Euro Outlook: EUR/USD

EUR/USD may attempt to test the March low (1.0516) as it carves a series of lower highs and lows, and the update to the Euro Area Consumer Price Index (CPI) may do little to prop up the exchange rate as both the headline and core rate are anticipated to show slowing inflation.

EUR/USD Forecast: RSI Flirts with Oversold Zone Ahead of Euro Area CPI

EUR/USD remains under pressure following the Federal Reserve interest rate decision as European Central Bank (ECB) President Christine Lagarde tames speculation for higher Euro Area interest rates, and the Euro may face headwinds over the remainder of the year as the Governing Council seems to be at the end of its hiking-cycle.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Recent remarks from President Lagarde suggest the ECB will refrain from a more restrictive policy as Euro Area interest rates ‘have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to our target,’ and the Governor Council may prepare to switch gears over the coming months as the ‘services sector, which had been resilient until recently, is now also weakening.’

Euro Area Economic Calendar

In turn, a slowdown in both the headline and core Euro Area CPI may keep EUR/USD under pressure as it fuels speculation for a looming change in regime, but a stronger-than-expected print may generate a bullish reaction in the Euro as it puts pressure on President Lagarde and Co. to further combat inflation.

With that said, data prints coming out of the Euro Area may sway EUR/USD as the ECB tames speculation for higher interest rates, and the exchange rate may attempt to test the March low (1.0516) as it seems to be tracking the negative slope in the 50-Day SMA (1.0859).

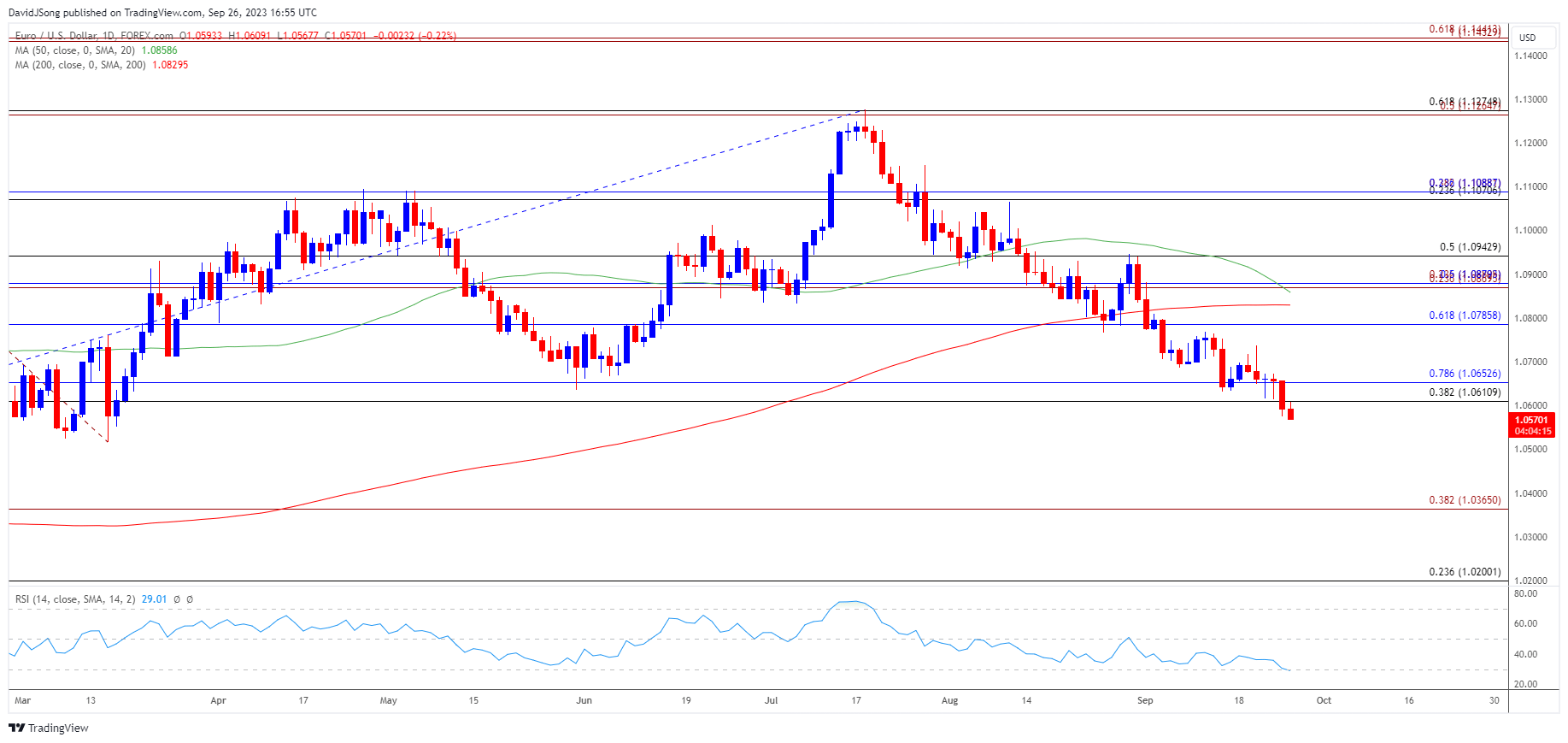

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD trades to a fresh monthly low (1.0568) as it carves a series of lower highs and lows, and the bearish price action may persist as the Relative Strength Index (RSI) flirts with oversold territory for the first time this year.

- A move below 30 in the RSI is likely to be accompanied by a further decline in EUR/USD like the price action from last year, with a break below the March low (1.0516) raising the scope for a test of the January low (1.0483) as the exchange rate appears to be tracking the negative slope in the 50-Day SMA (1.0859).

- Next area of interest comes in around 1.0370 (38.2% Fibonacci extension), but failure to test the March low (1.0516) may curb the bearish price series in EUR/USD, with a move above the 1.0610 (38.2% Fibonacci retracement) to 1.0650 (78.6% Fibonacci retracement) region bringing 1.0790 (61.8% Fibonacci retracement) back on the radar.

Additional Market Outlooks

US Dollar Forecast: USD/JPY Mirrors Rise in Long-Term US Yields

US Dollar Forecast: USD/CAD Continues to Bounce Along 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong