EUR/USD Outlook

The opening range for July is in focus as EUR/USD bounces along the 50-Day SMA (1.0869), with the exchange rate like to face increase volatility over the coming days as the Non-Farm Payrolls (NFP) report is anticipated to show a further improvement in the labor market.

EUR/USD Outlook: Pay Attention to July Opening Range

EUR/USD is little changed ahead of a major US holiday and the exchange rate may continue to trade within the price range from May as the moving average no longer reflects a positive slope.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

Nevertheless, the NFP report may sway the near-term outlook for EUR/USD as the US economy is projected to add 200K jobs in June, and ongoing signs of a tight labor market may generate a bullish reaction in the Greenback as it puts pressure on the Federal Reserve to pursue a more restrictive policy.

As a result, expectations for higher US interest rates may drag on EUR/USD as Chairman Jerome Powell and Co. forecast a steeper path for the Fed Funds rate, but a weaker-than-expected NFP print may spark a bearish reaction in the Dollar as it limits the central bank’s scope to further combat inflation.

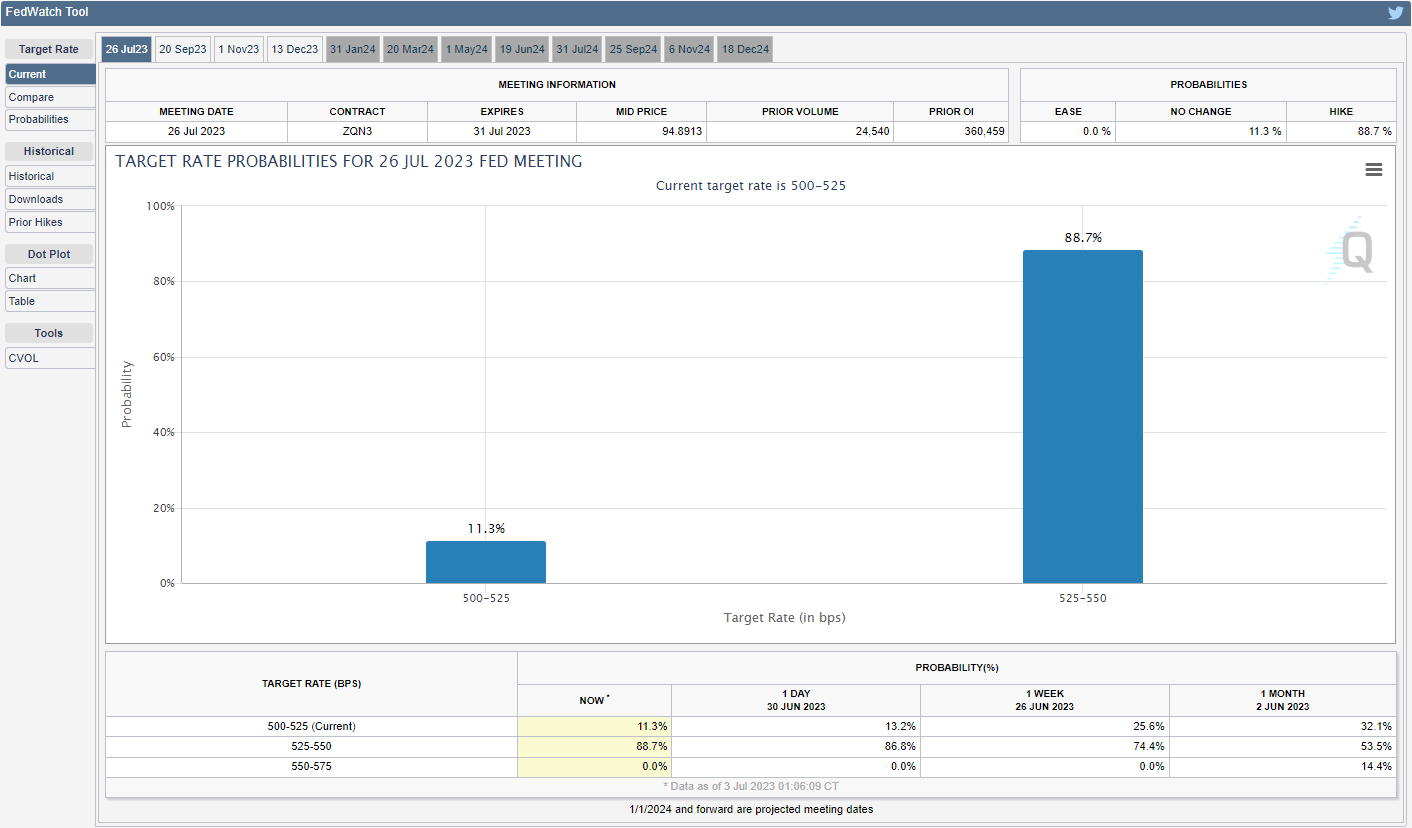

Source: CME

Until then, speculation surrounding Fed policy may influence EUR/USD as the CME FedWatch Tool reflects a greater than 80% probability for a 25bp rate hike later this month, and it remains to be seen if the Federal Open Market Committee (FOMC) will continue to strike a hawkish forward guidance on July 26 as the central bank anticipates inflation to hold above the 2% target until 2025.

With that said, the monthly opening range is in focus as EUR/USD bounces along the 50-Day SMA (1.0869), but the exchange rate may consolidate ahead of the NFP report as the moving average no longer reflects a positive slope.

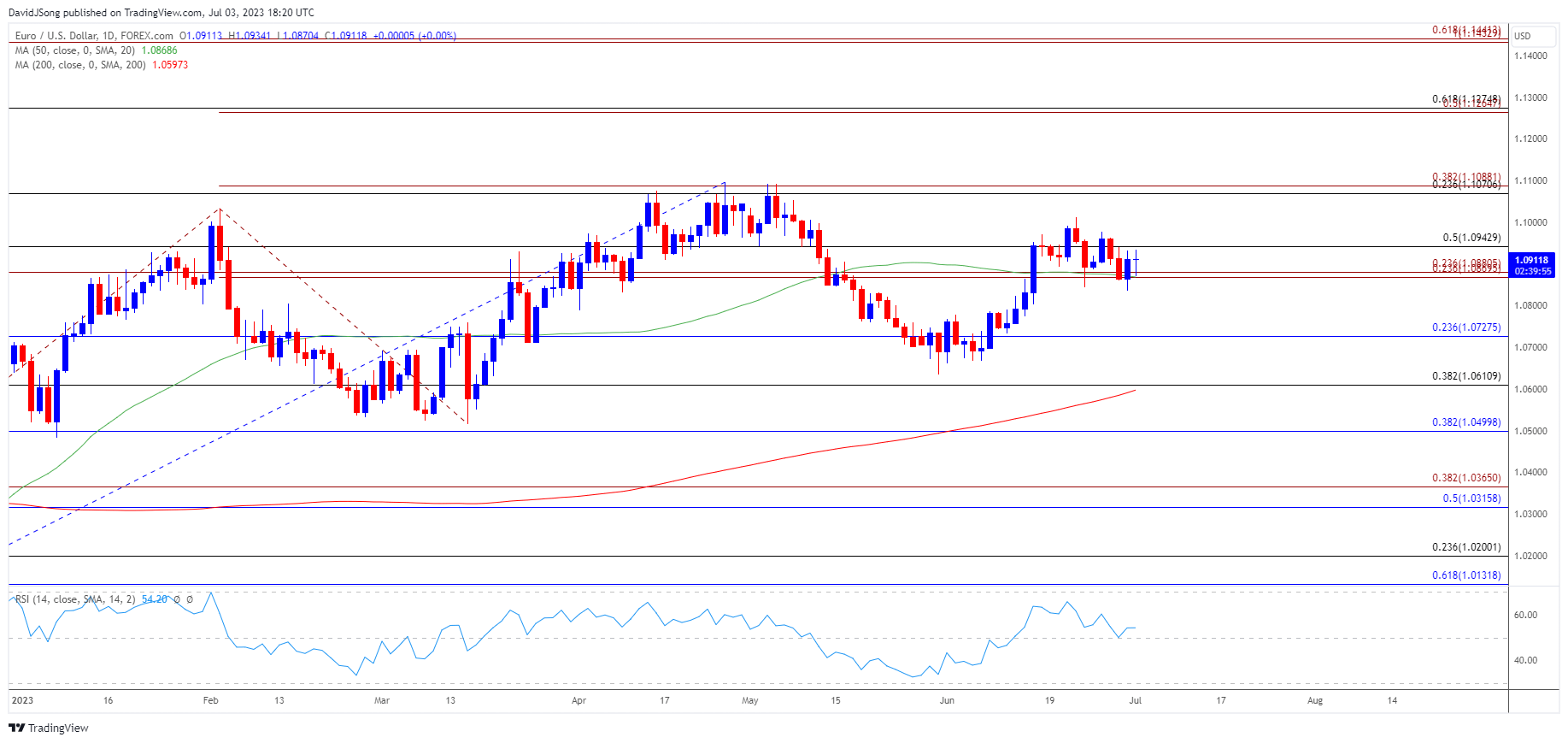

Euro Price Chart – EUR/USD Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD bounces along the 50-Day SMA (1.0869) after failing to test the May high (1.1092), and the exchange rate may trade within a defined range as the moving average no longer reflects a positive slope.

- Failure to trade back above 1.0880 (23.6% Fibonacci extension) to 1.0940 (50% Fibonacci retracement) region may push EUR/USD below the moving average, with a move below 1.0730 (23.6% Fibonacci retracement) raising the scope for a test of the May low (1.0635).

- Next area of interest comes in around 1.0610 (38.2% Fibonacci retracement), but a close above the 1.0880 (23.6% Fibonacci extension) to 1.0940 (50% Fibonacci retracement) region may push the EUR/USD towards the June high (1.1012), with the opening range for July in focus amid the price action from earlier this year.

Additional Market Outlooks

USD/JPY Forecast: Overbought RSI Reading Persists

USD/CAD Forecast: Test of Former Support in Focus

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong