- Euro to US dollar forecast: EUR/USD traders await key US data

- PPI and FOMC minutes due on Wednesday, CPI on Thursday and Consumer Sentiment on Friday

- EUR/USD technical analysis shows bullish case improving

The EUR/USD has now turned positive on the week following a weaker start. The fact that global bond yields are lower, and gold higher, may be indication of risk aversion remaining the key theme amid raised geopolitical risks. However, this has not been reflected in equity markets, with the major indices continuing to recover nicely. So, you have got to wonder what really is pushing yields lower. Is it haven flows into government bonds, or a case of peak interest rates being fully priced in now. I think it is the latter.

Euro to US dollar forecast: EUR/USD traders await key US data

Indeed, there is a possibility that bond yields, and potentially the dollar, may be peaked, with the Fed’s hawkish repricing near completion. The stronger-than-expected US jobs report on Friday failed to deliver any more dollar strength and with the greenback falling further so far this week, the possibility that the dollar may have formed a top is undoubtedly something that many investors are wondering about. If we see a similar response to this week’s upcoming data, then this could further alleviate pressure on the EUR/USD and other major FX pairs.

We will have some key US data to look forward to this week, starting with PPI and FOMC meeting minutes today. CPI will be released on Thursday followed by UoM’s consumer sentiment survey.

Ahead of these data releases, we have seen the tone of the Fed change slightly, now a bit more dovish. This has raised further doubts over whether the Fed will hike interest rates again this year. Futures pricing suggesting that traders now see only a 30% chance of another rate hike this year.

German inflation confirmed at 4.5%

There were no major surprises with German CPI data, which was left unrevised at 4.5% YoY in September, down from 6.1% recorded in August. The weakening inflation data across the Eurozone supports the view that the ECB’s hiking is now done and dusted. But a rate cut is nowhere near in sight yet, meaning the ECB is likely to hold interest rates at 4.5% for an extended period of time, thereby providing a floor under the euro against some of the weaker currencies. However, that’s assuming that growth concerns won’t intensify too significantly to trigger a response from the ECB.

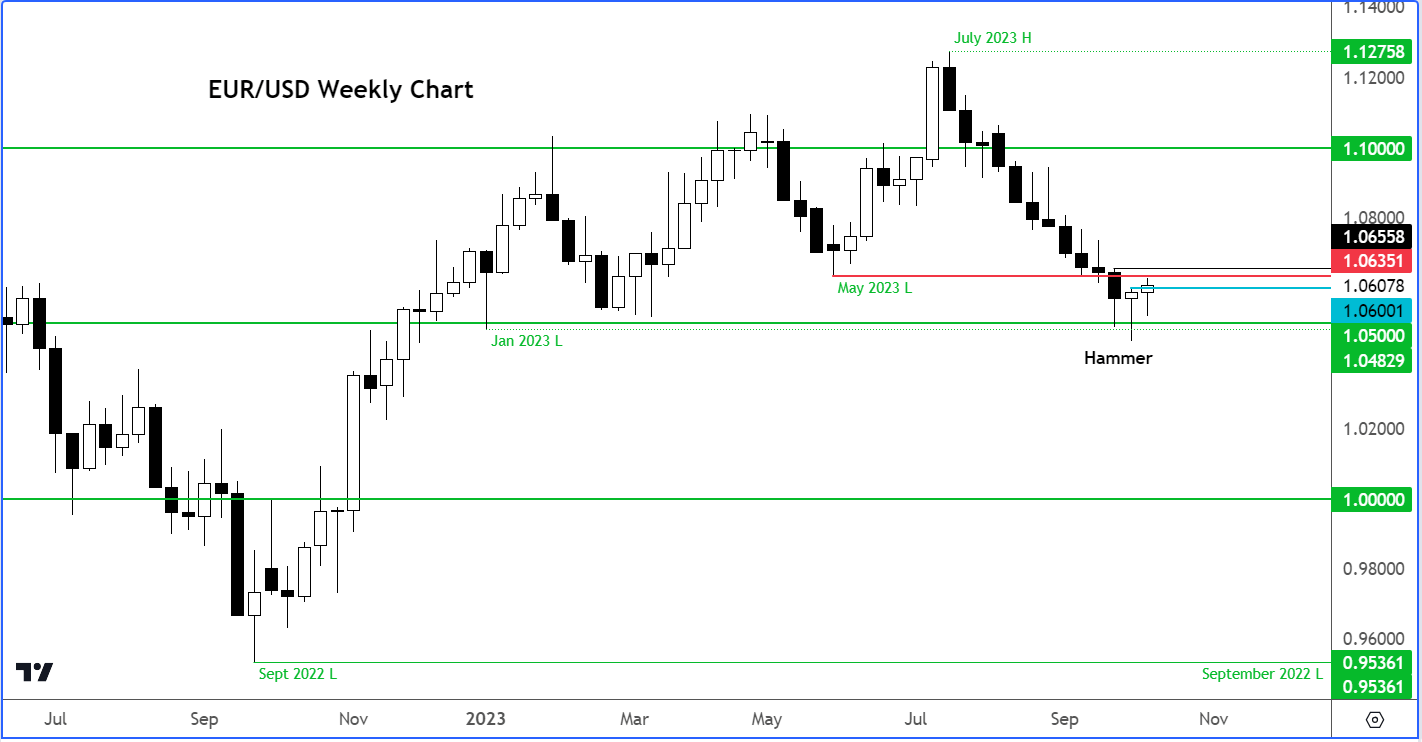

Euro to US dollar forecast: EUR/USD technical analysis

The EUR/USD formed a weekly hammer candle at key 1.05 support level las week. This was the clearest signal yet that rates may have formed a low. But after a weaker start, the EUR/USD has now turned positive on the week, rising above last week’s high of 1.0600. This could be the start of the upside follow-through the bulls are looking for. A break above 1.0655 would start to make this like a three-bar reversal pattern. So, there is the possibility we could see the bullish momentum accelerate as more and more levels start to break down.

But before we get too ahead of ourselves, the EUR/USD needs to establish a base and hold above the 1.06 handle. Failure to do so would raise the prospects of a move below 1.05 handle because it would indicate the bulls are trapped.

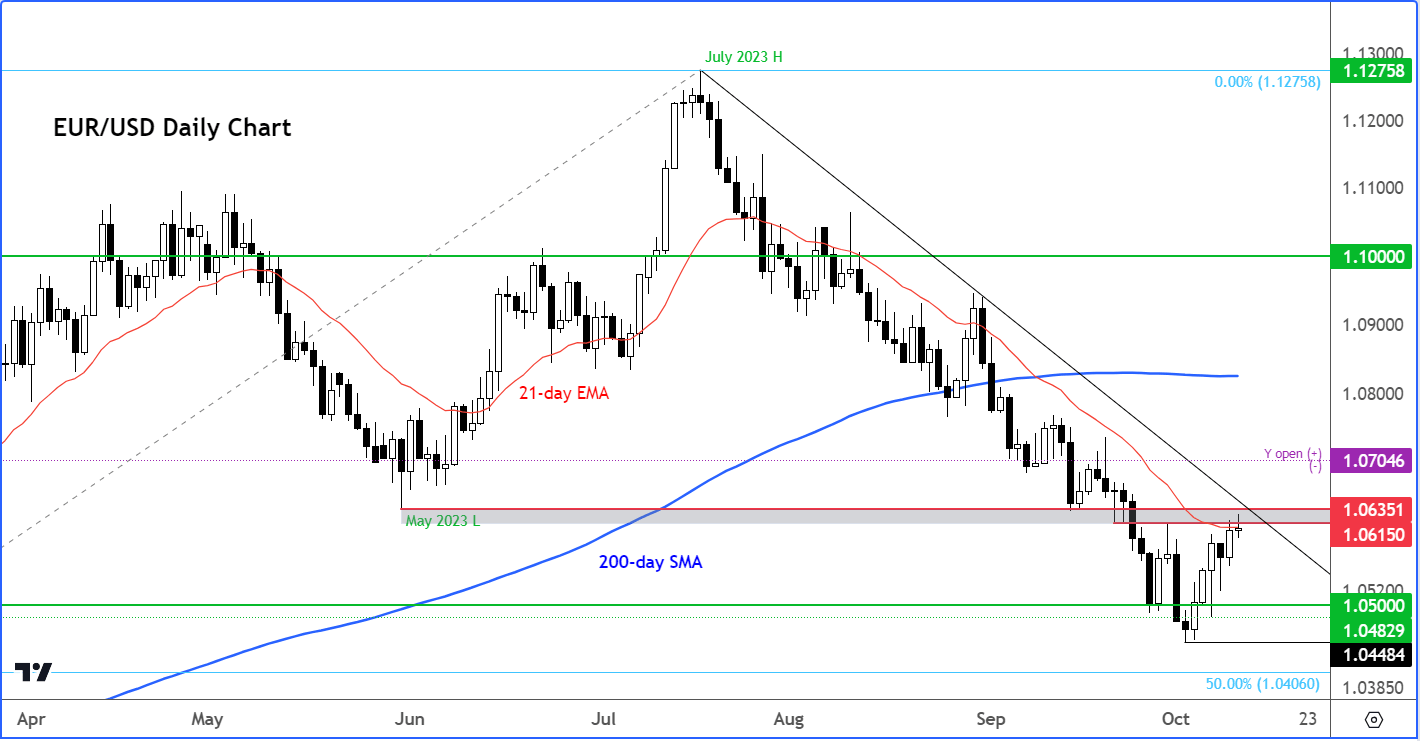

Zooming in to the daily chart, here we can see that that area between 1.0615 and 1.0635 was a key battle zone in the past few weeks. The 1.0635 level was also the low point hit in May. Here, we also have the 21-day exponential moving average converging, as well as the bearish trend line.

So, looking at the two charts, the area between 1.0600 and 1.0635 is massively important. If the bulls manage to reclaim this area, then it would be a positive outcome and would point to a potential low in the EUR/USD exchange rate.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

Source for all charts used in this article: TradingView.com