US Dollar Outlook: EUR/USD

EUR/USD struggles to test the monthly high (1.1156) as the US Retail Sales report shows a 0.1% rise in August versus forecasts for a 0.2% decline, but the Federal Reserve interest rate decision may influence the near-term outlook for the exchange rate as the central bank is widely expected to deliver at least a 25bp rate-cut.

EUR/USD Struggles to Test Monthly High Ahead of Fed Rate Decision

EUR/USD pulls back from a fresh weekly high (1.1146) as the better-than-expected US Retail Sales report casts doubts for an aggressive move from the Federal Open Market Committee (FOMC), and it remains to be seen if the central bank will heavily adjust its forward guidance for monetary policy as Chairman Jerome Powell and Co. are slated to update the Summary of Economic Projections (SEP).

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

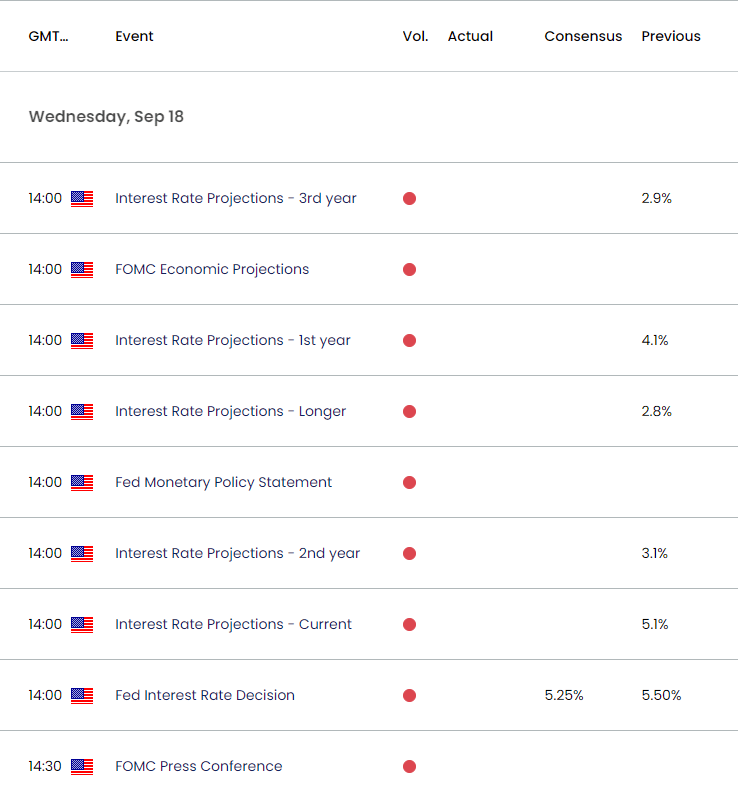

US Economic Calendar

With that said, the fresh forecasts from Fed officials may produce headwinds for the Greenback should Chairman Powell and Co. project a lower trajectory for US interest rates, but more of the same from the central bank may lead to a bullish reaction in the US Dollar as the dot-plot from the June meeting showed that ‘the appropriate level of the federal funds rate will be 5.1 percent at the end of this year.’

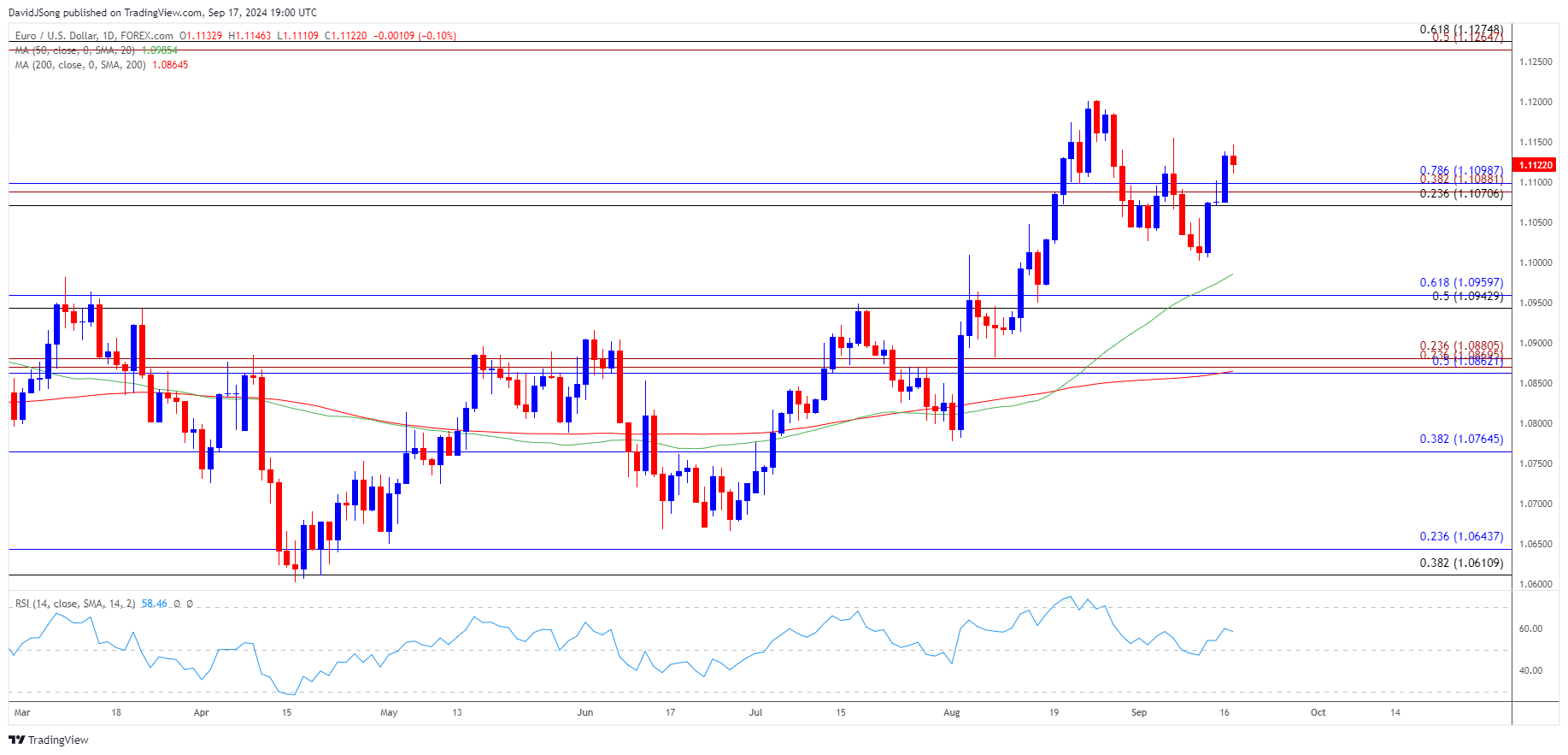

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD may track the positive slope in the 50-Day SMA (1.0985) as it holds above the moving average, and the exchange rate may stage further attempts to test the monthly high (1.1156) as it extends the series of higher highs and lows from last week.

- A breach above the August high (1.1202) bringing the 1.1270 (50% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) region on the radar, which incorporates the 2023 high (1.1276) but the bullish price series in EUR/USD may unravel if it struggles to hold above the 1.1070 (23.6% Fibonacci retracement) to 1.1100 (78.6% Fibonacci retracement) area.

- Failure to defend the monthly low (1.1002) may push EUR/USD towards the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) zone, with the next region of interest coming in around 1.0860 (50% Fibonacci retracement) to 1.0880 (23.6% Fibonacci extension).

Additional Market Outlooks

Federal Reserve Rate Decision Preview (SEP 2024)

US Dollar Forecast: USD/JPY Clears December Low with Fed on Tap

GBP/USD Bull-Flag Starts to Unfold ahead of Fed and BoE Rate Decision

Gold Price Breakout Pushes RSI Toward Overbought Zone

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong