Euro, EUR/USD Talking Points:

- EUR/USD found support at a key Fibonacci level last month and since then a series of higher-highs and higher-lows have posted.

- The 200-day moving average came back into the picture last Friday after the NFP release and, so far, that’s held resistance. The big question now is whether bulls can hold the sequence of higher-lows.

- I’ll be discussing these themes in-depth in the weekly webinar. It’s free for all to register: Click here to register.

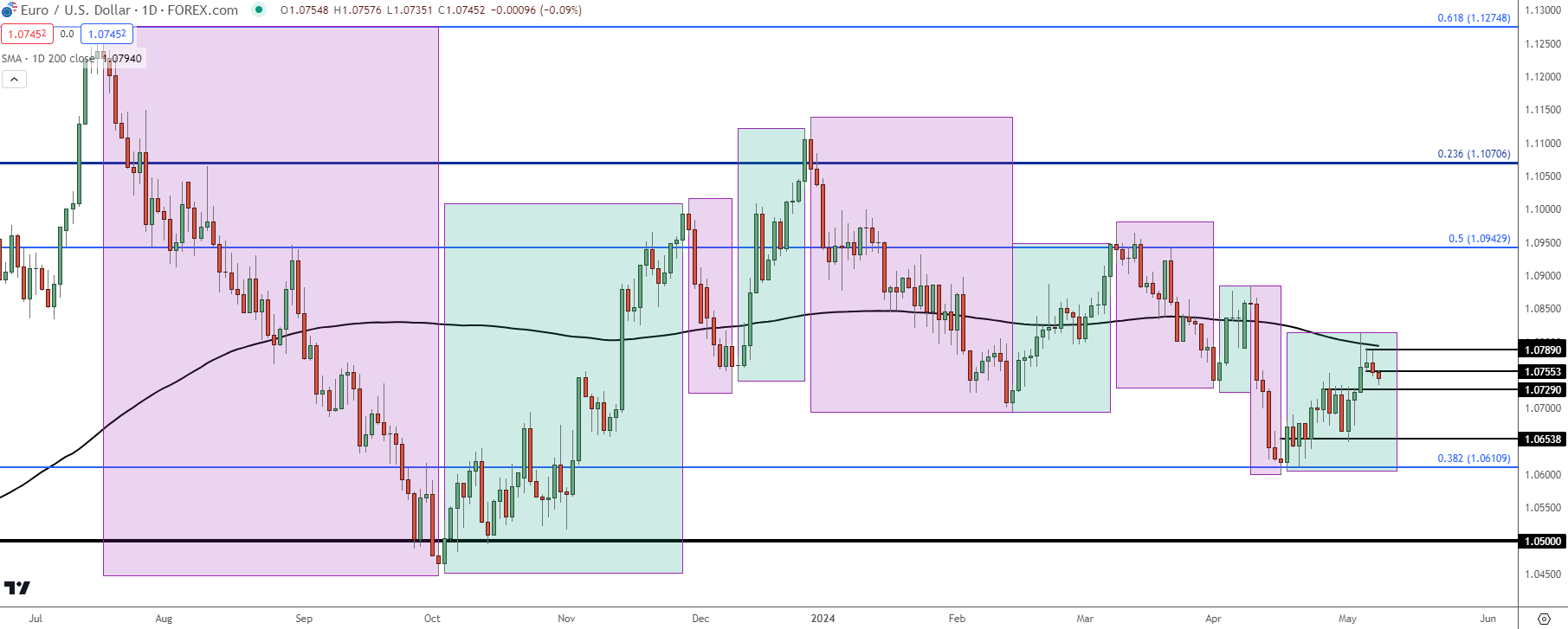

While EUR/USD has been range-bound for more than a year now, there have been several shorter-term trends to work with. And from the daily chart, we can see how those trends have shown in a relatively clean manner as driven by larger macro themes.

Since the Fibonacci support test at 1.0611 in April, bulls have been driving EUR/USD and this finally pushed into a re-test of the 200-day moving average last Friday after the Non-farm Payrolls report.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

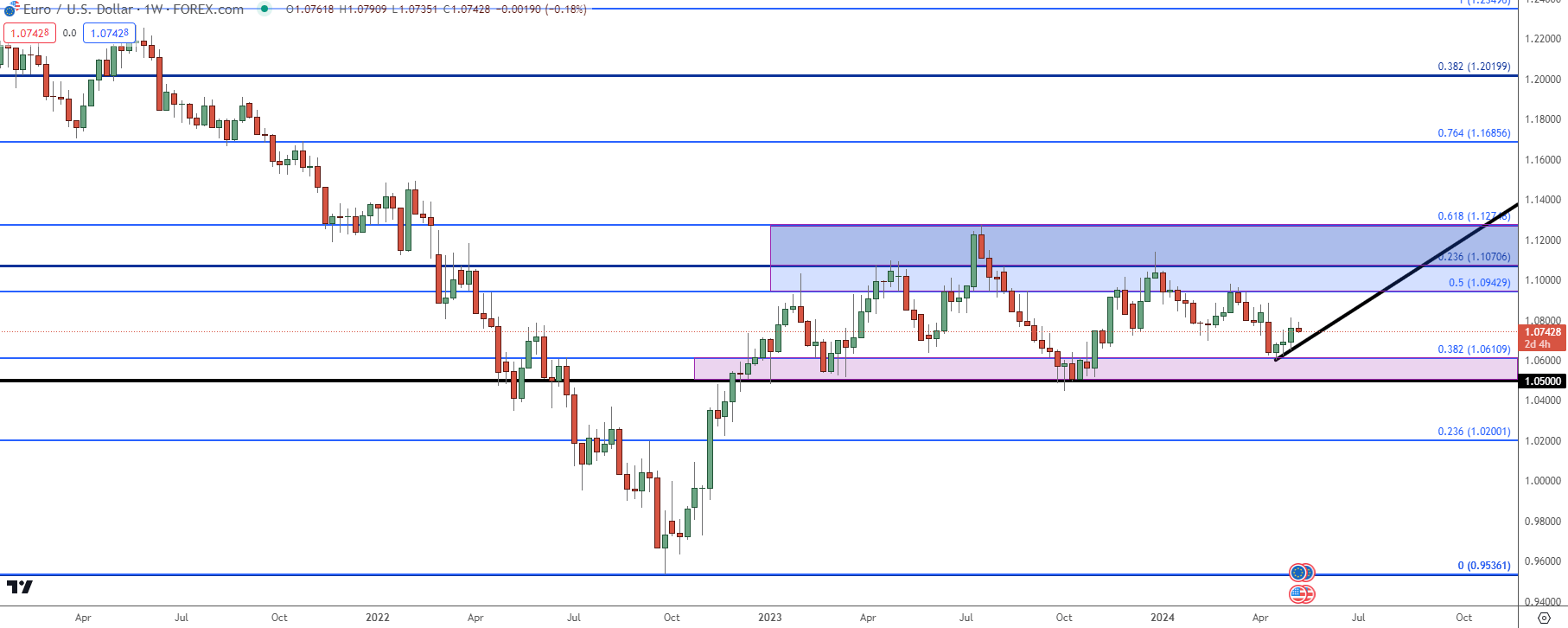

EUR/USD Bigger Picture

Referring to the range that’s been in-play since the 2023 open, we can see where there’s been a tendency for support to show around the area of the April low. That’s at a key Fibonacci level, which is the 38.2% retracement of the 2021-2022 major move.

And there’s more reference to be had from that Fibonacci sequence, as the 61.8% level helped to set the high last year; and then the 50% mark helped to set resistance in March at 1.0943.

The big question now, particularly with the 200-day moving average coming in to hold resistance, is whether bears want another shot at that longer-term support zone. Like we saw last year, the Fibonacci level at 1.0611 does not preclude a deeper test from sellers as it was the 1.0500 level that held that held the lows on two separate occasions, and that’s what I’m looking at for the bottom of range support.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

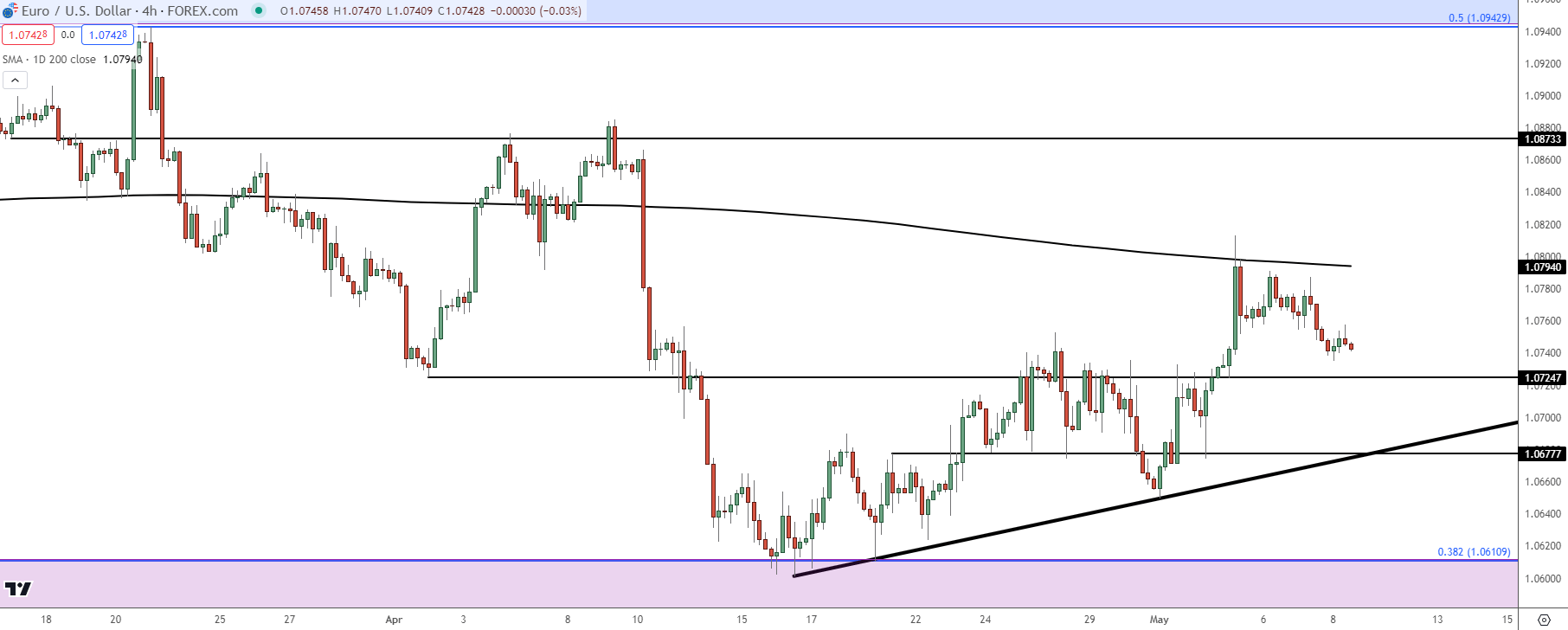

From the four-hour chart below, we can get better view of that recent series of higher-highs and lows on a shorter-term basis. But the other side of the matter shows bears taking a greater role since that 200-dma re-test last week. This does highlight an area of note around 1.0725, which is a prior swing low that bulls had struggled to mount above in the immediate aftermath of FOMC last week.

If bears can take that level out, the focus would then shift to the bullish trendline that’s currently spanning from April to May swing lows, and that similarly projects to near a familiar price at 1.0677.

A hold of support at 1.0725 would keep the door open for bulls to run a re-test of the 200-day moving average which currently projects to just under the 1.0800 level. However, if bulls fail to hold 1.0677 the door re-opens for re-test of 1.0611 and the second test of that support may not be treated as kindly as the first.

EUR/USD Four-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

--- written by James Stanley, Senior Strategist