EUR/USD Outlook

EUR/USD continues to appreciate following the European Central Bank (ECB) meeting as it registers a fresh monthly high (1.0971), and the exchange rate may continue retrace the decline from the April high (1.1096) as it extends the series of higher highs and lows from the start of the week.

EUR/USD Post-ECB Rally Puts April High in Sight

EUR/USD trades back above the 50-Day SMA (1.0879) as ECB President Christine Lagarde emphasizes that ‘we have ground to cover,’ and the comments suggest the Governing Council will take further steps to combat inflation as the head of the central bank insists ‘we will continue to hike at our next meeting.’

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

As a result, expectations for higher Euro Area interest rates may keep EUR/USD afloat as the Federal Reserve moves to the sidelines, and the semi-annual testimony from Chairman Jerome Powell may do little to influence the exchange rate as central bank points to the ‘uncertain lags with which monetary policy affects the economy.’

It remains to be seen if Chairman Powell will reveal anything new in front of US lawmakers as ‘nearly all Committee participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year,’ and more of the same from Chairman Powell may drag on the Greenback as the Federal Open Market Committee (FOMC) plans to ‘make our decisions meeting by meeting.’

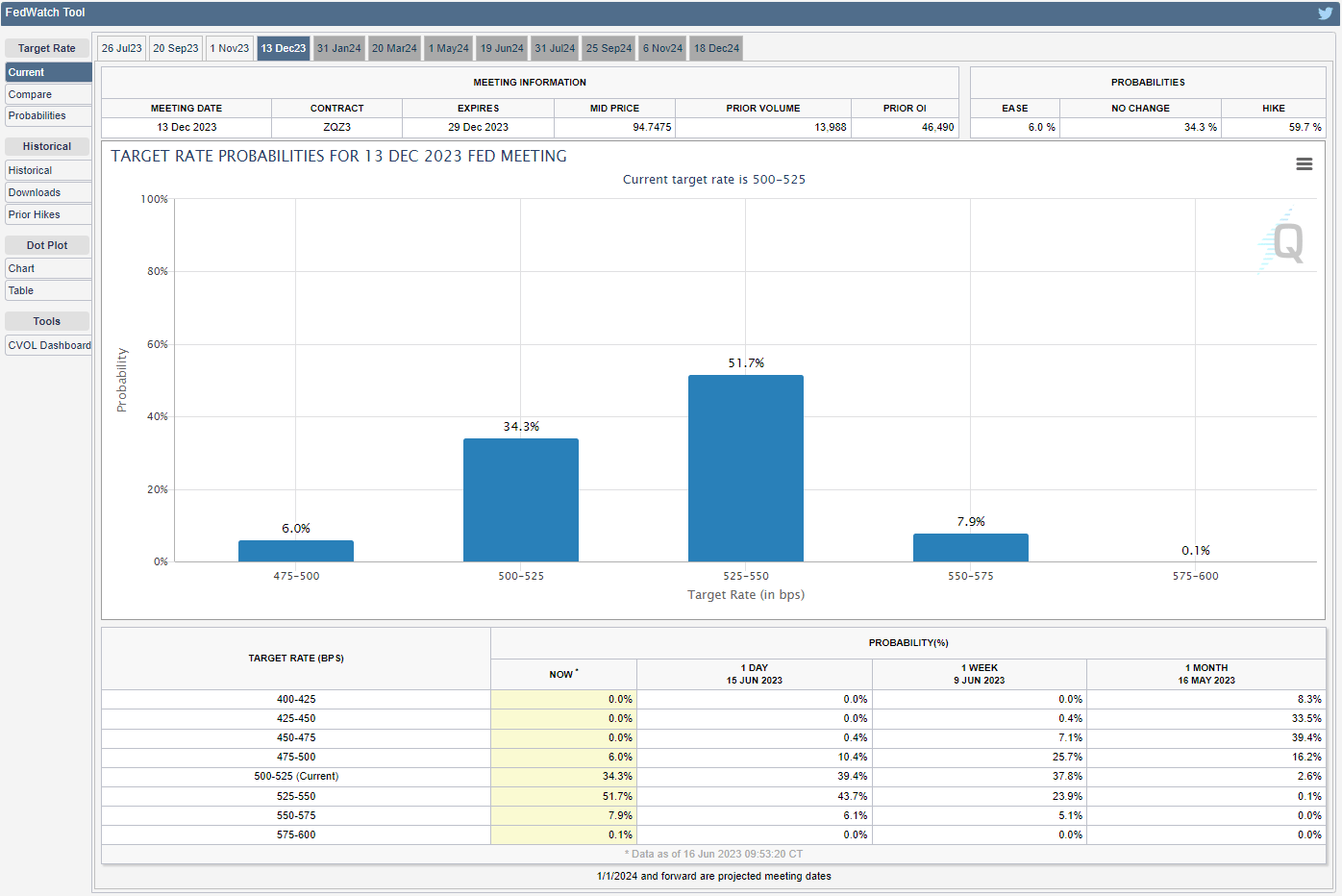

Source: CME

In turn, the Euro may continue to appreciate against its US counterpart as the CME FedWatch Tool reflects a greater than 30% chance of seeing US interest rates unchanged for the remainder of the year, and EUR/USD may appreciate over the remainder of the month as it carves a series of higher highs and lows.

With that said, the semi-annual testimony from Chairman Powell may do little to curb the rally in EUR/USD as the Fed adopts a wait-and-see approach in managing monetary policy, and the exchange rate may continue retrace the decline from the April high (1.1096) as it trades back above the 50-Day SMA (1.0879).

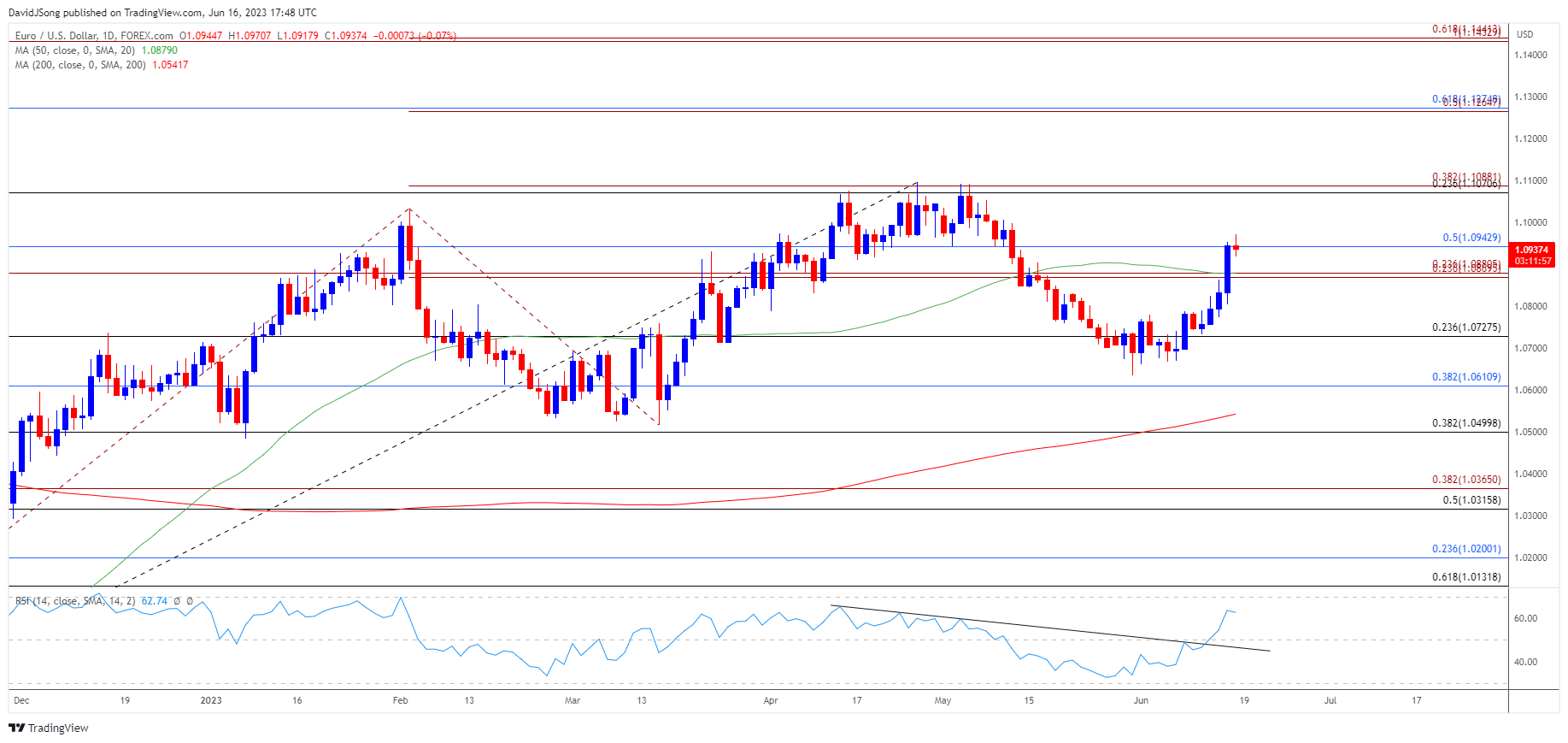

Euro Price Chart – EUR/USD Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD extends the series of higher highs and lows from the start of the week to trade back above the 50-Day SMA (1.0879), and the exchange rate may continue to push to fresh monthly highs as the Relative Strength Index (RSI) breaks out of the downward trend from earlier this year.

- Need a close above the 1.0880 (23.6% Fibonacci extension) to 1.0940 (50% Fibonacci retracement) region to bring the April high (1.1096) on the radar, with a break/close above the 1.1070 (78.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension) area opening up March 2022 high (1.1233).

- However, failure to close above 1.0880 (23.6% Fibonacci extension) to 1.0940 (50% Fibonacci retracement) region may curb the recent advance in EUR/USD, with a move below the moving average bringing the 1.0730 (23.6% Fibonacci retracement) area back on the radar.

Additional Market Outlooks

Gold Price Pending Test of 50-Day SMA amid Bullish Outside Day

AUD/USD Forecast: Post-RBA Rally Eyes May High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong