- GBP/USD outlook remains negative ahead of UK election

- EUR/USD outlook again hurt by weak manufacturing data as French election looms

- Next week: German Ifo, US consumer confidence and Core PCE inflation among data highlights

US dollar extends rally, receiving indirect support

This morning saw the US dollar extend its recent gains. It has strengthened thanks to weakness in European PMI data released earlier today and ongoing concerns about the upcoming elections in France and the UK, both holding back the euro and pound. Meanwhile a surprise rate cut by the SNB hurt the franc on Thursday, which was followed by a marginally more dovish Bank of England rate decision than expected. So, the dollar has been getting a boost from external factors more than internal factors. Indeed, this week’s US data has been far from convincing with core retail sales falling unexpectedly and Thursday’s data dump all missing the mark. This partly explains why gold and silver have not responded by falling to the dollar strength. For now, the GBP/USD outlook remains tilted to the downside while the EUR/USD outlook is uncertain amid political uncertainty in France and the rise of far-right parties across Europe.

GBP/USD outlook remains negative ahead of UK election

The pound was already trading weaker after the Bank of England kept rates unchanged on Thursday as expected, in a "finely balanced" decision for some members, which the market interpreted as a signal that the first rate cut was going to come in August. Today, we had weaker-than-expected PMI data from the UK, which means that "balance" is shifting towards a cut on a marginal basis. On top of this, you have the ongoing election uncertainty in the UK. So, traders seem happy to sit on the offer on the GBP/USD, keeping the short-term path of least resistance to the downside.

Consequently, the GBP/USD has fallen to its lowest point since mid-May, testing potential support at 1.2635. A more significant support area to watch is at around 1.2550 where the 200-day average meets a prior support and resistance zone.

In terms of GBP/USD resistance levels to watch, they include 1.2655, 1.2700 and 1.2735 – all prior support/resistance levels.

Video: GBP/USD outlook and insights on metals, indices and oil

EUR/USD outlook again hurt by weak manufacturing data as French election looms

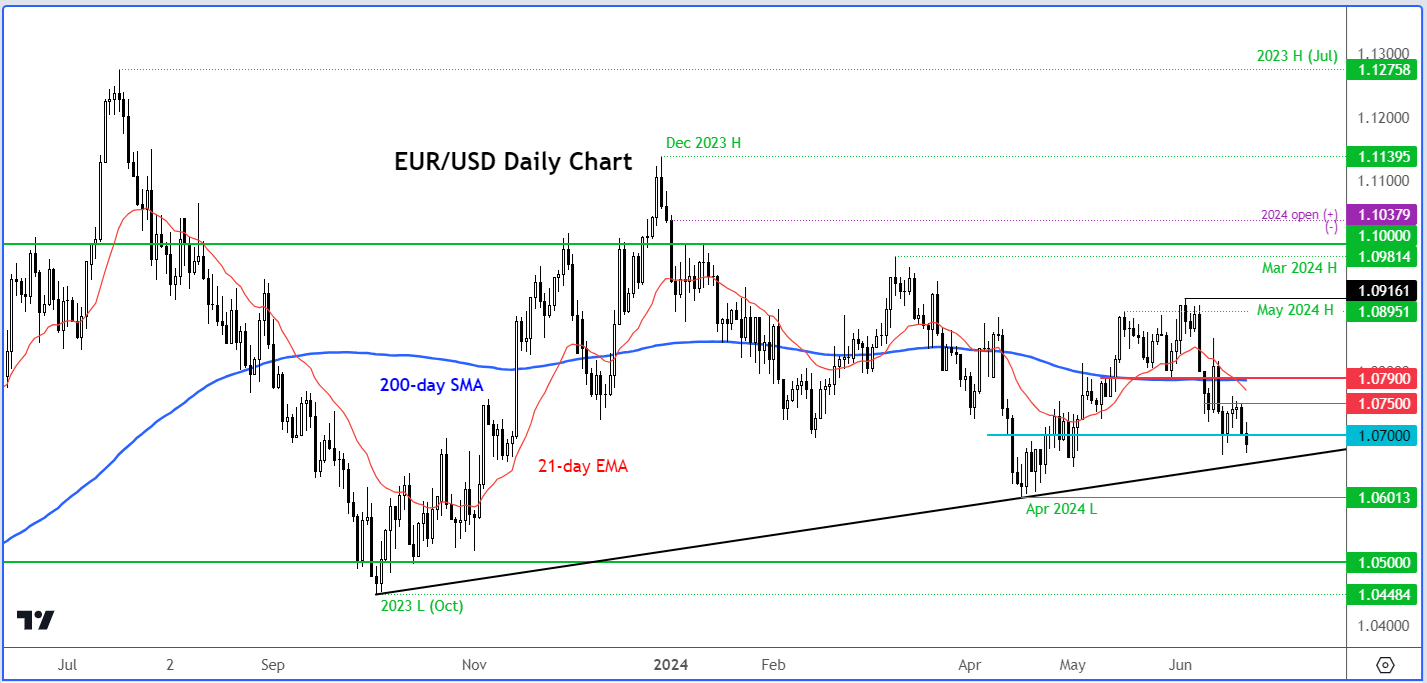

Once again, the manufacturing sector of the Eurozone continues to disappoint expectations. This morning saw the EUR/USD get another reality check with the release of weaker-than-expected services and manufacturing PMI data from the eurozone, suggesting that growth in Q2 may be lower than expected. Add to this, you have the ongoing French election uncertainty and the rise of far-right parties across Europe, and not to mention the recent rise in oil prices. All these factors are weighing on the euro, keeping the short-term EUR/USD outlook bearish.

Thanks to the renewed weakness in Eurozone data and French election uncertainty, I wouldn't be surprised if the EUR/USD continues heading lower in the short-term outlook. It may now establish a new ceiling below the 1.07 handle. The bears have already defended prior broken support levels such as 1.0750 and 1.0790 successfully.

If the bearish trend continues, then the next potential support to watch is the trend line support at 1.0650ish, following by the prior low made in April around 1.06 area.

Today’s weakness in PMI data come on the back of a stronger ZEW survey released earlier in the week, which showed institutional investors grew more optimistic over the 6-month economic outlook for Germany and Eurozone. The PMI data is quite volatile and can easily turn higher. But for the euro to start a new bullish trend, we will potentially have to wait until after the French election on June 30. Should investors scale back political risk premium, there would likely be a substantial room for rebound in the EUR/USD.

This implies that the euro should remain a laggard in any USD-negative dynamics. Investors anticipating a weaker US dollar should concentrate on another pair, such as the AUD/USD, for example, with the Reserve Bank of Australia remaining a hawk.

Looking ahead to next week: German Ifo, US consumer confidence and Core PCE inflation

German ifo Business Climate

Monday, June 24

09:00 BST

The fallout from the recent EU elections has caused the euro to drop across the board with equity indices in the region, especially France, also taking a hit. The rise of far-right parties across Europe has unnerved investors, amid concerns about a future potentially shifting EU cooperation towards domestic agendas, making Europe less predictable and attractive to investors. Let’s see if that sentiment is going to be shared by business leaders. The ifo survey’s large sample size of about 9,000 businesses and its historic correlation with German and Eurozone economic conditions makes it an important release for the region’s asset prices.

US CB Consumer Confidence

Tuesday, June 25

15:00 BST

Consumer sentiment showed a surprise rise last month according to this survey of about 3,000 households by the Conference Board. However, the more up-to-date measure, the UoM Consumer Sentiment barometer, disappointed last week, suggesting the tech optimism is not reflected on the wider US citizen outside of the stock market. Another drop could lift haven assets like gold and undermine USD, especially as after we saw weaker retail sales data, as we as rising jobless claims numbers.

US Core PCE

Friday, June 28

13:30 BST

It is all about the timing of the first Fed rate cut, which has been pushed around significantly throughout this year. Initially, markets had expected the rate cut to come in June, before a series of stronger data releases pushed it to December and recently, we have seen a few data misses and it is now expected to be September. The Core PCE data is the Fed’s preferred measure of inflation. After weaker CPI and PPI reports, another weaker-than-expected inflation report could send the dollar tumbling.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R