Euro Outlook: EUR/USD

EUR/USD holds above the monthly low (1.0448) as Federal Reserve Chairman Jerome Powell pledges to proceed ‘carefully’ in managing monetary policy, but the European Central Bank (ECB) meeting may drag on the exchange rate if the Governing Council keeps Euro Area interest rates on hold.

EUR/USD Forecast: All Eyes on ECB Interest Rate Decision

EUR/USD trades in a narrow range after clearing the opening range for October, and fresh developments coming out of the ECB may sway the near-term outlook for the exchange rate as the Governing Council pledges to ‘ensure that inflation returns to our two per cent medium-term target in a timely manner.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

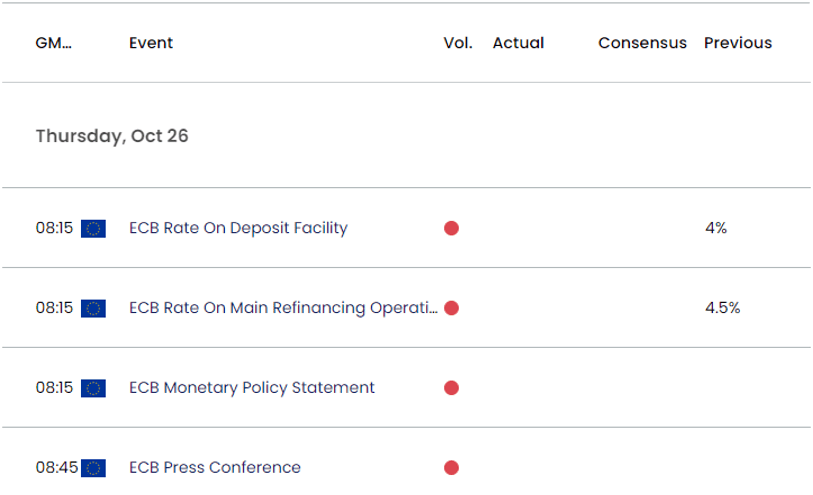

Euro Area Economic Calendar

As a result, another ECB rate-hike may generate a bullish reaction in EUR/USD as the central bank seems to be in no rush to switch gears, but it seems as though Governing Council is at or nearing the end of its hiking-cycle as President Christine Lagarde and Co. argue that Euro Area ‘interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to our target.’

In turn, the Euro may face headwinds should the Governing Council endorse a wait-and-see approach for monetary policy, and EUR/USD may struggle to retain the advance from the monthly low (1.0448) amid the failed attempt to trade back above the former support zone around the May low (1.0635).

With that said, EUR/USD may continue to consolidate ahead of the ECB meeting as it holds within the monthly range, but the exchange rate may track the negative slope in the 50-Day SMA (1.0689) if it fails to push above the monthly high (1.0640).

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD consolidates after clearing the opening range for October, but the advance from the monthly low (1.0448) may unravel amid the failed attempts to trade back above the former support zone around the May low (1.0635).

- In turn, EUR/USD may track the negative slope in the 50-Day SMA (1.0689) if it fails to defend the monthly range, with a breach below the December 2022 low (1.0393) opening up the 1.0370 (38.2% Fibonacci extension) region.

- Nevertheless, a break/close above the 1.0610 (38.2% Fibonacci retracement) to 1.0650 (78.6% Fibonacci retracement) area may push EUR/USD towards the moving average, with the next area of interest coming in around 1.0790 (61.8% Fibonacci retracement).

Additional Market Outlooks

British Pound Forecast: GBP/USD Rebound Stalls at Former Support Zone

USD/CAD Rebounds Ahead of 50-Day SMA amid Slowdown in Canada CPI

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong