US Dollar Outlook: EUR/USD

EUR/USD dips below the 50-Day SMA (1.0926) after registering a fresh yearly high (1.2676) during the previous month, and data prints coming out of the US may keep the exchange rate under pressure as the Non-Farm Payrolls (NFP) report is anticipated to show another rise in employment.

EUR/USD Dips Below 50-Day SMA Ahead of US NFP Report

EUR/USD extends the decline from earlier this week as the ADP Employment report shows a 324K rise in July versus forecasts for a 189K print, and the exchange rate may struggle to track the positive slope in the moving average as evidence of a tight labor market raises the Federal Reserve’s scope to further combat inflation.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

Looking ahead, the NFP report may also produce headwinds for EUR/USD as the US is projected to add 200K jobs in July, and a positive development may fuel speculation for higher interest rates as inflation remains above the Fed’s 2% target.

In turn, EUR/USD may continue to give back the advance from July low (1.0834) as it fails to hold above the moving average, but a weaker-than-expected NFP print may curb the recent weakness in the exchange rate as it encourages the Federal Open Market Committee (FOMC) to conclude its hiking-cycle.

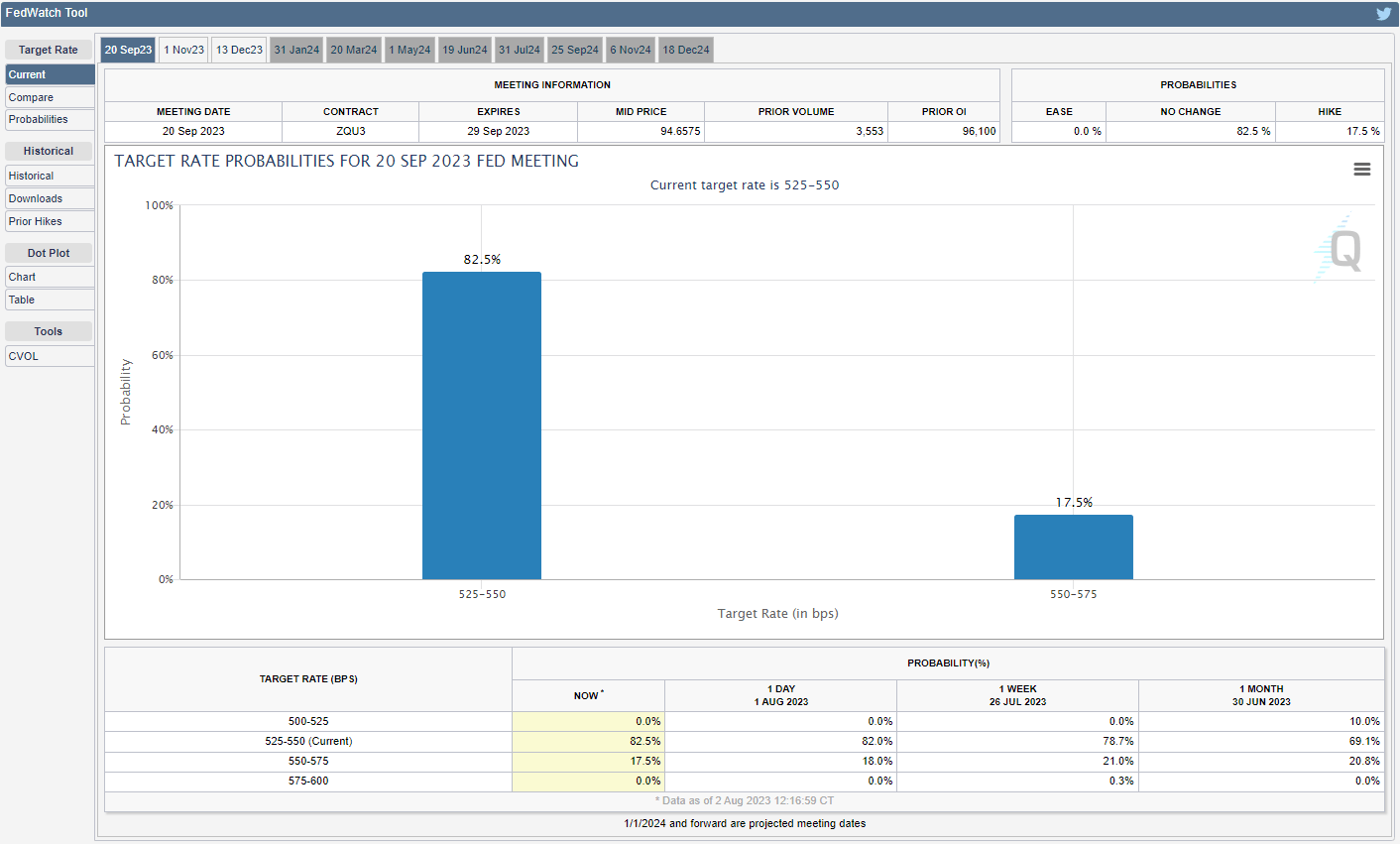

Source: CME

According to the CME FedWatch Tool, market participants are pricing a greater than 80% probability of seeing the Fed Funds rate hold steady in September, and speculation surrounding US monetary policy may influence EUR/USD ahead of the next interest rate decision on September 20 as ‘the process of getting inflation back down to 2 percent has a long way to go.’

With that said, the US NFP report may sway EUR/USD as the FOMC keeps the door open to implement higher interest rates, and the exchange rate may continue to give back the advance from the July low (1.0834) if it struggles to track the positive slope in the 50-Day SMA (1.0863).

Euro Price Chart – EUR/USD Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD tests the 50-Day SMA (1.0926) after registering a fresh yearly high (1.2676) during the previous month, and the exchange rate may continue to give back the advance from the July low (1.0834) if it struggles to track the positive slope in the moving average.

- A break/close below the 1.0880 (23.6% Fibonacci extension) to 1.0940 (50% Fibonacci retracement) region may lead to a test of the July low (1.0834), with a break below the 200-Day SMA (1.0735) bringing the May low (1.0635) on the radar.

- Nevertheless, EUR/USD may track the July range if it defends the 1.0880 (23.6% Fibonacci extension) to 1.0940 (50% Fibonacci retracement) region, with a move above the 1.1070 (23.6% Fibonacci retracement) to 1.1090 (38.2% Fibonacci extension) area bringing the 1.1270 (50% Fibonacci extension) to 1.1280 (61.8% Fibonacci retracement) zone back on the radar.

Additional Market Outlooks

AUD/USD Post-RBA Weakness Brings Test of July Low

Japanese Yen Forecast: Post-BoJ Rebound Keeps USD/JPY Above July Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong