- Japan comes out swinging with record stimulus package

- The Fed chair decision is on the horizon

- UK retail sales to continue losing steam?

- GBP rally pauses for breath

- Potential bear-flag on GBP/CHF

Asian Indices:

- Australia's ASX 200 index rose by 17.3 points (0.23%) and currently trades at 7,396.50

- Japan's Nikkei 225 index has risen by 161.35 points (0.55%) and currently trades at 29,761.18

- Hong Kong's Hang Seng index has fallen by -444.82 points (-1.76%) and currently trades at 24,874.90

- China's A50 Index has risen by 57.65 points (0.37%) and currently trades at 15,473.07

UK and Europe:

- UK's FTSE 100 futures are currently up 28.5 points (0.39%), the cash market is currently estimated to open at 7,284.46

- Euro STOXX 50 futures are currently up 17.5 points (0.4%), the cash market is currently estimated to open at 4,401.20

- Germany's DAX futures are currently up 64 points (0.39%), the cash market is currently estimated to open at 16,285.73

US Futures:

- DJI futures are currently down -60.1 points (-0.17%)

- S&P 500 futures are currently up 88 points (0.53%)

- Nasdaq 100 futures are currently up 18 points (0.38%)

Japan comes out swinging with record stimulus package

The Prime Minister of Japan Fumio Kishida announced a ¥56 trillion stimulus package to fight the economic devastation form the COVID-19 pandemic. In US dollar terms this is just shy of half a trillion dollars ($500 billion) and 60% above earlier estimates. A budget to fund the mammoth package will be announced by year-end. Taking it within its stride the Nikkei was up 0.4%.

The Fed chair decision is on the horizon

Late on Tuesday, President Biden said that he expects his decision on who will chair the Fed to be announced “in about four day”. Assuming that means between three to five days, we could have an answer today or by Saturday latest. As we discussed in our preview, both candidates are doves which plays well in the governments eyes. But out of the two markets deem Brainard to be the more dovish, and that is why markets are increasingly favouring the potential for the second female to grace the position in the Fed’s history.

UK retail sales to continue losing steam?

UK retail sales is scheduled for 07:00 GMT, and it has been one of the weaker data sets of late in the UK. And that’s of no great surprise considering the grand reopening has long gone, and retail prices (along with inflation) are through the roof by historical standards. At 6% y/y the retail prices index is at its highest level since 1992 and energy costs have continued to pinch. And with Black Friday and Christmas ahead of us it may make sense for consumers to hold off a little this month, but then we had the same logic with the US consumer who seemingly went on a spending spree in October anyway.

Canadian retail sales are scheduled for 13:30, but with the BOC reminding markets that any rate hike in the ‘middle quarters’ of next year doesn’t necessarily mean it would be Q2 2020, it would take a particularly strong sales set to revive hopes of an earlier hike.

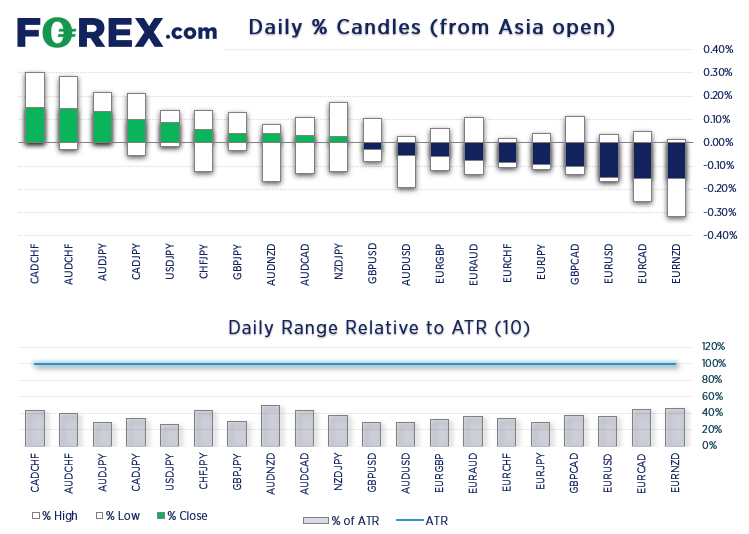

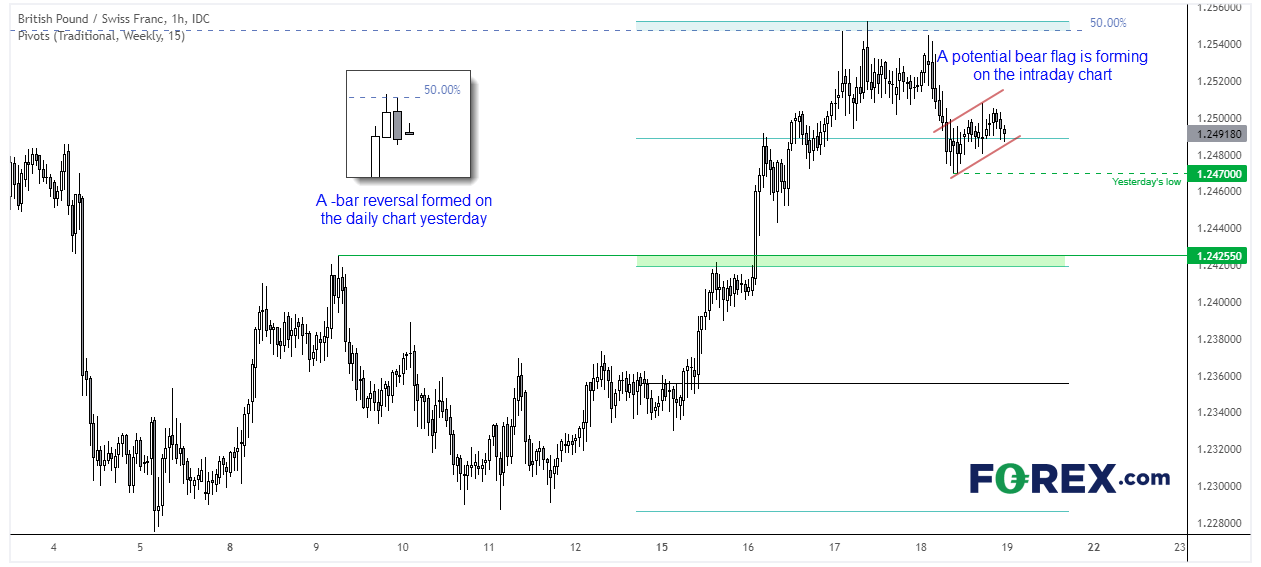

GBP rally pauses for breath, potential bear-flag on GBP/CHF

We noted in yesterday’s report that several pound pairs were looking stretched and in need of a pause or retracement. GBP/AUD paused at trend resistance of its bearish channel, GBP/USD formed an indecision candle whilst GBP/CHF formed a 2-bar reversal at a 50% retracement level.

We can see on the one-hour chart that a potential bearish flag is forming. Yesterday’s high met resistance at the weekly R2 pivot and prices are now trading around R1. There is still the potential for the flag to form and prices creep up the lower trendline, but we’re looking for momentum to show an obvious sign it has realigned with the bearish reversal candle of yesterday. Traders could either consider a break or close of the lower flag trendline or wait for a break of yesterday’s low for extra confirmation.

The FTSE has closed lower for three consecutive sessions

The FTSE 100 has closed lower for three consecutive days and it is over -2% lower from Friday’s high. Given we suspect the pound’s rally has seen its high for the week, this leaves a little wriggle room for the FTSE to lift itself from its lows. Still, we’d want to see a break above 7270 before becoming too confident of a noteworthy bounce, and whilst prices remains below this resistance level then it leaves scope for another leg lower.

FTSE 350: 4171.04 (-0.48%) 18 November 2021

- 211 (60.11%) stocks advanced and 125 (35.61%) declined

- 17 stocks rose to a new 52-week high, 5 fell to new lows

- 59.54% of stocks closed above their 200-day average

- 73.79% of stocks closed above their 50-day average

- 22.22% of stocks closed above their 20-day average

Outperformers:

- + 9.75%-Royal Mail PLC(RMG.L)

- + 5.36%-Watches of Switzerland Group PLC(WOSG.L)

- + 5.15%-Crest Nicholson Holdings PLC(CRST.L)

Underperformers:

- -9.24%-Biffa PLC(BIFF.L)

- -7.15%-Rotork PLC(ROR.L)

- -5.94%-Petropavlovsk PLC(POG.L)

Up Next (Times in BST)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.