Euro Outlook: EUR/USD

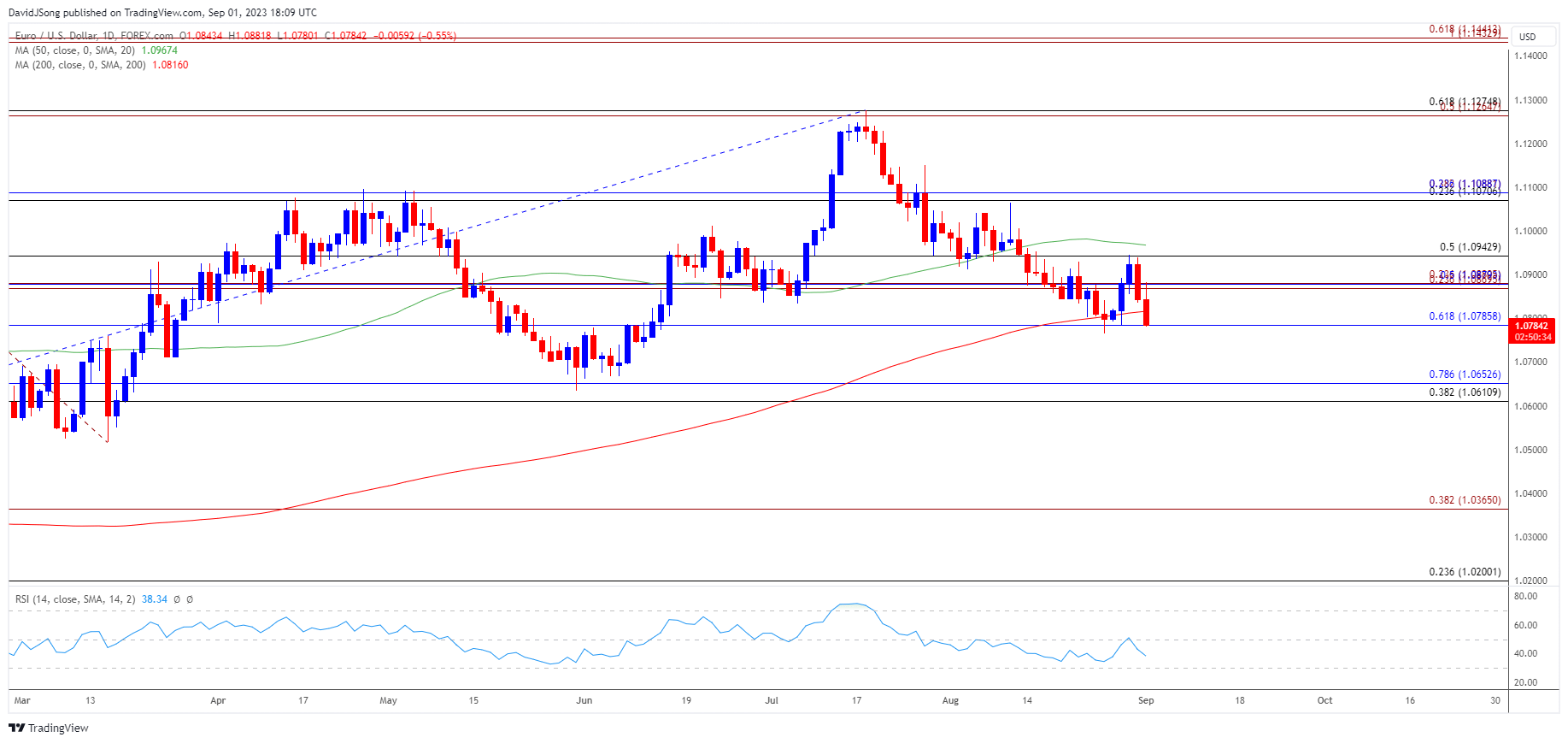

EUR/USD carves a series of lower highs and lows following the limited reaction to the US Non-Farm Payrolls (NFP) report, and the exchange rate is on the cusp of testing the August low (1.0766) following the failed attempt to push back above the 50-Day SMA (1.0967).

EUR/USD Post-NFP Weakness Brings Test of August Low

The flattening slope in the moving average warns of a potential change in market conditions even though EUR/USD halts a six-week selloff, and the exchange rate may no longer exhibit the bullish trend from earlier this year as it tests the 200-Day SMA (1.0377) for the first time since November 2022.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Euro Area Economic Calendar

Looking ahead, it remains to be seen if fresh remarks from European Central Bank (ECB) President Christine Lagarde will sway EUR/USD as the Governing Council no longer provides forward-guidance on monetary policy, and market participants may pay increased attention to the data prints coming out of the Euro Area as the Retail Sales report is anticipated to show a 1.2% contraction in July.

Signs of a slowing economy may push the Governing Council to conclude its hiking-cycle as ‘the weakening of economic activity could be expected to help generate the conditions necessary to restore price stability,’ and the Euro may face headwinds ahead of the next ECB meeting on September 14 as the ‘economy might be entering a phase of stagflation.’

Until then, speculation surrounding ECB policy may influence EUR/USD as the central bank prefers to ‘tighten monetary policy further than to not tighten it enough,’ but the exchange rate appears to be on track to test the August low (1.0766) as it extends the series of lower highs and lows from earlier this week.

With that said, the monthly opening range is in focus for EUR/USD following the failed attempt to push above the 50-Day SMA (1.0967), and the exchange rate may no longer exhibit the bullish trend from earlier this year amid the flattening slope in the moving average.

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD carves a series of lower highs and lows failed attempt to push above the 50-Day SMA (1.0967), with the moving average no longer reflecting a positive slope as the exchange rate approaches the August low (1.0766).

- Need a close below 1.0790 (61.8% Fibonacci retracement) to bring the June low (1.0662) on the radar, with the next area of interest coming in around 1.0610 (38.2% Fibonacci retracement) to 1.0650 (78.6% Fibonacci retracement), which incorporates the May low (1.0635).

- Nevertheless, the recent weakness in EUR/USD may end up being short-lived if it defends the August low (1.0766), with a move above the 1.0880 (23.6% Fibonacci extension) to 1.0940 (50% Fibonacci retracement) area bringing the moving average back on the radar.

Additional Market Outlooks

USD/JPY Outlook Mired by Failure to Test November 2022 High

GBP/USD Vulnerable to Head-and-Shoulders Pattern

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong