Euro Outlook: EUR/USD

EUR/USD fails to hold within the opening range for September ahead of the European Central Bank (ECB) interest rate decision, with the exchange rate extending the decline from the start of the week to register a fresh monthly low (1.1002).

EUR/USD Fails to Hold in September Opening Range Ahead of ECB

EUR/USD remains under pressure following the failed attempt to test the August high (1.1202), and developments coming out of the ECB meeting may sway the exchange rate as the central bank is expected to deliver a 25bp rate-cut.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

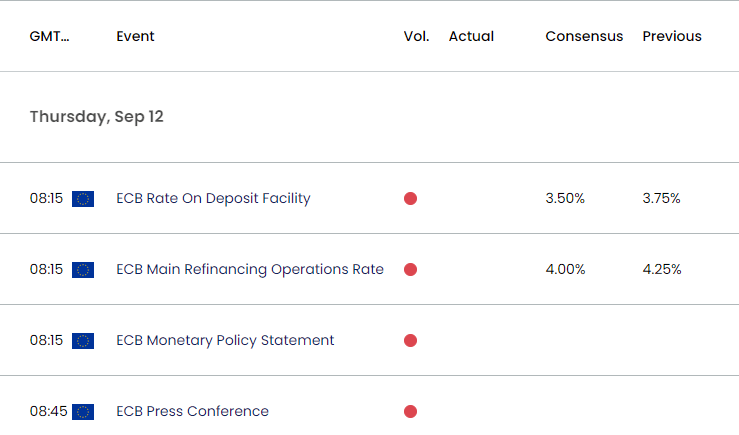

Euro Area Economic Calendar

With that said, EUR/USD may struggle to retain the advance from the August low (1.0778) should the ECB continue to unwind its restrictive policy, but the recent weakness in the exchange rate may end up short-lived should it respond to the positive slope in the 50-Day SMA (1.0963).

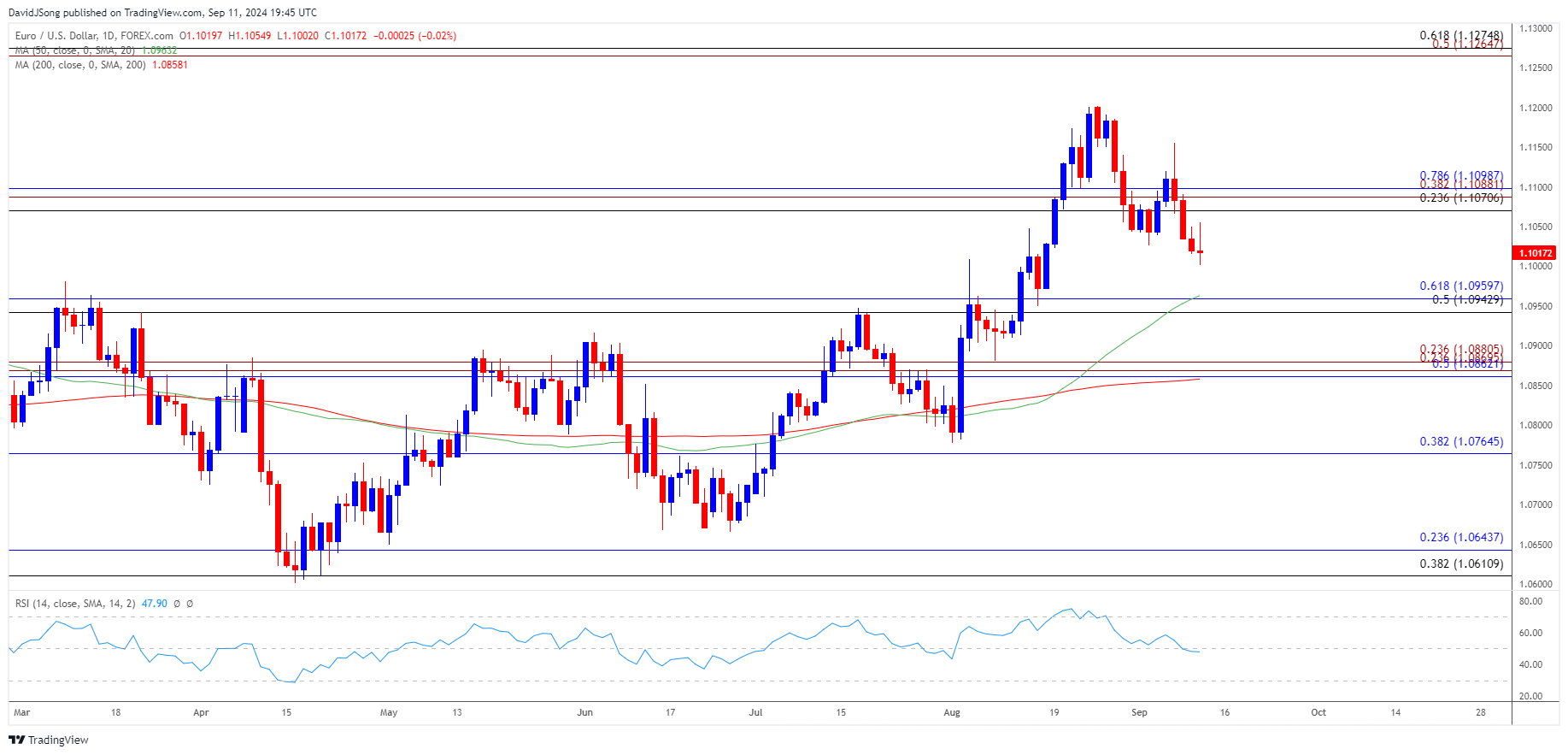

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD may continue to trade to fresh monthly lows as it fails to hold within the opening range for September, with a breach below the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) zone bringing the 1.0860 (50% Fibonacci retracement) to 1.0880 (23.6% Fibonacci extension) region back on the radar.

- Next area of interest comes in around the August low (1.0778) but EUR/USD may track the positive slope in the 50-Day SMA (1.0963) as it holds above the moving average.

- Need a move above the 1.1070 (23.6% Fibonacci retracement) to 1.1100 (78.6% Fibonacci retracement) area for a test of the monthly high (1.1156), with a breach above the August high (1.1202) opening up the 1.1270 (50% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) region.

Additional Market Outlooks

US Dollar Forecast: GBP/USD Susceptible to Bull-Flag Formation

Australia Dollar Forecast: AUD/USD Reverses Ahead of January High

US Dollar Forecast: USD/JPY Eyes August Low as NFP Report Disappoints

Gold Price Outlook Supported by Positive Slope in 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong