Asian Indices:

- Australia's ASX 200 index fell by -10.7 points (-0.15%) and currently trades at 7,225.20

- Japan's Nikkei 225 index has risen by 125.32 points (0.45%) and currently trades at 27,807.70

- Hong Kong's Hang Seng index has risen by 15.86 points (0.07%) and currently trades at 23,674.78

- China's A50 Index has risen by 25.73 points (0.17%) and currently trades at 15,427.97

UK and Europe:

- UK's FTSE 100 futures are currently down -78.5 points (-1.09%), the cash market is currently estimated to open at 7,090.18

- Euro STOXX 50 futures are currently down -58.5 points (-1.4%), the cash market is currently estimated to open at 4,120.65

- Germany's DAX futures are currently down -195 points (-1.26%), the cash market is currently estimated to open at 15,277.67

US Futures:

- DJI futures are currently down -461.68 points (-1.34%)

- S&P 500 futures are currently up 76.25 points (0.48%)

- Nasdaq 100 futures are currently up 26.25 points (0.58%)

US futures markets have opened higher with S&P and Nasdaq E-mini futures up around 0.6%. The S& 500 and Dow Jones futures perfectly respected their 200-day eMA’s yesterday whilst the Nasdaq held above its 50-day.

Turkish lira hits new lows

Not satisfied with culling central bankers, President Erdogan’s ire has moved over to the Finance Minister – who was given his carboard box to collect his things, less than 12-months on the job. His mistake? He opposed rate cuts, just as the former central bankers did. SO we assume he knew what was coming when he did. The Turkish lira was already at record lows, yet his latest move sent it weaker still.

Top military officials between China and US to meet

The Xi-Biden virtual summit is the reason that top military officials between the two super powers are under orders to meet. The format is yet to be agreed upon, although telephone or video call are the two primary candidates. At a time when tensions over Taiwan continue to rise whilst both sides are in a race over the world’s most powerful hypersonic weapons, the meeting provides a glimmer of hope that tensions to thaw somewhat

OPEC+ in focus around covid concerns

It’s not all that clear that OPEC will continue to increase their oil supply by 400k barrels per day in January, as they have been since August now covid is on the scene. With prices falling and oil demand dented with covid they may decide to halt increases. But if they really wanted to support (or lift prices) then they could come out with a cut. Whilst a cut is not expected, it would likely provoke the more volatile reaction out of the three scenarios and appease bulls.

WTI is trading around 66.44 and has shows the potential for a double bottom around Wednesday’s low. Also take note that yesterday was an inside candle so there is clearly a hesitancy to drive prices lower immediately, and a surprise oil cut could easily propel oil prices from its lows.

GBP/AUD grinds higher

Whilst there has been some choppy trading around recent highs, the daily trend structure on GBP/AUD remains bullish. We like how yesterday’s bullish hammer closed back above the October high and its low remained well above the elongated candle on Friday, which shows demand for the pair is rising. Overnight trade has been it break above yesterday’ high

Whilst there has been some choppy trading around recent highs, the daily trend structure on GBP/AUD remains bullish. We like how yesterday’s bullish hammer closed back above the October high and its low remained well above the elongated candle on Friday, which shows demand for the pair is rising. Overnight trade has been it break above yesterday’ high

USD pullback complete?

Elsewhere for currencies the US dollar index is trying to hold above 95.50. Tuesday’s volatile (and bearish candle) perfectly respected the monthly pivot and weekly S1 pivot, then yesterday formed a small bullish inside day / hammer which shows bearish momentum is waning. Yet before go all-out bull, take note of resistance around 96.25 (monthly pivot) and 96.43 (daily low of the record high) which may cap upside potential over the near-term.

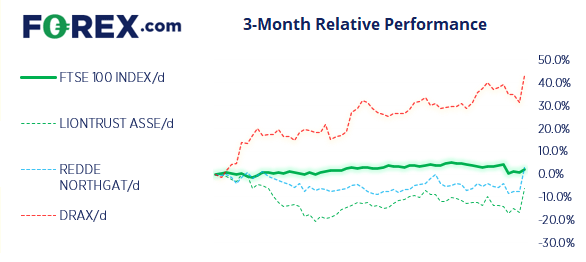

FTSE 350: Market Internals

FTSE 350: 4108.89 (1.55%) 01 December 2021

- 313 (89.17%) stocks advanced and 32 (9.12%) declined

- 4 stocks rose to a new 52-week high, 5 fell to new lows

- 49.57% of stocks closed above their 200-day average

- 42.74% of stocks closed above their 50-day average

- 6.84% of stocks closed above their 20-day average

Outperformers:

- + 12.47%-Liontrust Asset Management PLC(LIO.L)

- + 11.01%-Redde Northgate PLC(REDD.L)

- + 9.27%-Drax Group PLC(DRX.L)

Underperformers:

- -3.12%-Ocado Group PLC(OCDO.L)

- -2.96%-Croda International PLC(CRDA.L)

- -2.54%-Endeavour Mining PLC(EDV.L)

Up Next (Times in BST)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.