US Dollar Outlook: EUR/USD

EUR/USD bounces along the 50-Day SMA (1.0829) as it attempts to retrace the decline following the 303K rise in US Non-Farm Payrolls (NFP), but the exchange rate may give back the advance from the monthly low (1.0725) as it snaps the series of higher highs and lows from earlier this week.

EUR/USD Bounces Along 50-Day SMA amid Post-NFP Rebound

EUR/USD may track the negative slope in the moving average if it struggles to hold the indicator, and developments coming out of the US may continue to sway the exchange rate as the Federal Reserve still forecasts a less restrictive policy in 2024.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

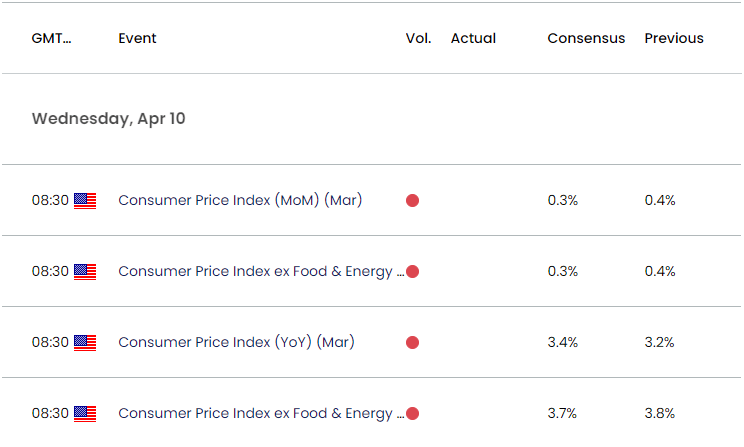

US Economic Calendar

However, the update to US Consumer Price Index (CPI) may keep the Federal Open Market Committee (FOMC) on the sidelines if the report reveals persistent inflation, and evidence of sticky price growth may generate a bullish reaction in the Greenback as it puts pressure on the Fed to keep US interest rates higher for longer.

At the same time, a lower-than-expected CPI print may produce headwind for the US Dollar as it encourages Chairman Jerome Powell and Co. to implement lower interest rates, and EUR/USD may face increased volatility ahead of the European Central Bank (ECB) interest rate decision on April 11 as the FOMC pursues a data dependent approach in managing monetary policy.

With that said, the failed attempt to test the February low (1.0695) may keep EUR/USD within a defined range, but the exchange rate may struggle to retain the advance from the monthly low (1.0725) as it snaps the series of higher highs and lows from earlier this week.

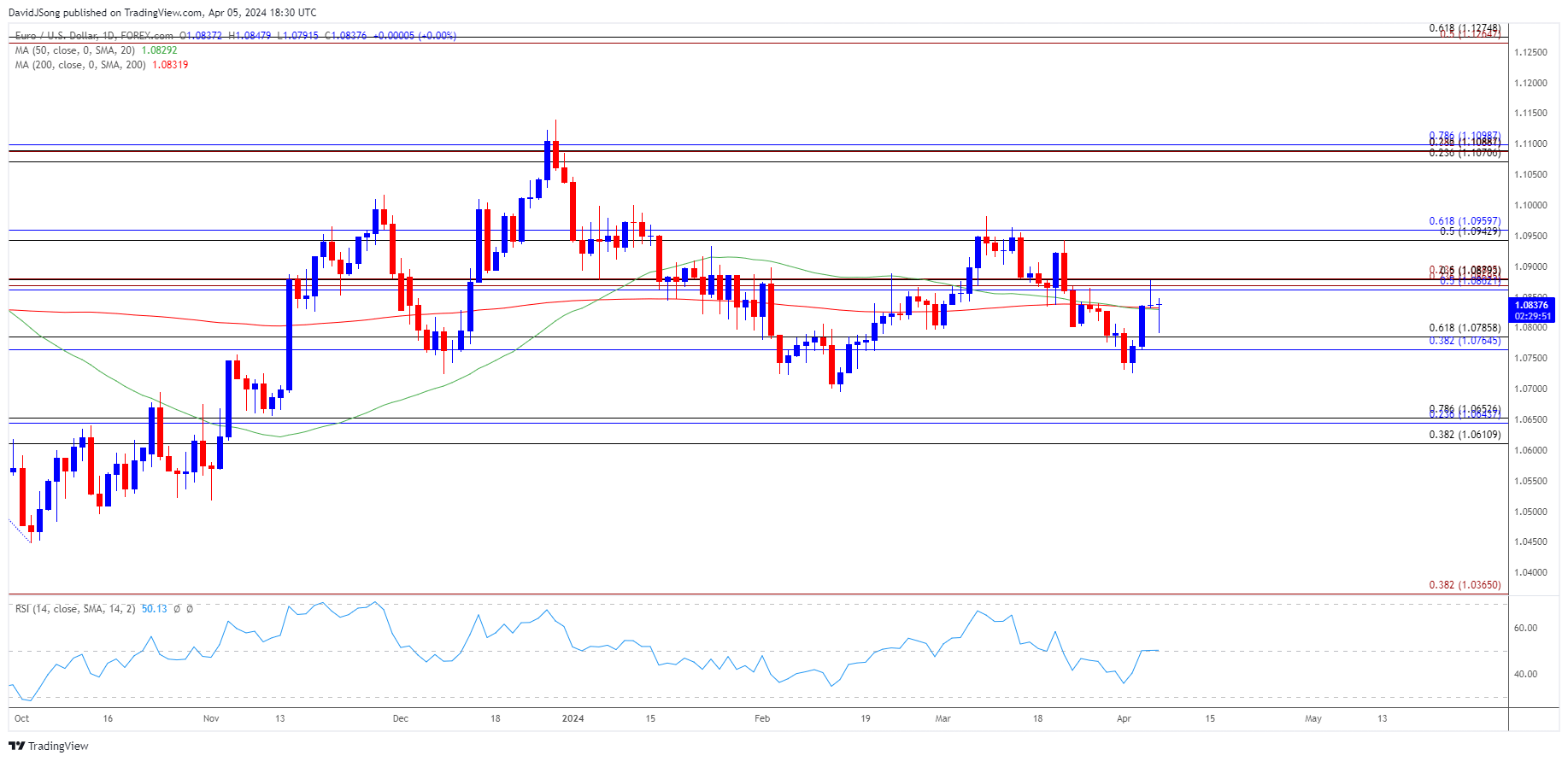

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD appears to have reversed ahead of the February low (1.0695) as it trades back above the 50-Day SMA (1.0829), with a break/close above the 1.0860 (50% Fibonacci retracement) to 1.0880 (23.6% Fibonacci extension) region raising the scope for a move towards the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) area.

- Next region of interest comes in around the March high (1.0981), but EUR/USD may track the negative slope in the moving average as it snaps the series of higher highs and lows from earlier this week.

- Lack of momentum to hold above the indicator may push EUR/USD back towards the 1.0770 (38.2% Fibonacci retracement) to 1.0790 (61.8% Fibonacci retracement) region, with a breach below the monthly low (1.0725) bringing the February low (1.0695) back on the radar.

Additional Market Outlooks

US Dollar Forecast: USD/CAD Selloff Eyes March Low

US Dollar Forecast: AUD/USD Attempts to Defend March Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong