Euro, EUR/USD, ECB Talking Points:

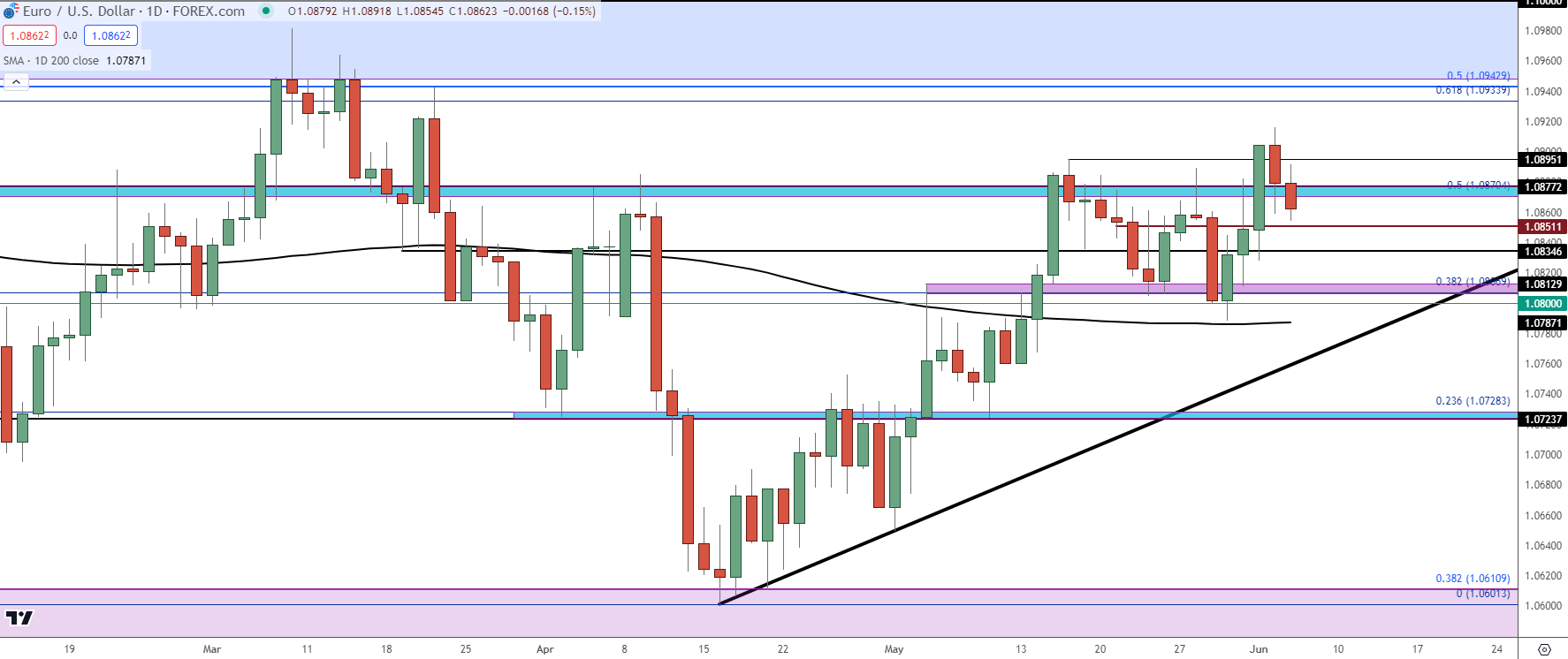

- The EUR/USD began a rally eight weeks ago after running into longer-term range support. But for the past three-and-a-half weeks, that move has been stalled at resistance.

- The ECB is expected to cut rates tomorrow but that’s likely priced-in to a large degree. The bigger question is what they say about forward-looking conditions and when or how aggressively they expect to continue loosening policy. There’s also a USD consideration with Non-Farm Payrolls set for Friday and FOMC set for next Wednesday.

- If you’re looking to learn more about meshing fundamental analysis with technical analysis, the Trader’s Course focuses on both. More information can be found at the following link: The Trader’s Course

The Bank of Canada cut rates this morning and there’s the wide expectation that the European Central Bank will also loosen policy at their rate decision tomorrow. This isn’t a secret and that expectation has been there for a while, but that hasn’t stopped the Euro from gaining ground against the US Dollar since mid-April.

After the US CPI report in April, EUR/USD slid down to the topside of longer-term range support and that stalled the sell-off. And bulls slowly came back in, with a major boost arriving in early-May after the FOMC rate decision on the first of the month and the NFP report two days later.

The rest of May was a build of lower-lows and highs in the US Dollar, which helped to prod a bullish move in EUR/USD. Once again, the US CPI print played a large role in the matter, extending the breakout in the middle of May, at which point the trend began to digest. That pullback ran down for a support test at prior resistance, at which point bulls returned to the matter last Thursday.

That topside move ran through Monday to create a fresh two-month-high. Price has since started to pullback from that breakout, but there remains a show of bullish structure on the chart.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

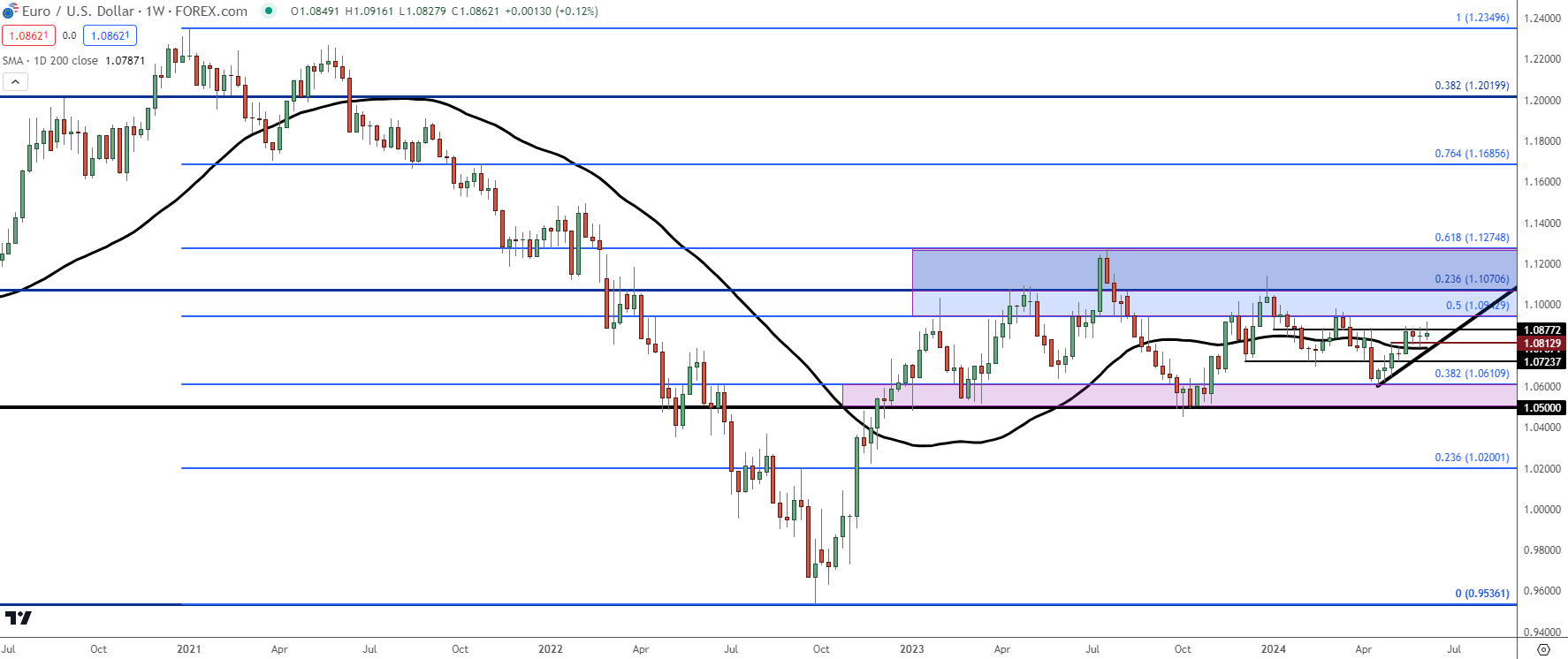

EUR/USD Longer-Term

The rates dynamic between the US and Europe is a long brewing affair.

It was through the year of 2021 that inflation in the US started to climb. Initially, the Fed brushed this off, saying that it was ‘transitory’ and supply-chain related as a product of the pandemic. Markets nonetheless priced in USD-strength against the Euro and we can see the start of a bearish trend around the 2021 open.

But it was 2022 when matters really began to expand as the Fed started hiking rates to address that inflation that no longer seemed transitory. At the time, the ECB held the line, fearful of choking off growth. But as the Euro lost value, there was an additional pressure point for inflation.

As the bearish trend drove further in EUR/USD, the need for rate hikes grew in Europe and eventually the ECB came to the table more aggressively with 75 bp hikes. As that was happening, US inflation was beginning to soften and this had opened the door for the Fed to begin slowing down rate hikes.

The bearish trend took 21 months to build, but only four months to erase 50% of that move, with resistance showing at 1.0943 in early-2023 trade.

Since then, however, EUR/USD has been range-bound; and neither the Fed nor the ECB have seemed to want to take the lead with rate policy.

EUR/USD Weekly Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

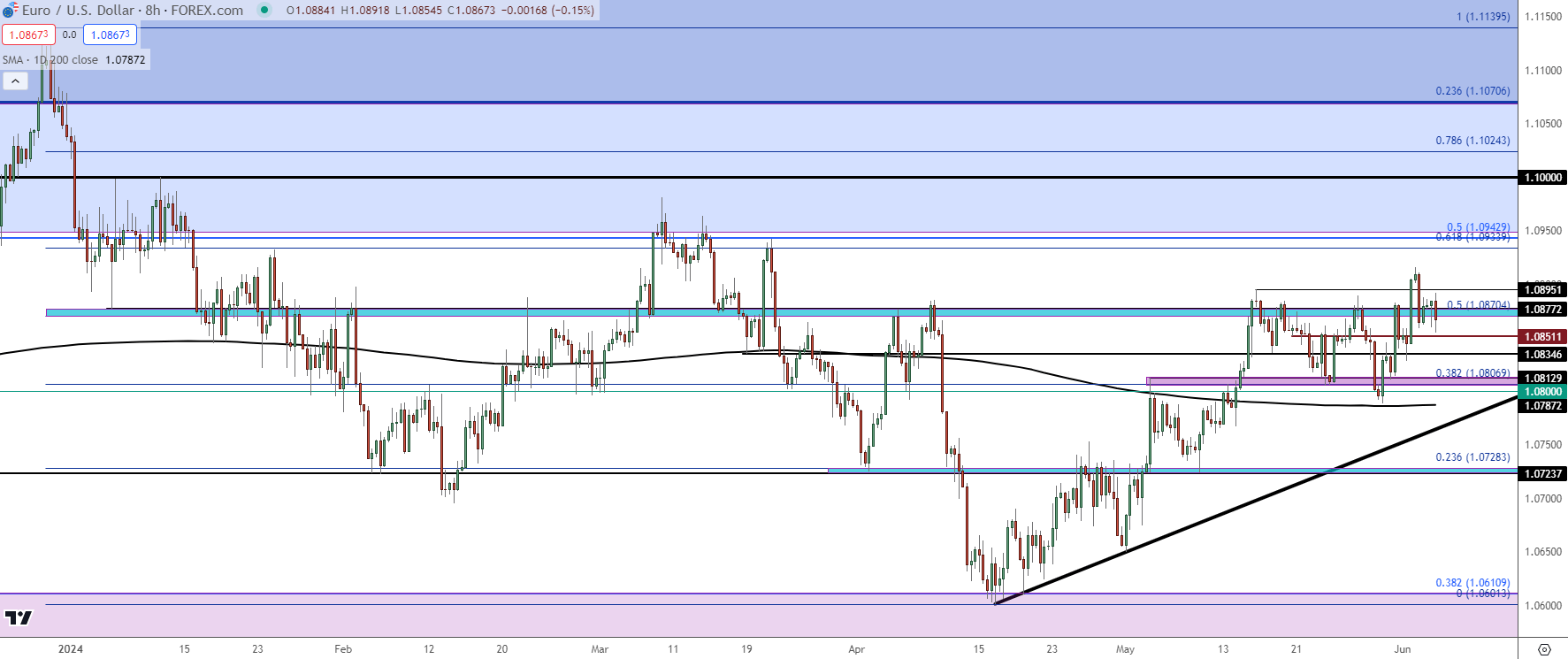

EUR/USD Shorter-Term: Trends Inside of the Range

While the pair has been in a range for more than 17 months now, there have been multiple shorter-term trends in the context of that mean reversion. Last summer, for instance, the US Dollar put in an impressive 11-week streak of consecutive gains. This happened shortly after EUR/USD found resistance at the 61.8% Fibonacci retracement of that 2021-2022 major move.

EUR/USD eventually bottomed at 1.0450, marking a move of more than 700 pips. The reaction to that was another trend, but this time in the opposite direction. Price ran above the 1.1100 handle, and as the door opened into 2024 sellers started to take control again.

There’s been a pretty clear deviation in the data where US numbers have had favor against European data. But, the Fed has remained as very dovish considering all factors and the ECB has probably been more-hawkish than I’d expect, and that’s led to more choppiness.

So, does this all rectify tomorrow?

Probably not. I don’t think the ECB wants to see the Euro tank against the US Dollar any more than the Fed does. A sinking currency invites more inflation and that seems like something that both would want to avoid at the moment. For both Central Banks, balance would be a desirable thing and that means that either taking a concerted tact in either direction, either dovish or hawkish, could create reverberations down-the-road.

So, the big question for tomorrow isn’t whether the ECB cuts rates, but what they say about their plans for after the rate cut. If the pledge to another 25 bp cut in July or September, that could bring excuse for Euro weakness. But with the Fed expected to cut in September there may not be a grand case for big picture trends.

If the bank does surprise by holding rates steady, I think we could see 1.0943 come into the equation quickly, after which the 1.1000 psychological level would come into play. There were two touches there at the beginning of the year before bears took over and re-engaging with that spot near-term would illustrate a major push from bulls.

For levels – key support is around the 1.0800 handle that held the lows last week, which is also in proximity to the 200-day moving average. If bears can power through that, the door will be open for short-term bearish trends. There’s a level around 1.0725 that would come into the equation before a re-test of range support at 1.0611.

Above current price, the 50% mark of the same Fibonacci retracement that produced 1.0611 is that 1.0943 level. This was last in-play in March to hold the highs in the pair and this becomes a major decision point if bulls show stall at that level. That also marks the lower-portion of longer-term range resistance.

EUR/USD Eight-Hour Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

--- written by James Stanley, Senior Strategist