Euro, EUR/USD Talking Points:

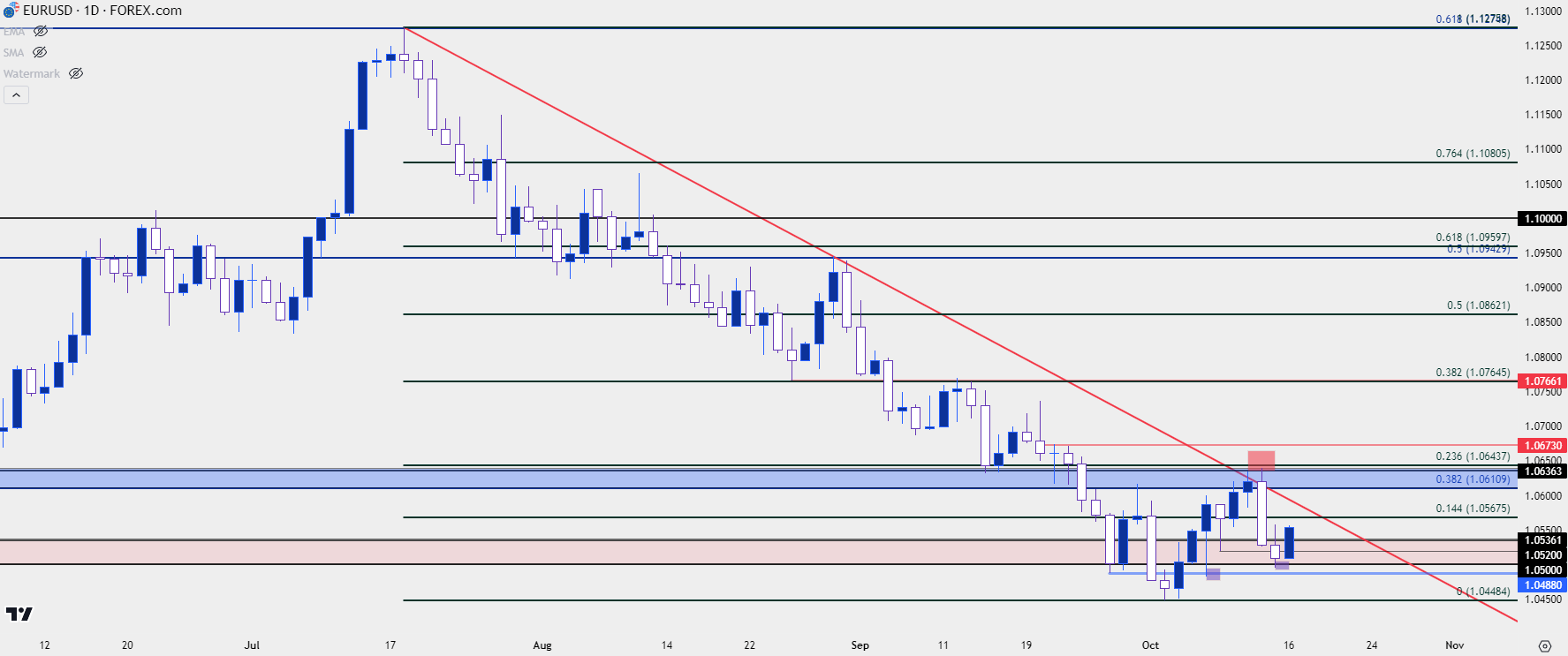

- EUR/USD began to test the 1.0500 psychological level three weeks ago but so far, has not been able to leave that price behind.

- The bearish trend in EUR/USD began in mid-July and this led to a record 11 consecutive weekly declines, which brought in that eventual test of the 1.0500 psychological level. Since then, however, bears have had challenge in holding trends, particularly below the big figure.

- Last week saw a strong response from a key spot of resistance, but that has so far led into another higher-low with support showing at the 1.0500 psychological level. This keeps the door open for pullback potential in the pair.

- This was also a big theme in the Tuesday webinar, and I’ll be talking about this again next Tuesday. To sign up: Click here to register.

Timing trends can be challenging. While the trend itself can be very obviously displayed on the chart, the concern soon comes in that the market may be stretched into either oversold or overbought conditions. And while that doesn’t necessarily preclude continuation, it does create complication and it can soon create a hindrance for traders looking to drive that trend into to fresh highs or lows.

Psychological levels can be a point of interest in such matters. Take EUR/USD in the summer of 2022, for instance. At the time the FOMC was hiking rates and until July, the ECB had stood pat. That allowed for a clean one-sided move to develop in EUR/USD, until price eventually started to test the 1.0000 parity level. The first test began on Tuesday July 12th, with a second on Wednesday July 13th. For both days the 1.0000 level set the lows but bears finally went for it on that Thursday July 14th. Sellers couldn’t hold the move, however, and prices soon began to reverse. A few weeks later and EUR/USD was testing resistance at prior support around 1.0369. That resistance helped to bring bears back into the mix after which they could finally take out the parity level, but the ultimate breakdown below the big figure didn’t happen until more than a month after the initial test.

While the 1.0500 level isn’t usually considered to be as rounded of a level as parity, both can stifle trends or at the very least produce a pause point. I talked about this in the webinar regarding EUR/USD a couple of weeks ago, and since then we’ve seen the pair put in two higher lows on the daily chart which begs the question as to whether a deeper pullback in the bearish trend is on the cards.

On NFP Friday, sellers were able to penetrate the 1.0500 handle, albeit barely. And that’s when a higher-low showed at 1.0488. And then last Friday, sellers weren’t even able to drive below 1.0500, which illustrates some level of defense of the big figure.

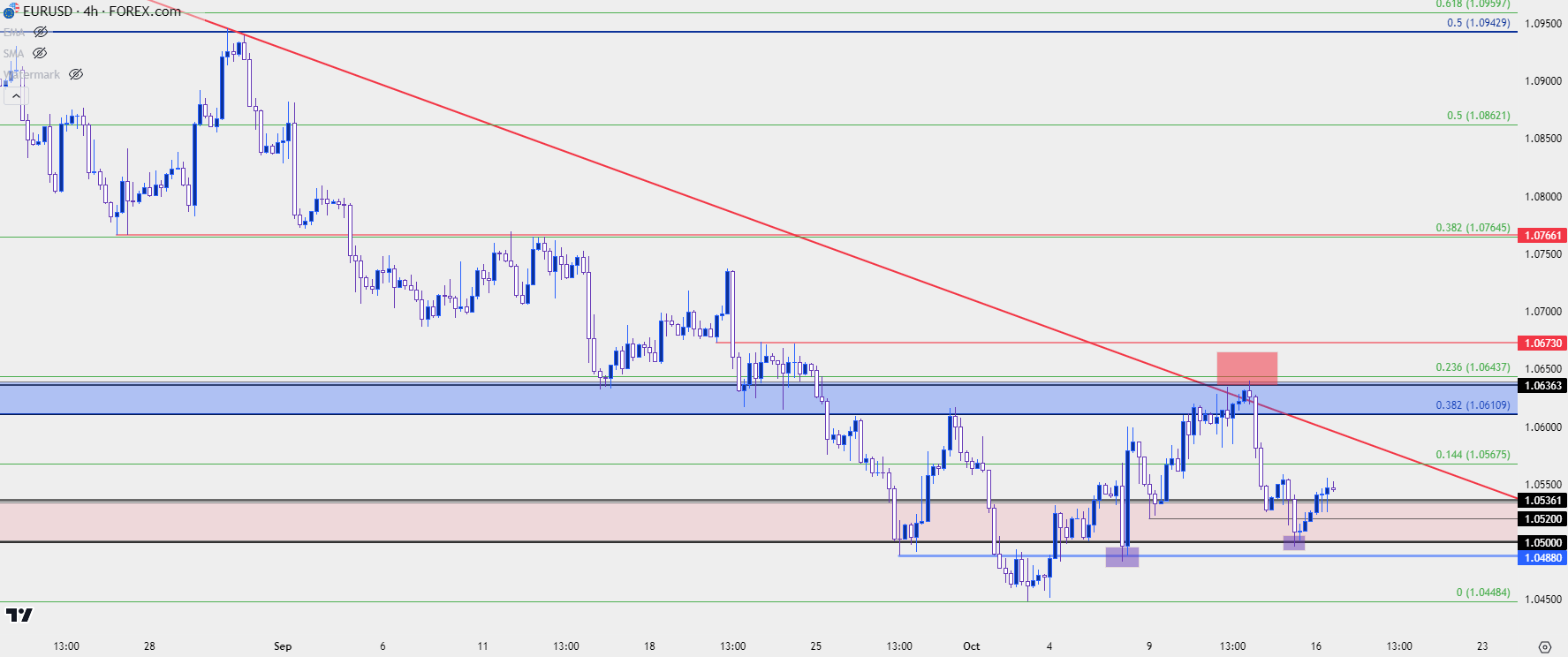

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

EUR/USD Pullback in the Bearish Run

The setup showing in EUR/USD isn’t unique. We had a similar backdrop last week, where the pair had set a higher-low around NFP as selling pressure dried up below the 1.0500 handle.

That led to a clean bullish run until resistance finally showed at a confluent spot on the chart. The 1.0636 level has some historical importance as this was the low during the pandemonium of the pandemic, and it came back into play this May 31st as it helped to set the low in the pair. The response in late-May led to a strong run in June that ran through the July open, and that’s when EUR/USD found resistance at the 61.8% retracement of the 2021-2022 major move at 1.1275.

Since then, both the 50% mark and the 38.2% spot of that same Fibonacci retracement have been in the picture. The 50% mark at 1.0943 helped to set the high in late-August. More recently, it’s the 38.2% retracement that’s been in the picture at 1.0611.

Collectively, those two prices help to set up a resistance zone in the pair with 25 pips of range. The very top of that zone was in-play last Wednesday to help set the high and then Thursday saw a strong response from that level with sellers pushing down for another 1.0500 re-test.

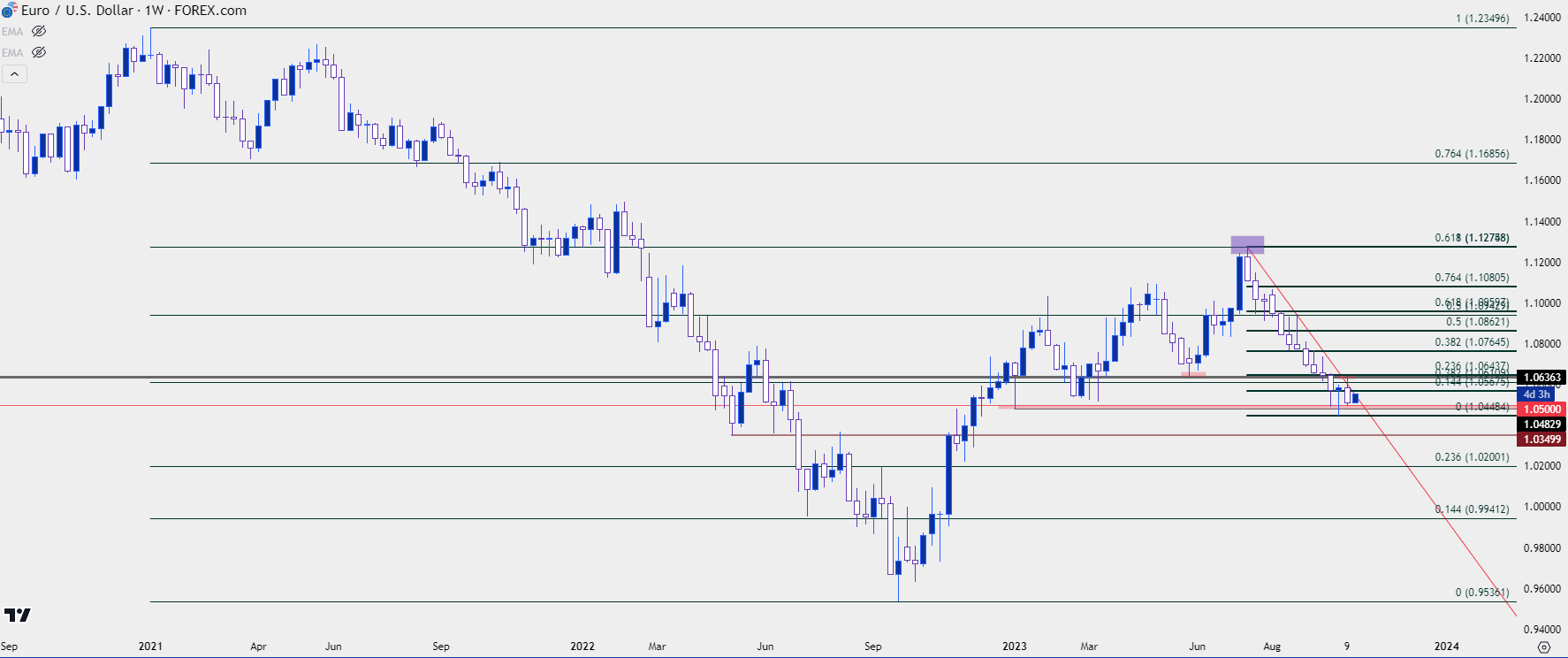

EUR/USD Weekly Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

EUR/USD Bigger Picture

At this point the chief concern from longer time frames is the fact that the bearish trend in EUR/USD remains somewhat stretched. Price action hasn’t even been able to muster a 23.6% retracement of the bearish trend that started in July, and this raises concerns of a still-crowded trade.

Sellers showed optimism, and a degree of aggression last week when holding the lower-high right at 1.0636, so bearish potential does remain. But the fact that bears were unable to drive below 1.0500 and, instead, left a higher-low on the chart, indicates that sellers may not yet be ready to evoke that lasting push below the 1.0500 handle.

This keeps the door open for deeper pullback potential in the pair and that same zone from 1.0611-1.0636 remains of interest. If sellers can hold a lower-high upon a re-test, and then make another push back towards 1.0500, there could be breakdown potential at that point as there’d be another item of anticipation from bears. If they can’t hold a lower-high, however, the pullback could stretch up to resistance at 1.0673.

Above that is a big level around the 1.0750 psychological level, where the 38.2% Fibonacci retracement of the recent bearish trend rests at 1.0765. This is also a spot of support-turned-resistance, so if this comes back into play, particularly over this week, that becomes an item of interest for bears looking to push continuation themes.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

--- written by James Stanley, Senior Strategist