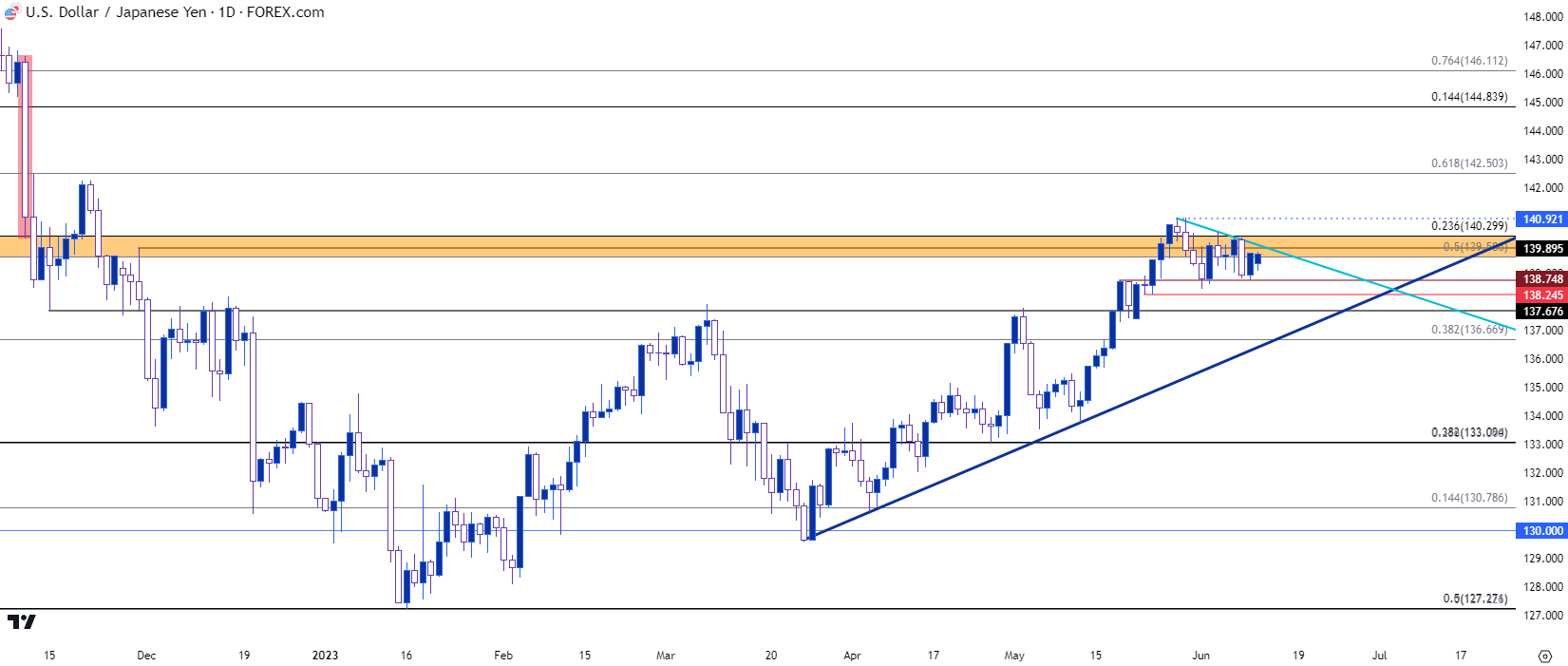

USD/JPY

The Bank of Japan announces their rate decision after the FOMC and the ECB, but interest remains around any possible changes to policy there. This will be the second meeting hosted by newly installed BoJ Governor Kazuo Ueda and, so far, markets seem optimistic around the theme of Yen-weakness. The 140.00 level remains of issue, however, as I had shared a couple of weeks ago.

There have been numerous tests above that level but to date, nothing that’s lasted, and this has allowed for a shorter-term descending triangle formation to form. These are often approached from a bearish angle, which can keep the door open for a deeper pullback, with support levels at 138.25 and 137.68 of interest for such scenarios.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Gold

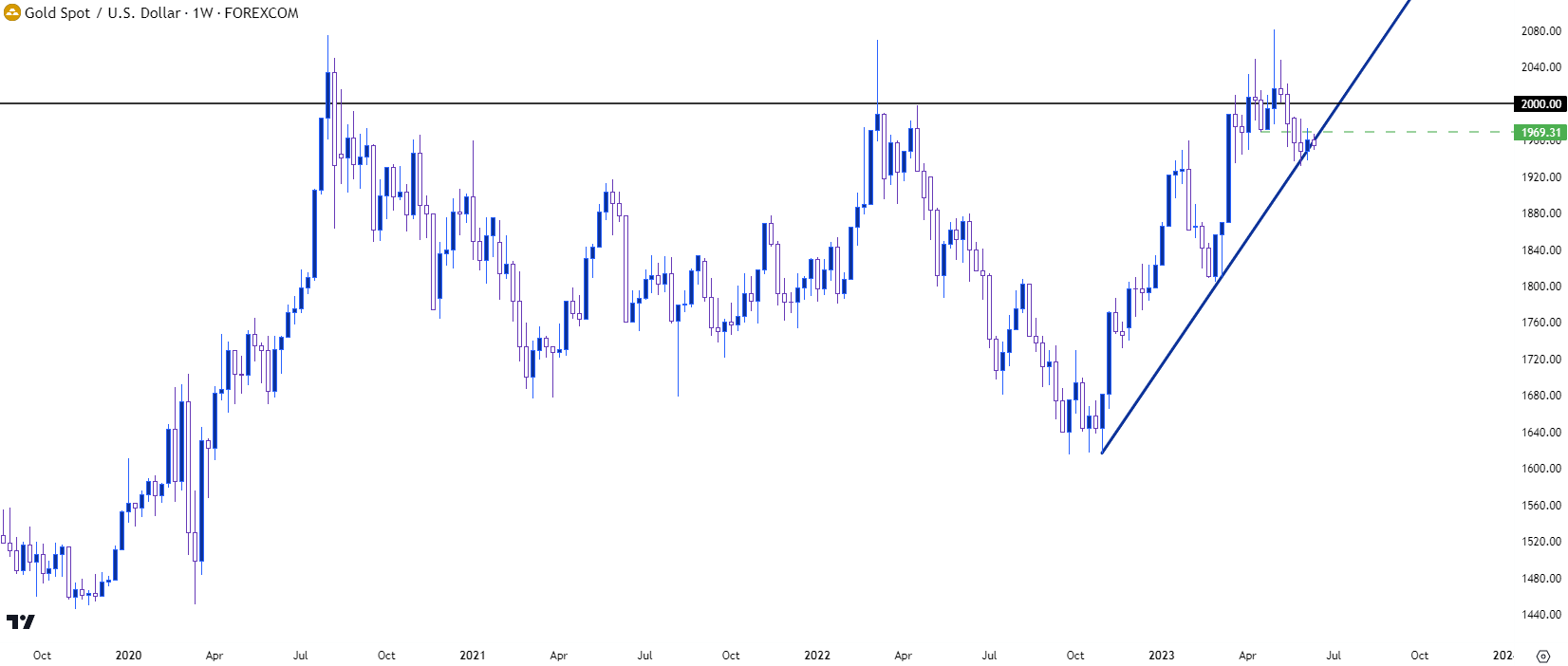

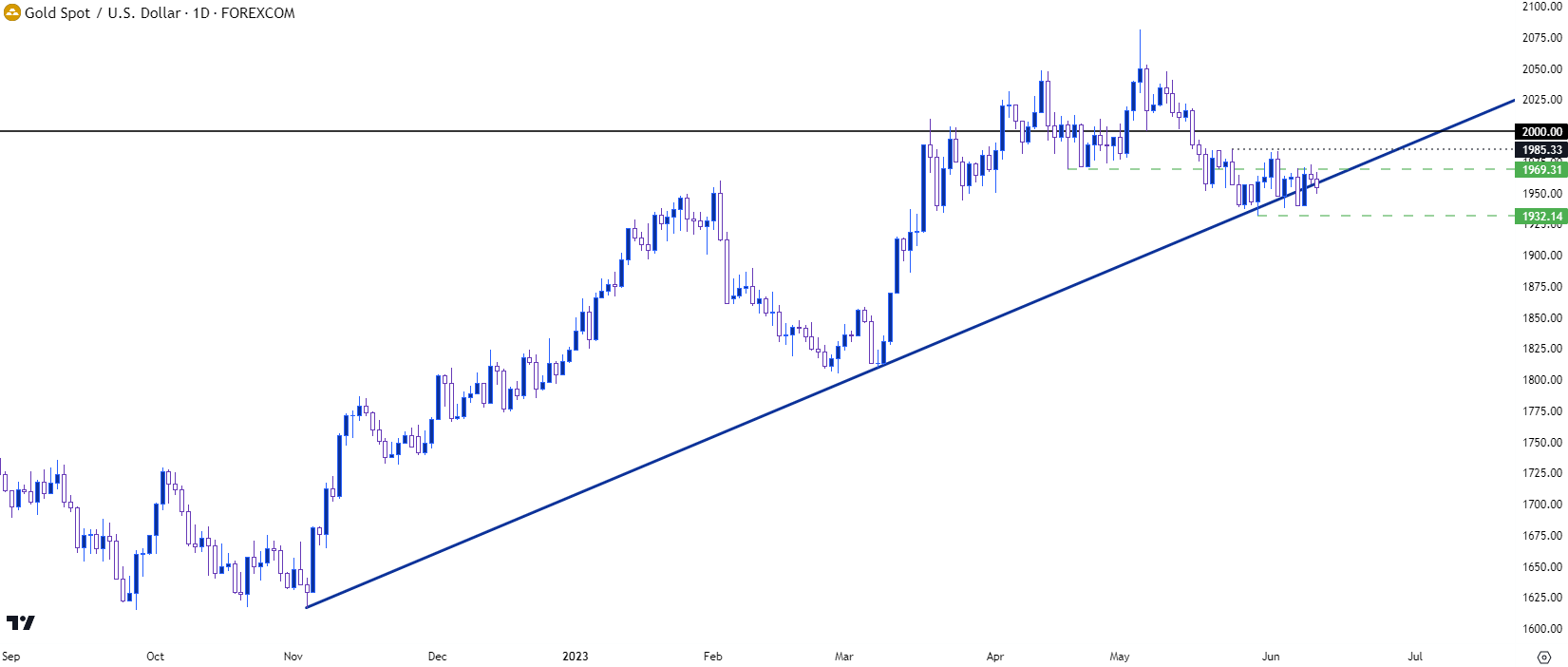

Gold prices remain in a state of consolidation after pulling back below the $2,000/oz mark. There’s a bullish trendline that’s come in to help hold support over the past couple of weeks, but bulls haven’t been able to make much ground above prior support.

On a longer-term basis, the range in Gold remains in-play, with continued resistance around the $2,000/oz mark. Sellers haven’t exactly taken control of the matter after prices began to pullback from that resistance last month, with support holding around a bullish trendline connecting November and March swing lows.

Gold Weekly Price Chart

Chart prepared by James Stanley, Gold on Tradingview

Chart prepared by James Stanley, Gold on Tradingview

On a shorter-term basis, there’s been a continued build of lower-lows and lower-highs. But, of challenge for bears is the number of bear traps that have set in Gold of recent. The bullish trendline started to come into play a couple of weeks ago and prices are still working in that same vicinity: The door has been open for bears to take over and they haven’t yet, and the question must be asked as to why.

This keeps the door open for continued pullback potential, with eyes on that 2k level as a possibility given this week’s economic docket. There’s shorter-term resistance around 1969 and 1985 in spot Gold, but the big question is whether bulls can mount another move above the $2k handle, or whether a pullback to resistance may re-open the door for bears to take another shot.

Gold Daily Price Chart

Chart prepared by James Stanley, Gold on Tradingview

Chart prepared by James Stanley, Gold on Tradingview

--- written by James Stanley, Senior Strategist