EUR/USD Outlook

EUR/USD has come up against the 50-Day SMA (1.0876) as it continues to pull back from a fresh monthly high (1.1012), and the exchange rate may continue to trade within the May range as the moving average no longer reflects a positive slope.

EUR/USD Fails to Test May High as Fed Officials Defend Higher Rates

EUR/USD appears to be reversing course ahead of the May high (1.1092) as initiates a series of lower highs and lows, with the Relative Strength Index (RSI) reflecting a similar dynamic amid the failed attempt to push into overbought territory.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

Looking ahead, it remains to be seen if data prints coming out of the US will sway EUR/USD as Durable Goods Orders are projected to contract 1.0% in May, while Non-Defense Capital Goods Orders excluding Aircrafts, a proxy for business investment, is anticipated to hold flat during the same period.

The development may encourage the Federal Reserve to keep US interest rates on hold as it points to a slowing economy, but an unexpected rise in demand for large-ticket items may lead to a bullish reaction in the US Dollar as it puts pressure on the central bank to reestablish its hiking-cycle.

In turn, a growing number of Fed officials may prepare US households and businesses for higher interest rates as Governor Michelle Bowman, a permanent voting-member of on the Federal Open Market Committee (FOMC), warns that that ‘we will need to increase the federal funds rate further to achieve a sufficiently restrictive stance of monetary policy to meaningfully and durably bring inflation down’ while speaking at the Cleveland Fed’s 2023 Policy Summit.

With that said, speculation surrounding Fed policy may sway EUR/USD ahead of the next interest rate decision on July 23 as Chairman Jerome Powell strikes a hawkish tone in front of US lawmakers, but the exchange rate may continue to trade within last month’s range as it appears to be reversing course ahead of the May high (1.1092).

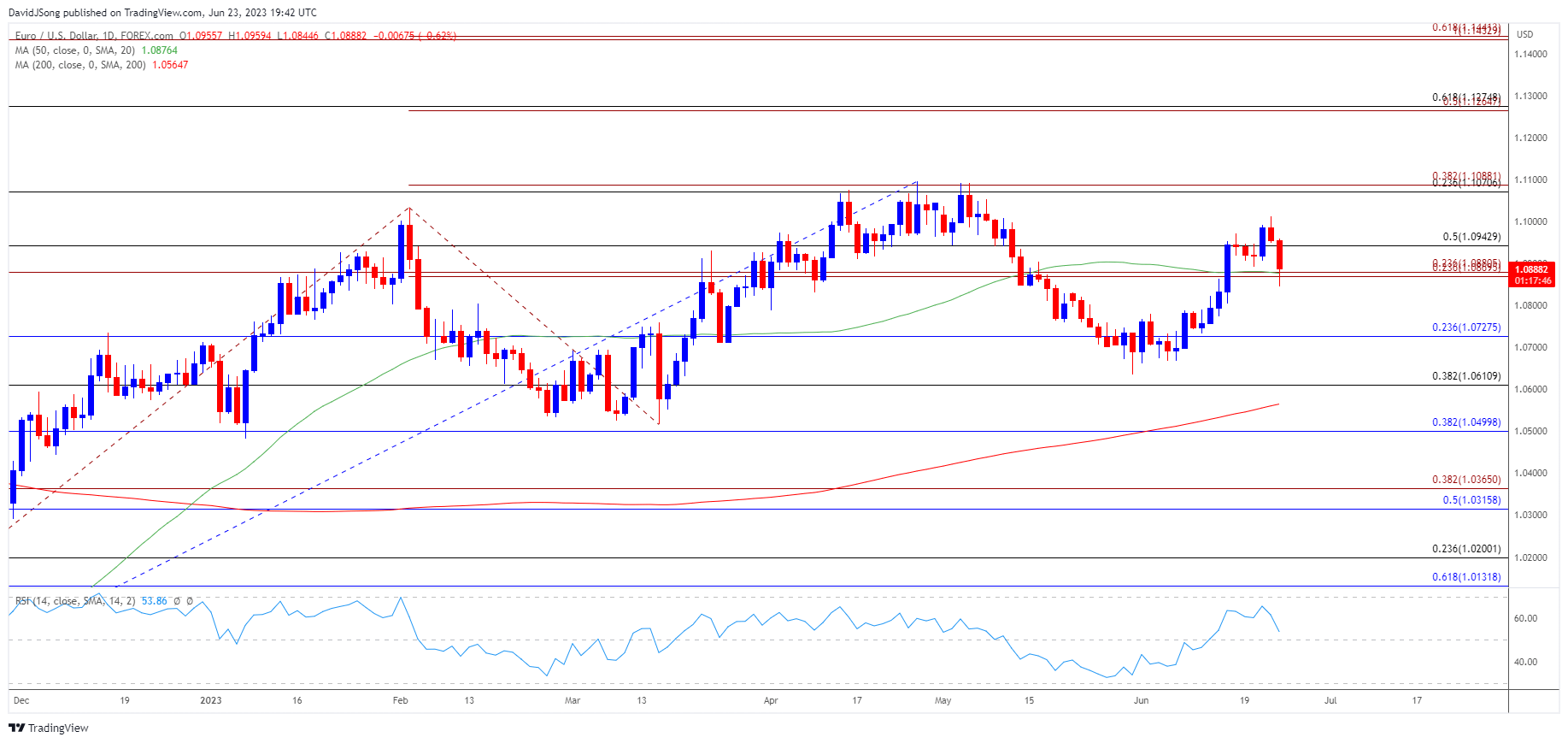

Euro Price Chart – EUR/USD Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD initiates a series of lower highs and lows as it continues to pullback from a fresh monthly high (1.1012), with the exchange rate coming up against the 50-Day SMA (1.0876) following the failed attempt to test the May high (1.1092).

- EUR/USD may track last month’s range as the moving average no longer reflects a positive slope, with a close below the 1.0880 (23.6% Fibonacci extension) to 1.0940 (50% Fibonacci retracement) region bringing the 1.0730 (23.6% Fibonacci retracement) area back on the radar as the Relative Strength Index (RSI) seems to be reversing ahead of overbought territory.

- Failure to defend the May low (1.0635) opens up 1.0610 (38.2% Fibonacci retracement), but EUR/USD may stage further attempts to test the 1.1070 (78.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension) area if it manages to hold above the moving average.

Additional Market Outlooks

USD/CAD Weakness Triggers Another Oversold RSI Reading

GBP/USD Pulls Back to Keep RSI Out of Overbought Territory

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong