Key Events:

- US Elections

- Fed Rate Anticipation

- German Prelim CPI (Wednesday)

- US Advance GDP (Wednesday)

- Eurozone CPI (Thursday)

- US Core PCE (Thursday)

- US NFP (Friday)

Eurozone Inflation Impact

Germany’s preliminary CPI data came in at 0% in August, alongside a notable year-on-year decline in Eurozone CPI to 1.7% and a slight dip in core CPI from 2.8% to 2.7%. This trend has reinforced a dovish outlook for the ECB’s monetary policy, pushing the EUR/USD pair down 440 points from its September highs near 1.1220 to a low of 1.0760.

US Elections, NFP, and Dollar Strength

Beyond the dovish sentiment impacting the EUR/USD pair, rising market hopes for a Trump win are strengthening the dollar, potentially fueling inflation expectations. With anticipation building, upcoming statistics—particularly Friday’s non-farm payrolls and the Fed’s rate decision following the US election next week—are expected to heavily influence the pair.

The latest non-farm payroll report exceeded previous and expected figures, reaching a 5-month high with 254,000 jobs added in August. This data dampened dovish sentiment surrounding the Fed’s upcoming policy meeting, further supporting the dollar’s rally against the euro.

Momentum is currently at a critical level, and a possible trend reversal might be on the horizon.

Technical Analysis

EURUSD Forecast: 3Day Time Frame – Log Scale

Source: Tradingview

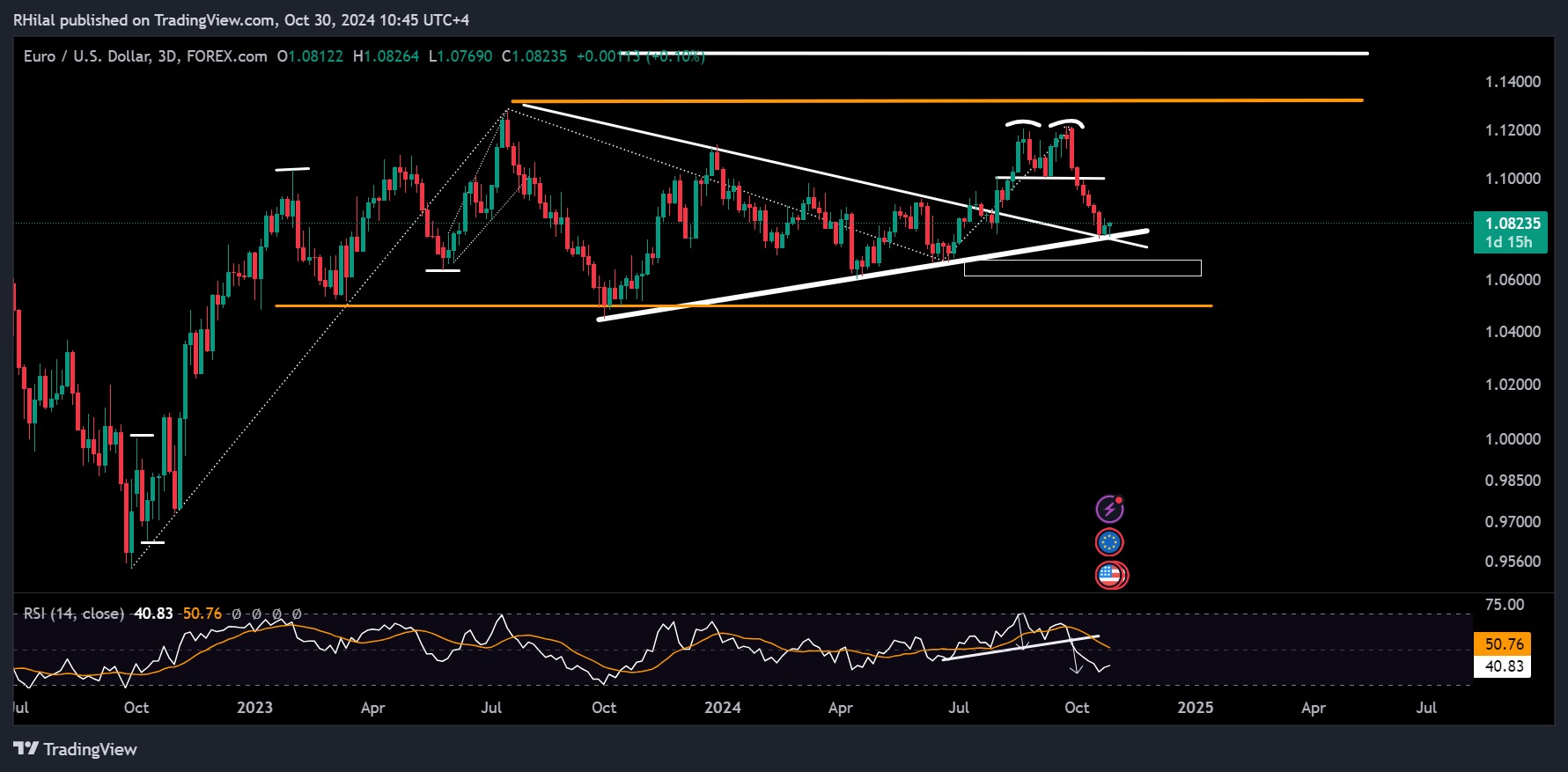

Based on the chart and its relative strength index (RSI) indicator on a 3-day time frame, notable patterns targets have been traced, including a double top on the chart and a head-and-shoulders on the RSI.

The EUR/USD is rebounding from a trendline that connects consecutive lows from October 2023 to October 2024, aligning with the triangle’s thrust (intersection of triangle borders) formed between the July 2023 high and June 2024 low.

A bullish continuation scenario toward 1.10, 1.12, and 1.13 is possible from the current strong support level. However, if this support level at 1.0760 is firmly breached, the drop could extend to 1.0680, 1.0630, and eventually 1.05, reducing the likelihood of a bullish scenario.

--- Written by Razan Hilal, CMT – on X: @Rh_waves