EUR/USD Outlook

EUR/USD attempts to retrace the decline from the weekly high (1.0760) following the bearish reaction to the European Central Bank (ECB) interest rate decision, and the exchange rate may stage a larger rebound as it continues to hold above the January low (1.0483).

EUR/USD rate continues to defend January low

EUR/USD initiates a series of higher highs and lows after marking the largest single-day decline since September, and the Euro may outperform most of its major counterparts as the exchange rate seems to be defending the opening range for 2023.

Join David Song for the next Live Economic Coverage webinar to cover the Federal Reserve rate decision on Wednesday, March 22. Register Here

As a result, EUR/USD may climb towards the 50-Day SMA (1.0727) ahead of the Federal Reserve interest rate decision, and it remains to be seen if the failure of Silicon Valley Bank (SVB) will lead to a change in regime as market participants scale back bets for higher US interest rates.

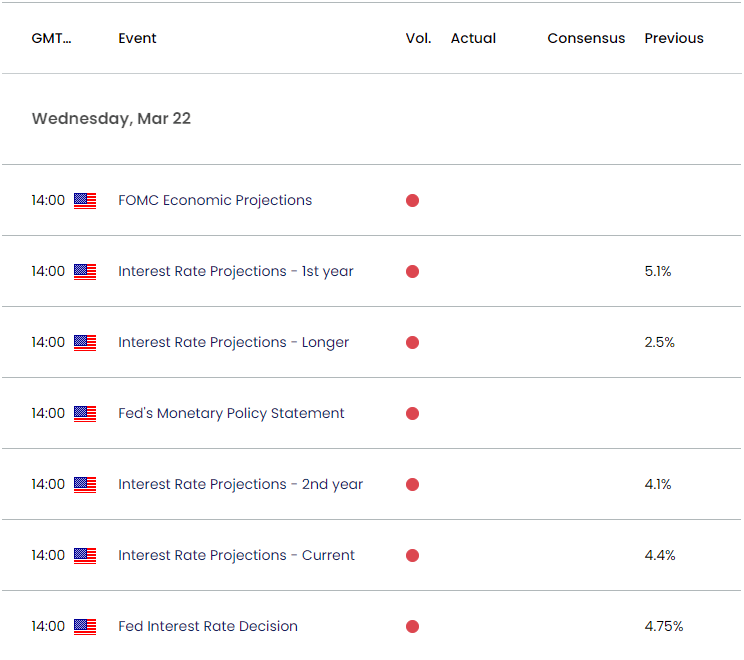

Source: CME

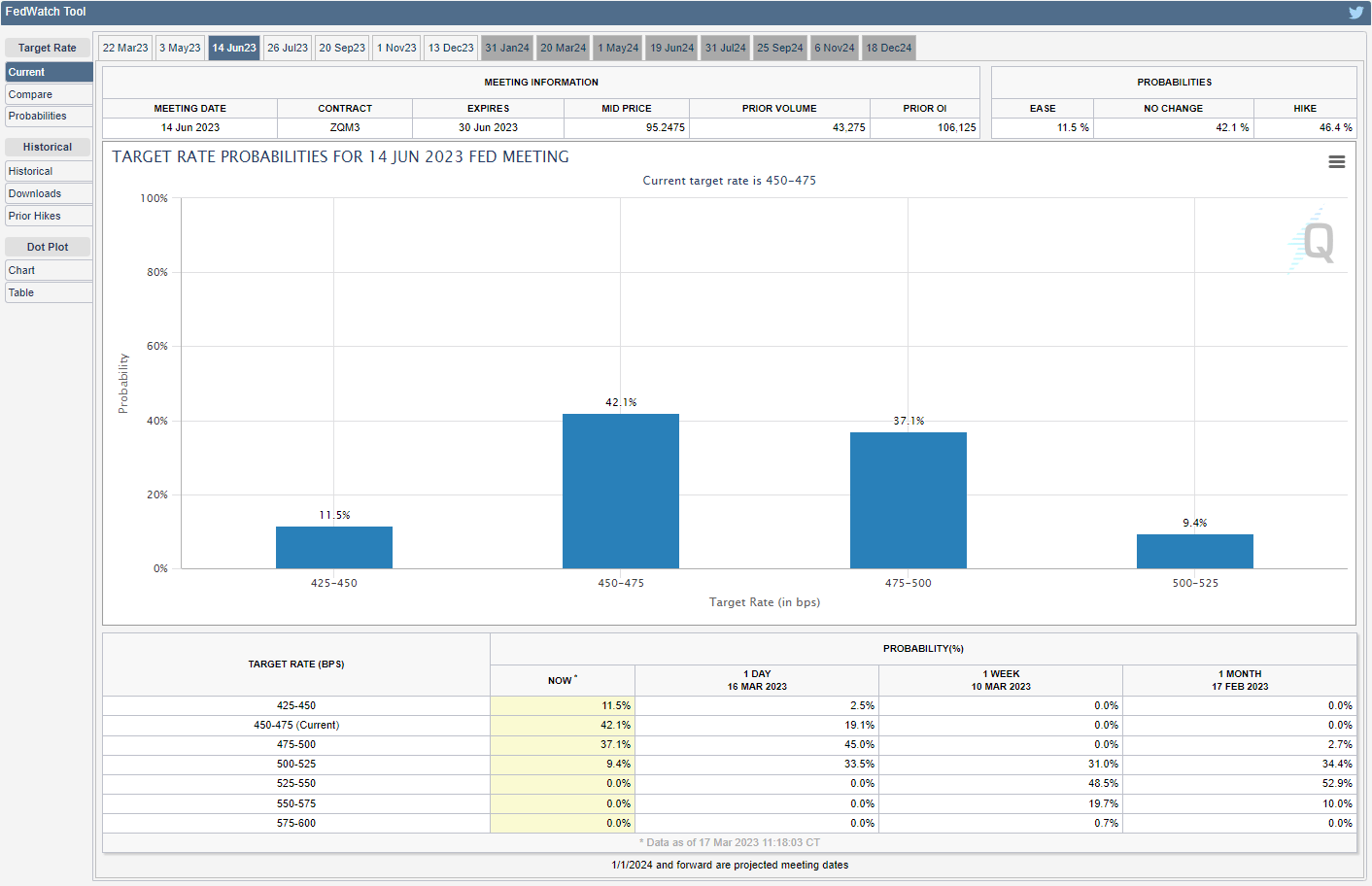

Source: CME

The CME FedWatch Tool reflects a greater than 90% probability for a terminal Fed funds rate of 4.75% to 5.00% as the Federal Open Market Committee (FOMC) is anticipated to implement another 25bp rate hike in March, and the update to the Fed’s Summary of Economic Projections (SEP) may influence the near-term outlook for EUR/USD as the forecasts from December 2022 show US interest rates above 5.00%.

Source: FOMC

In turn, a downward revision in the Fed’s dot-plot may drag on the US Dollar as the Fed concludes its hiking-cycle, but more of the same from Chairman Jerome Powell and Co. may undermine the recent rebound in EUR/USD as the FOMC pursues a more restrictive policy.

With that said, projections for additional Fed rate hikes may generate a bullish reaction in the Greenback, but a material shift in the forward guidance for monetary policy is likely to keep EUR/USD afloat as it defends the opening range for 2023.

Euro Price Chart – EUR/USD Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD continues to hold above the January low (1.0483), with the exchange rate initiating a series of higher highs and lows as it bounces back from a fresh monthly low (1.0516).

- EUR/USD may continue to defend the opening range for 2023 as it trades back above 1.0610 (38.2% Fibonacci retracement), with a move above the 50-Day SMA (1.0727) raising the scope for a run at the monthly high (1.0760).

- However, failure to hold above 1.0610 (38.2% Fibonacci retracement) may bring the January low (1.0483) back on the radar, with the next area of interest coming in around 1.0370 (38.2% Fibonacci extension).

--- Written by David Song, Strategist

Follow me on Twitter at @DavidJSong