Asian Indices:

- Australia's ASX 200 index fell by -90.5 points (-1.25%) and currently trades at 7,162.70

- Japan's Nikkei 225 index has fallen by -580.27 points (-1.74%) and currently trades at 32,758.43

- Hong Kong's Hang Seng index has fallen by -567.33 points (-2.97%) and currently trades at 18,543.05

- China's A50 Index has fallen by -88.93 points (-0.71%) and currently trades at 12,501.14

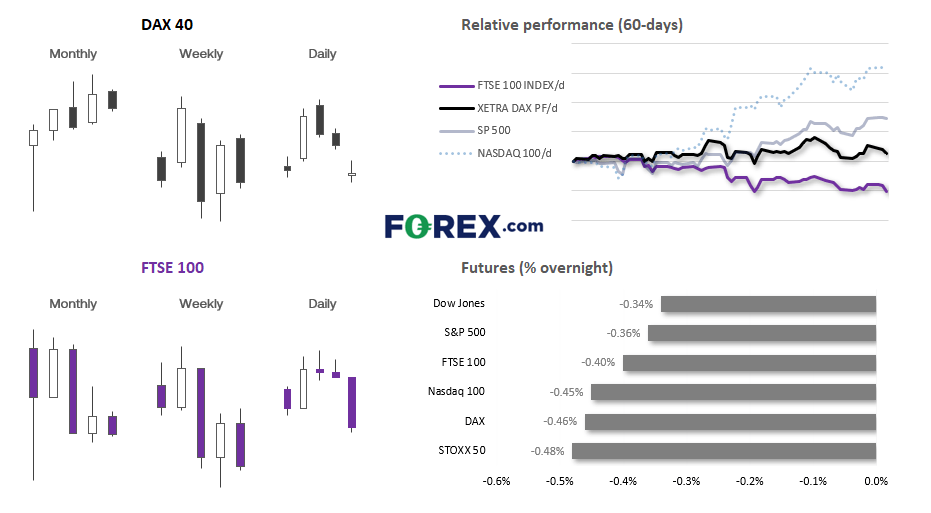

UK and Europe:

- UK's FTSE 100 futures are currently down -29 points (-0.39%), the cash market is currently estimated to open at 7,413.10

- Euro STOXX 50 futures are currently down -20 points (-0.46%), the cash market is currently estimated to open at 4,330.71

- Germany's DAX futures are currently down -71 points (-0.44%), the cash market is currently estimated to open at 15,866.58

US Futures:

- DJI futures are currently down -115 points (-0.33%)

- S&P 500 futures are currently down -15.75 points (-0.35%)

- Nasdaq 100 futures are currently down -68.25 points (-0.44%)

US-Sino relations continue to sour

Sentiment soured for equity bulls at the Asian open, as Sino-US relations took another step backwards and investors adjusted to the fact that the Fed remain more hawkish than hoped. The Fed’s decision to pause was not actually unanimous and most members are up for further hikes, so this could cap upside over the near-term. That said, US futures are holding higher and we’ve seen Asian indices close their opening gaps, so it seems to be more of a bump in the road as opposed to blood on the streets. We expect cautions trading from here ahead of the ISM services report overnight and US employment data, ahead of tomorrow’s Nonfarm payroll report.

US PMIs and employment data in focus

With US manufacturing data deteriorating further this week, we could see the US dollar hand bac some gains if today’s services PMIs also falter. S&P global release their service PMI at 13:45 and is expected to pull back to a 53 from 54.3. However, the ISM non-manufacturing survey is likely to gain the most attention to see if it falls below 50 to denote contraction, having come close last month with a print of just 50.3. With new orders also trending lower, a contraction today is very possible. Whilst this points to a weaker economy, I would not be surprised to see Wall Street celebrate as indices seem to like data which points towards a less-hawkish Fed. It could also weigh on the dollar as traders scale back some of yesterday’s hawkish bets.

Of course, if we’re to be treated with strong US employment data alongside better-than-expected PMI data, the US dollar might rip higher as fresh bets are placed for another couple of Fed hikes.

Hawkish FOMC minutes helped the US dollar continue to strengthen against most FX majors overnight, although a combination of softer PMI data from China and a step backwards for US-Sino relations saw the Japanese yen as the stronger FX major overnight. China has warned the US that its decision to curb key metals exports for microchips is “just the start”, just days ahead of Treasury Secretary Yellen’s visit to China.

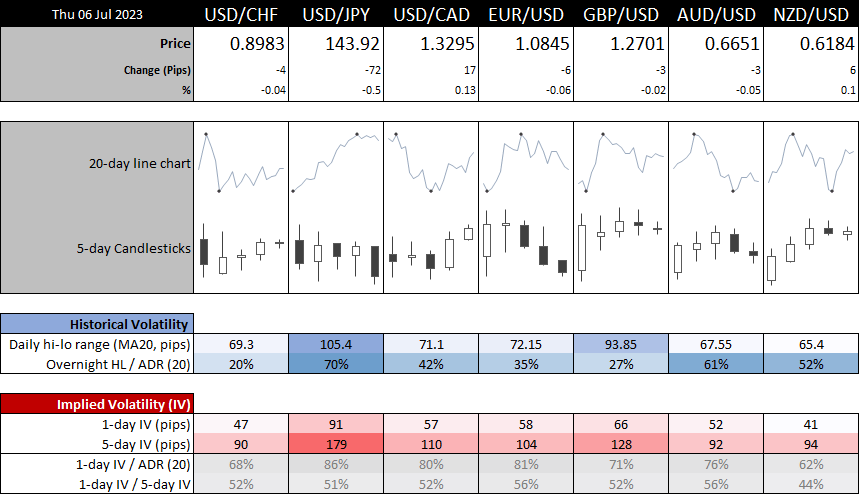

USD/CHF is drifting up to the top of its three-week range and is just 10-pips from the 0.90 handle, which could leave the potential for some mean reversion lower (assuming the range holds) or have traders on guard for a bullish breakout.

Gold has pulled back from yesterday’s lows after printing a bearish engulfing / outside day. Fresh rate-hike bets could weigh on gold, and we’re waiting to see if it finds resistance within yesterday’s range for a potential swing-trade short. Potential intraday resistance levels include the 1919.89 low, 1922.46 (38.2% Fibonacci retracement) and 1923.86 (volume cluster).

WTI crude oil rose above Monday’s bearish hammer high to invalidate yesterday’s near-term, bearish bias. Yet with resistance clusters around the 72 and 73 handles, weak China data and increased bearish exposure for large speculators, we prefer to maintain range-trading strategies unless there’s a compelling reason for large shorts to exit and create a bullish breakout.

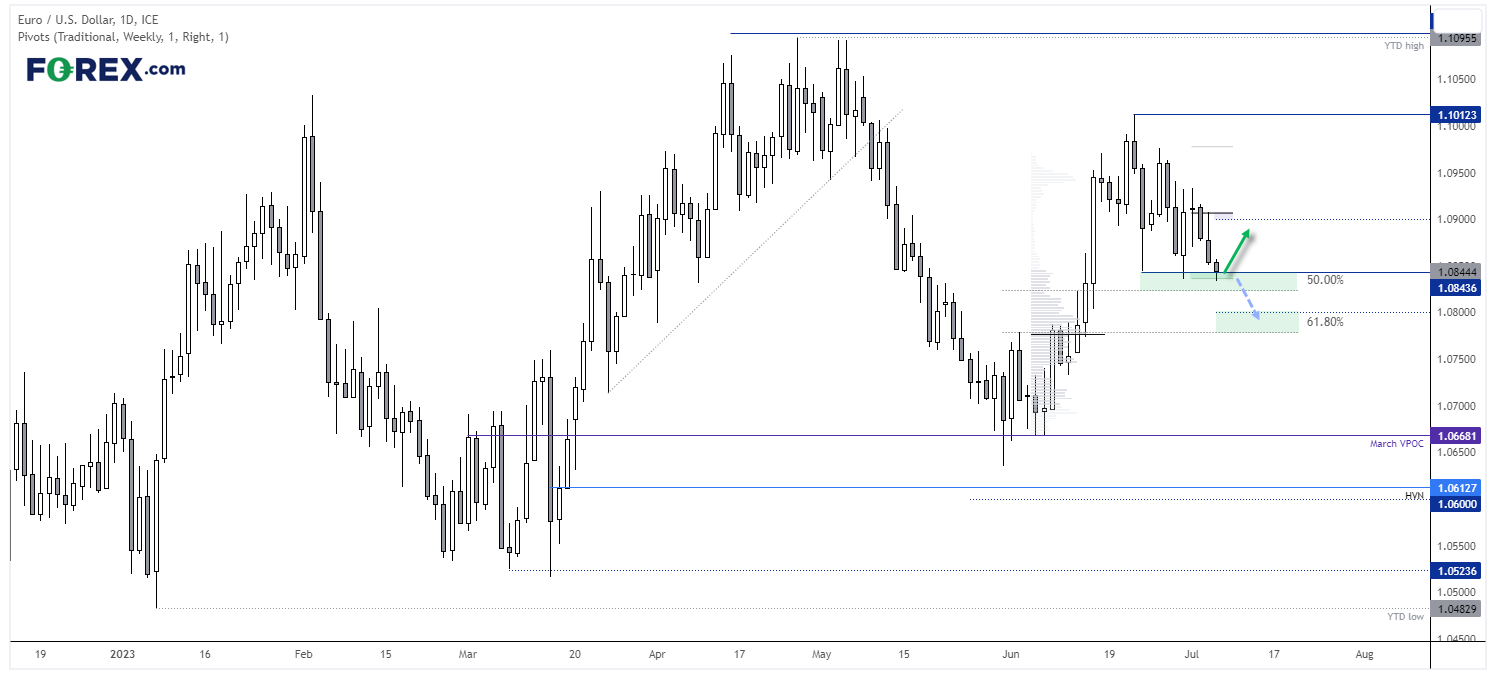

EUR/USD daily chart:

EUR/USD is trading below 1.0850 but managing to hold above last week’s low (just about). Whilst RSI (2) is within the oversold level, we’d need to wait for the daily close to confirm. But the lack of bearish follow-through during the Asian session suggests it may at least try to post a minor rebound. Who knows, if Germany’s PMI data is upwardly revised whilst US data sinks, perhaps it could have the legs to retest 1.0900 (although that seems unlikely given the lower levels of volatility). If data is to be stacked the other way, 1.0800 is the next major support level, although the reward to risk for bears is unfavourable with the 50% retracement line at 1.0825.

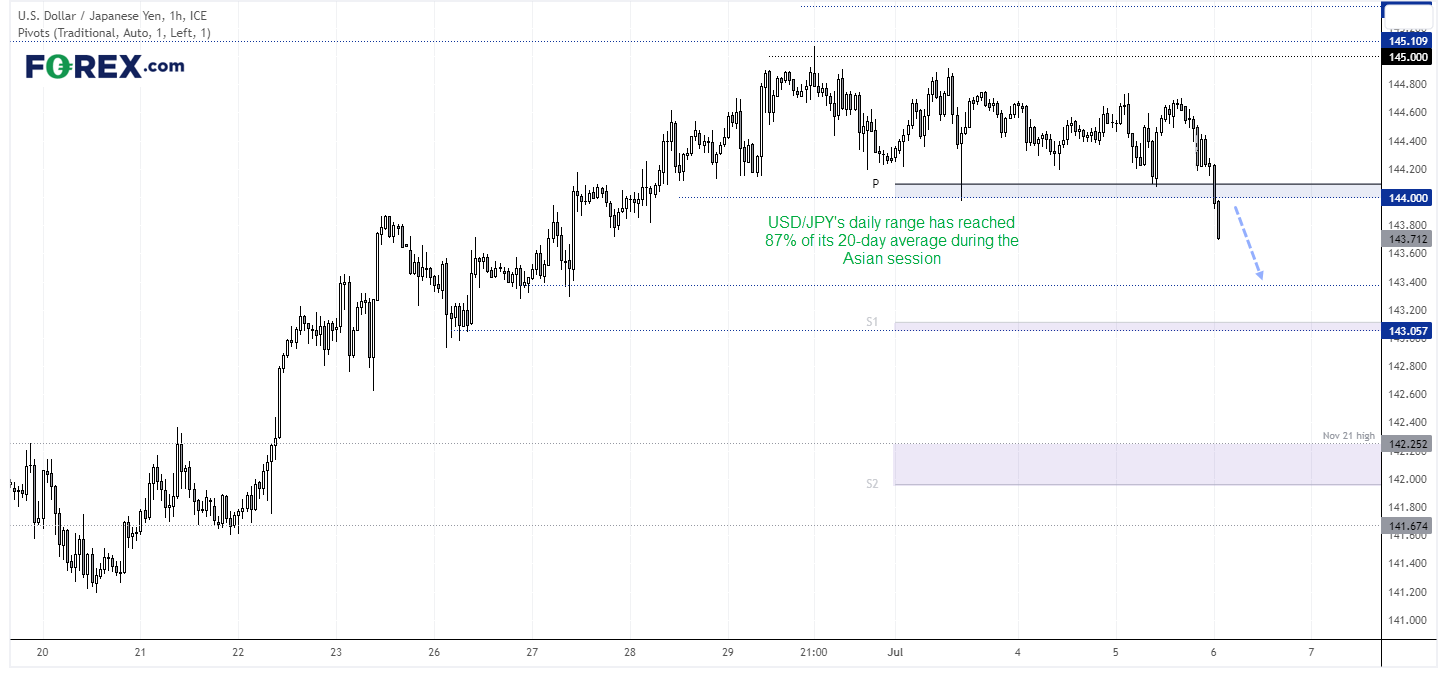

USD/JPY 1-hour chart:

USD/JPY has broken below the 144 handle after effectively falling since the Tokyo open, and has already used 87% of its 20-day ADR (average daily range). Yet the 1 and 5-day implied volatility remains below average, although that could change if today’s data diverges enough away from expectations.

Whilst momentum clearly points lower, bears may wat to wait for a retracement before seeking shorts. Besides, the London open is notorious for volatile shakeouts so perhaps we’ll see a technically-driven retracement higher. IN which case, bears could potential seek a lower-volatility entrance below resistance. A move towards 143.40 / 143 is favoured, but we’d prefer to avoid entering near cycle lows if possible.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge